Valuations tempting; Execution will be the key

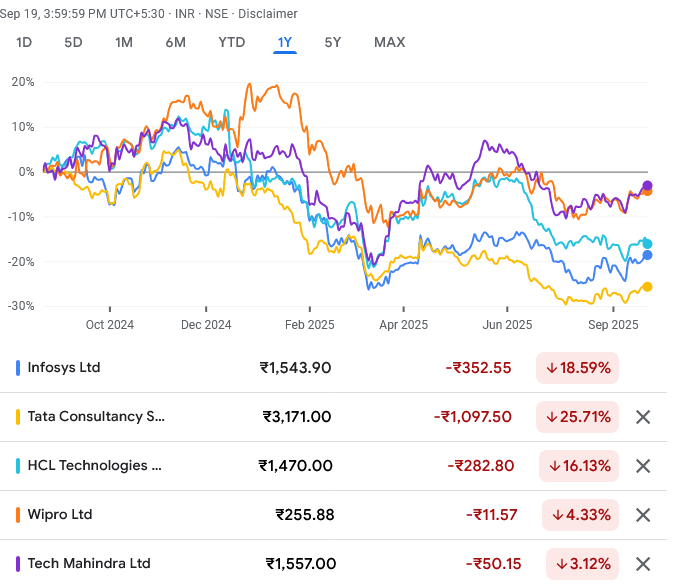

We initiate coverage on the Indian IT sector with a differentiated deep-dive into the US client base of large-cap players, offering sharper visibility into sectoral drivers beyond management commentary. Our analysis highlights downside risks to consensus BFSI growth assumptions, a more constructive stance on Retail, and steady outlook for Telecom and Hi-Tech. While deal momentum remains healthy across Tier1s, our revenue conversion metric shows momentum for Wipro & LTIM, is steady for INFY, and weak for HCLT & TechM. We don’t see Indian IT breaking away from structurally declining margins since FY14. Therefore, players with pricing power like INFY and significant margin headroom like TechM are our top picks. Against this backdrop, NIFTY-IT’s ~31% correction from its Dec-24 peak offers good entry points. We prefer Infosys for its GenAI leadership and solid execution, and TechM for margin recovery and recent deal wins, while we are NEUTRAL on HCLT & LTIM due to valuation & margin decline; ADD rated Wipro offers near term revenue momentum.

Diving deep into company’s US clients; Reassessing street’s estimates: We present a first-of-its-kind analysis of the top clients of our covered companies in US geography, revealing sharper insights into sectoral trends & distribution beyond broadbased sectoral commentary by the management. We have deep dived into client’s fundamentals to further understand the variable driving revenues for those sectors.

BFSI: We see NI of the BFSI clients to be the driving variable and are generally cautious compared to the street on BFSI revenue estimates for FY26 & 27 (Exhibits 15 – 20).

Telecom & Retail: Capex of the clients is the driving variable for both. Interestingly, Retail revenues of IT companies flow before clients make significant capex while telecom revenues move in tandem. We are broadly in-line with consensus for Telecom and a bit above on retail, basis consensus capex estimates (Exhibits 23- 28 & Exhibits 31-36).

Hi-Tech: Revenues of the Hi-Tech clients are driving this vertical for Indian IT. We are broadly in-line with consensus on FY26 & 27 estimates (Exhibits 39 – 42).

Orderbook strong for most; Revenue conversion diverge: Several Tier-1 players—Infosys, Wipro, Tech Mahindra, and LTIM—reported strong orderbook growth in 1QFY26, supported by two mega deals at Wipro and one at Infosys. Yet, revenue conversion has lagged across Indian IT in FY25 despite robust deal wins in FY24. Our delayed correlation analysis (Exhibit 45–50) of book-to-bill and revenue growth indicates solid conversion momentum for Wipro and LTIM, steady for Infosys, and weak for TechM & HCLT. Therefore, execution will be key monitorable for TechM.

Structural decline in margins giving some players an opportunity: We note a structural decline in EBIT margins across large-cap IT players over FY14–25, led by intensifying competition and slowing growth (Exhibit 8). Near-term triggers for margin expansion remain absent, as cost-takeout and vendor consolidation dominate deal activity, and traditional levers—utilization, subcontracting, and offshoring being largely exhausted. Flattening pyramids offer an opportunity for TechM & TCS, albeit in the medium to long term. We remain confident on TechM due several low hanging fruits such as sub-con reduction, pruning low margin business and better deal screening.

Valuations bottomed; INFY & TechM Top picks: NIFTY-IT has corrected ~31% from its Dec-24 peak, creating entry points across large-caps. Our top picks are INFY, backed by superior pricing power, consistent execution, and a healthy orderbook, and TechM, with visible margin tailwinds and strong deal wins. We retain NEUTRAL on HCLT & LTIM given continued margin pressure and stretched valuations, while Wipro offers short-term potential from large deal ramp-up and a stabilizing leadership team.