Demand revival, Liquidity fuels markets

NIFTY gave positive 1.6% returns since our last report despite rising volatility amidst deteriorating geopolitical situation as Indian markets were supported by 1) Normal monsoons raising hopes of demand revival in festival season. 2) Inflation at 3.54% came below RBI hurdle rate improving prospects of a 2H25 rate cut if FED bites the bullet and cuts rates 3) benign crude and commodity prices and 4) sustained capex led investments in economy despite maintaining fiscal prudence.

Liquidity remains strong, as domestic inflows have far exceeded FII flows, providing cushion to markets. We believe expectations of strong festival season demand; rural revival and interest rate cuts will provide support to markets. We believe US elections are most important factor to watch out for given rising geo political tensions globally (including SE Asia). We expect some tilt towards defensives like consumer, Durables, Building material, IT services, Pharma and Telecom, given rich valuations in some growth sectors. We believe Capital Goods, Infra, Logistics/ Ports, EMS, Hospitals, Tourism, Auto, New Energy, E-com etc. are great themes, but investors needs to be cognizant of valuations. We increase our base case NIFTY target to 26820 (26398 earlier). We expect market consolidation and recommend selective buying on dips, but quality focus needs to be key criteria.

Base Case: we value NIFTY at 15-year average PE (19x) with March 26 EPS of 1411 and arrive at 12-month target of 26820 (26398 earlier). Bull Case: we value NIFTY at PE of 20.2x and arrive at bull case target of 28564 (28575 earlier). Bear Case: Nifty can trade at 10% discount to LPA with a target of 24407 (24493 earlier).

Model Portfolio: We are cutting weights on ICICI, KMB, Maruti, ABB, L&T, HDFC AMC and ITC. We are increasing weights on M&M, Ambuja Cement, Ultratech, Interglobe Aviation, Britannia Inds and LTI Mindtree. We are adding Indusind Bank in model portfolio while we remove Apollo Hospitals. We are increasing weights in Consumer, Cement, IT and Banks while cut weights in Capital Goods, Healthcare and AMC.

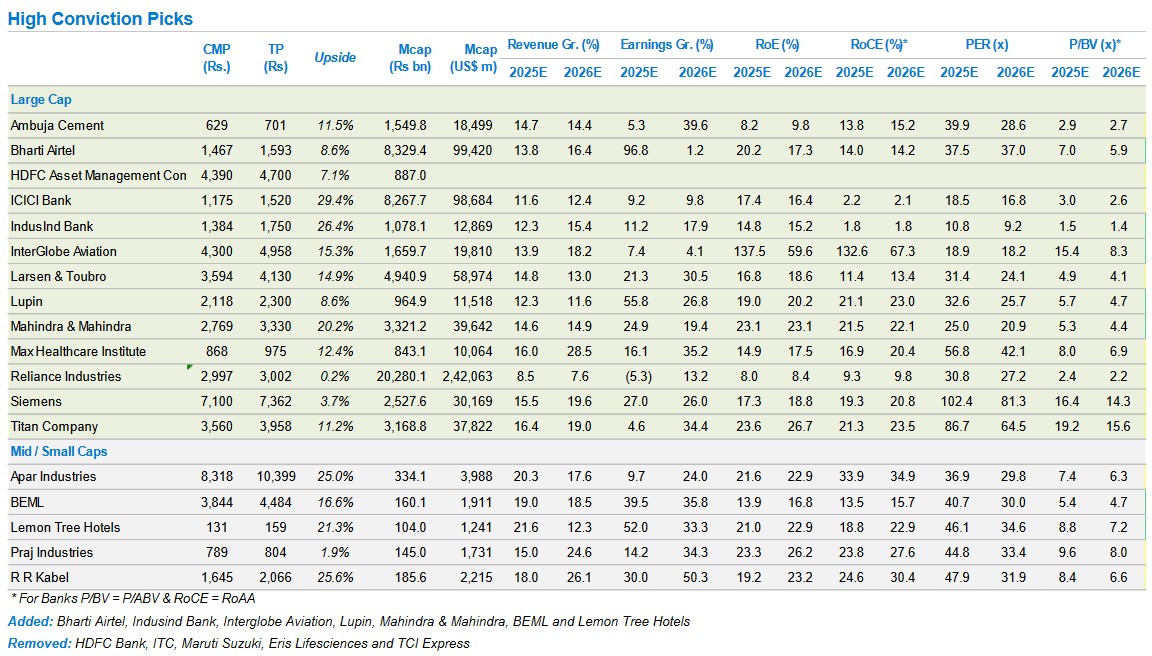

High Conviction Picks: We are removing HDFC Bank, ITC, Maruti Suzuki, Eris Lifesciences and TCI Express from conviction picks. We are adding Bharti Airtel, Indusind Bank, Interglobe Aviation, Lupin, M&M, BEML and Lemon Tree Hotels in conviction picks