We expect the company’s pre-sales to grow to +23% CAGR over FY25-27E, aided by...

Robust volume growth & focussing on growth capex are the key triggers.

Apart from BS

comfort, PARKHOTE IN offers valuation cushion as well

When Honourable judges of the Supreme Court are provided modest sedans, why do the...

His success, marked by these massive swings, serves as a high-octane example of what...

Given the company's consistent performance and strong management outlook, it's not far-fetched to expect...

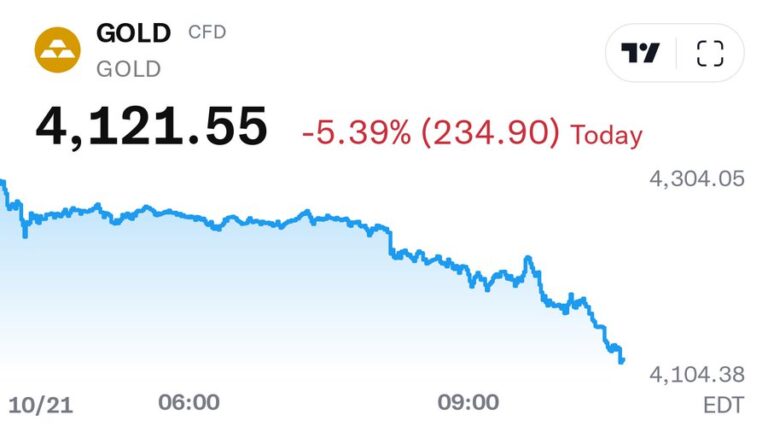

Silver also saw outsized moves, with prices down more than 6% intraday.

Eureka Forbes is a market leader in water purifiers with strong brand equity, annuity-driven...

Sustained strong performance across key operating metrics should drive a re-rating in the...

We value NVCL at an EV/EBITDA of 10x FY27E and arrive at a target...