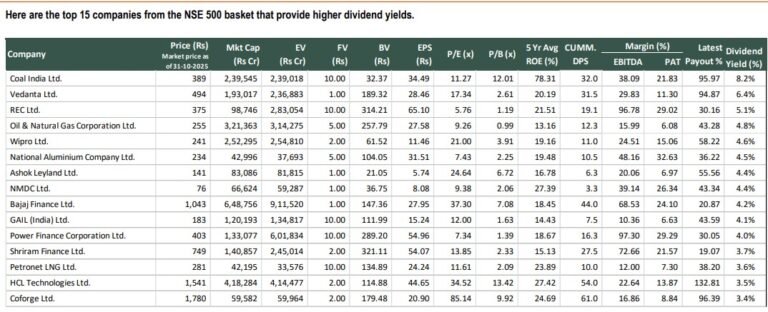

top 15 companies with high dividend yield

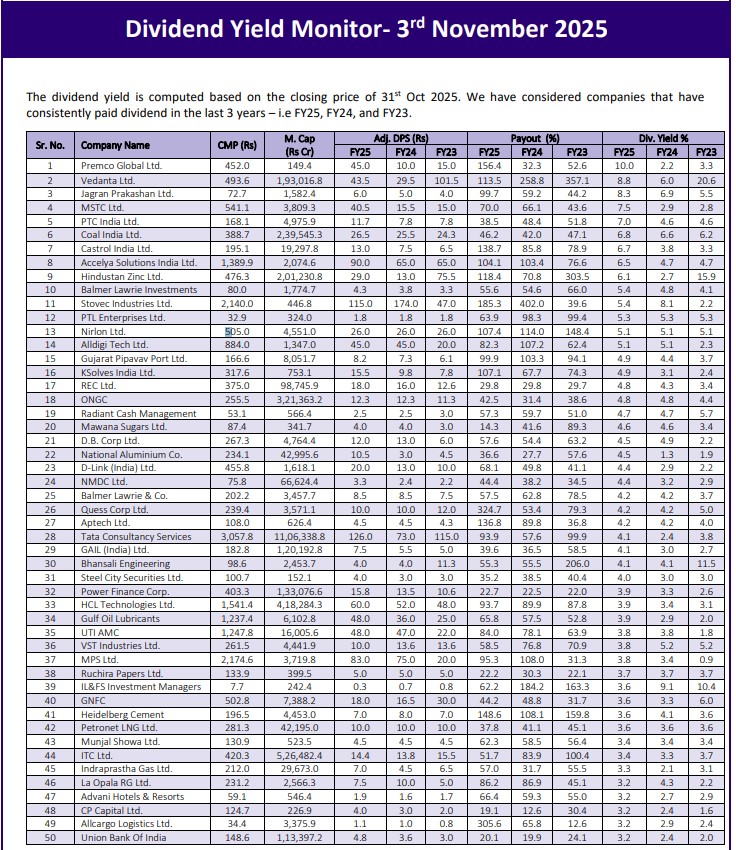

Dividend Yield Monitor- 3rd November 2025

The recycling industry is witnessing structural tailwinds, with increased regulatory focus shifting scrap flows...

Post the recent correction, APTUS is set for a re-rating

SAMHI IN trades at attractive valuation of 11.1x/8.8x our FY27E/FY28E EBITDA estimates

Does Lenskart justify its premium valuation, or is it another instance of growth optimism...

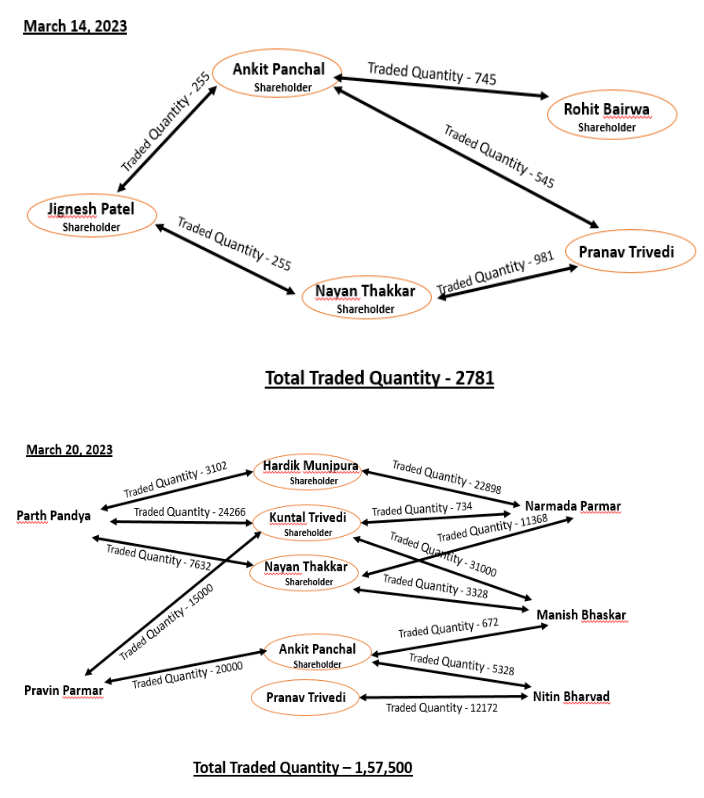

SEBI emphasized that manipulative trading in low-liquidity stocks damages investor confidence and undermines market...

Superior product mix to drive EBITDA, return ratios to expand

The company has witnessed over 25% correction in stock price over trailing four months