Nifty Outlook:

The index has given a breakout from a downward slopping channel on daily scale. This has translated the price to navigate on the upside to scale new heights. FII’s have come into play as they have started pumping longs in index futures front. The total number of longs in index futures now stand at 81,695 vs prev 66,619 contracts. On 15th January; 10,697 long contracts were added compared to the liquidation of 4,379 short contracts in index futures. The long/short has moved upto 66%; indicating addition of long contracts. Additionally, on the index options front, FII’s are holding a significant number of putshorts; which is a bullish indicator. To conclude, the data is positive from FII’s point of view now. Option data is indicating positive bias as long the index sustains above 21,800 level. Hence, itis now Advisable to keep trailing SL with 21,500 as a major support.

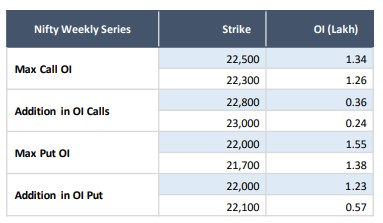

Weekly Expiry Point of View:

Option chain data for this weekly expiry is indicating a trading range of 22,000-22,500 zones. On the call side, 22,500 is the strike with highest OI. Majority of call writing was witnessed at this level; indicating resistance. On the putside, 22,000 is the strike with highest OI. As per the data, net call-put writing is indicating significant addition of put writers; which is a bullish indicator. However, It is advisable to be cautious with heavy longs as the volatility is on the higher side. 22,000 is as an immediate support.

Strategy:

The sentiment on Nifty is bullish. The strategy can be played out by selling 2 OTM CALL & buying 1 ATM CALL.

Nifty Bull Call Ratio Spread:

SELL 2 LOT CALL NIFTY 18JAN2024 22,400 @ 17 | BUY 1 LOT CALL NIFTY 18JAN2024 22,100 @ 122

Target – 55 POINTS | Stop Loss – 22,450 (SPOT)

Click here to download Derivatives Update – 16th January 2024