➢ Our composite model with equal weights on a) General election year price behaviour, b) bull market corrections and c) bottom up Nifty projection strongly recommends buying the current decline for target of 23400 by June 2024

➢ Empirically, in General election year, Nifty has a tendency to bottom out in FebMarch, followed by minimum 14% rally towards General election outcome in each of seven instances over past three decades (Refer chart)

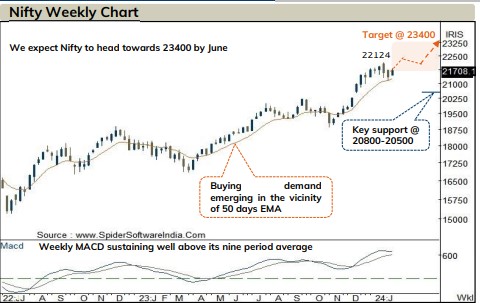

➢ Usual bull market corrections in Nifty are around 8% (multiple cycle average) followed by new highs. As 4.5% correction (from life high of 22124) is behind us, model indicate strong support in 20500-20800 which we expect to hold

➢ Bottom up chart study of Nifty constituents projects further upsides across sectors and heavyweights after many stocks coming out of large periods of consolidations, thus supporting bullish stance

➢ Largecaps at cycle lows: Ratio of Nifty / Nifty500 is at bottom of the cycle. Over two decades, ratio bottomed out at 1 on two occasions, followed by Large caps performing in subsequent quarters

➢ Global equity market setups are robust and support further rally over few quarters

➢ Breadth: Percentage of stocks above 200-day moving average continues to sustain above 80% even in corrective phase indicating strong underlying strength

➢ Taking cognizance of the above factors, we expect Nifty to head for 23400 by June 2024 and meanwhile form a durable bottom in Feb-March period wherein 20500-20800 to act as strong support. Therefore volatility from hereon should be embraced as a buying opportunity

Click here to download IDirect’s Technical Strategy Feb24 report