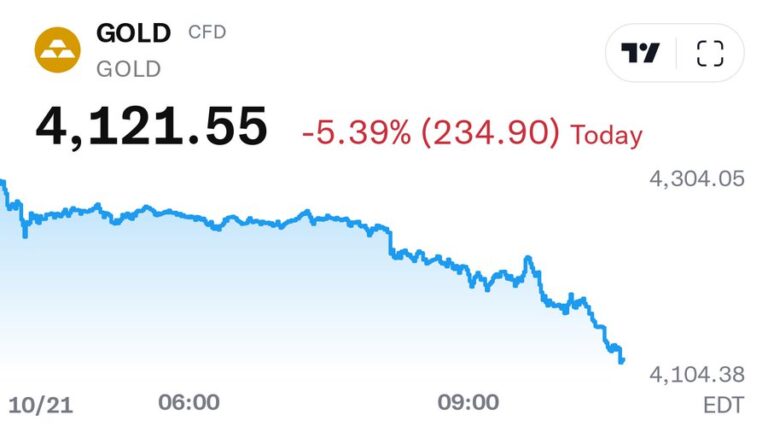

Silver also saw outsized moves, with prices down more than 6% intraday.

Eureka Forbes is a market leader in water purifiers with strong brand equity, annuity-driven...

Sustained strong performance across key operating metrics should drive a re-rating in the...

We value NVCL at an EV/EBITDA of 10x FY27E and arrive at a target...

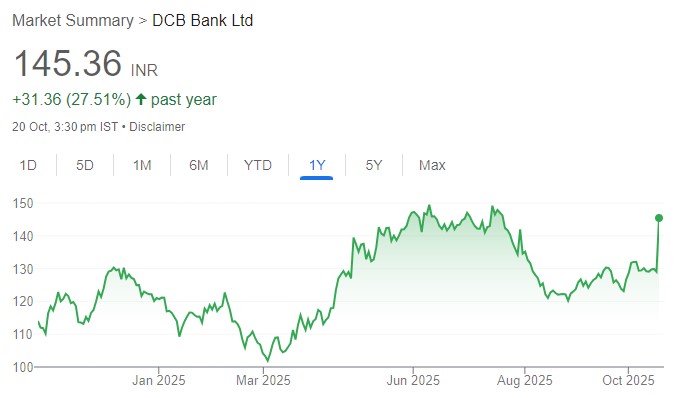

The online exchange highlights a recurring theme in Indian investing: the tension between traditional...

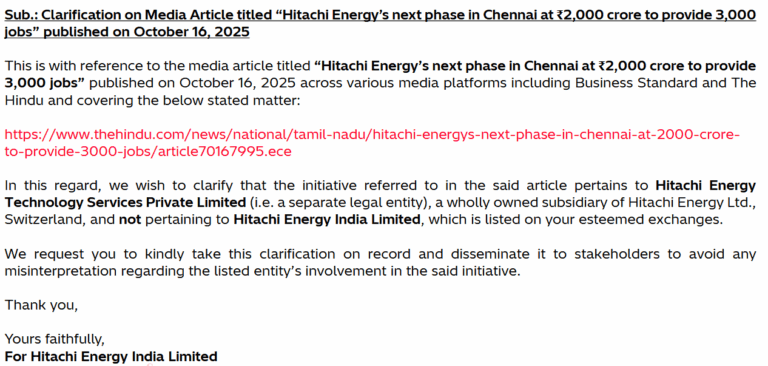

Market analysts believe that this distinction removes uncertainty about HEIL’s financial exposure

CIFC is gradually evolving into a more robust and resilient NBFC—one that is less...

Crizac’s lean, three-tiered operating model supports robust profitability, with EBITDA margins of ~25% in...

The current stock price has factored in most of the negatives.

Noticees collectively generated an amount of alleged ill-gotten gains totaling over ₹172 crore from...