The twin scandals have dealt a severe blow to IndusInd Bank's reputation. The bank's...

Kacholia’s investment reinforces the rising relevance of the recycling industry within India’s manufacturing landscape....

Kedia’s entry into Eimco Elecon has drawn attention to an otherwise overlooked mid-cap industrial...

The leading indices exhibited subdued performance throughout SAMVAT-2081 due to various challenges.

CARTRADE is well set to compound scale without stepping up CAC. We expect MUV...

Trading addiction is real. Talk to someone : a therapist, mentor, or friend. Focus...

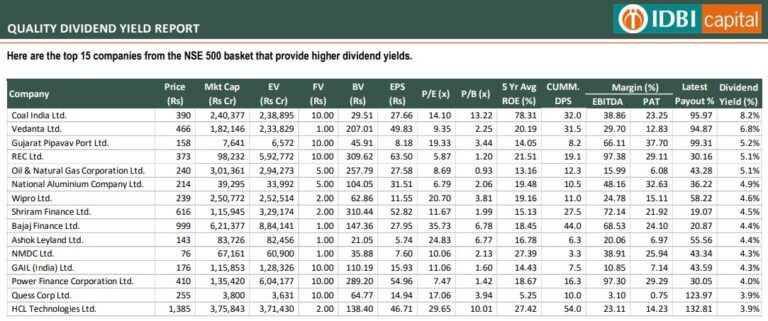

top 15 companies from the NSE 500 basket that provide higher dividend yields

When asked about his process for selecting companies, Kacholia outlined a systematic approach that...

Hindustan Copper has emerged as one of the biggest domestic beneficiaries. With no major...

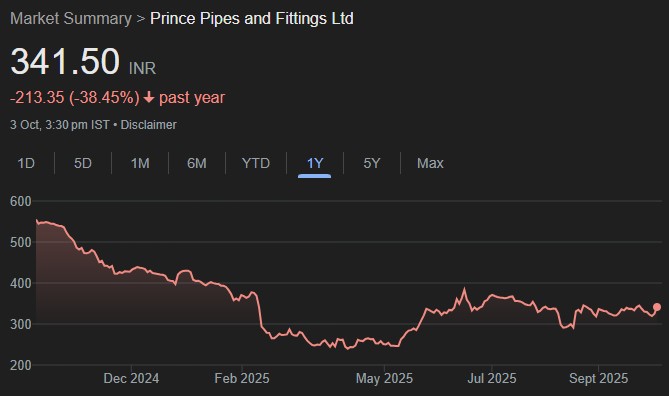

Prince pipes is working on improving its working capital cycle, focusing on reducing its...