With RoE/RoCE above 26% and a net cash status, LOTUS stands out as the...

South Indian Bank is old south based private sector bank headquartered in Thrissur, Kerala....

We expect the company to report 17%/18% CAGR in Revenue/EBITDA over FY25-28E, aided by...

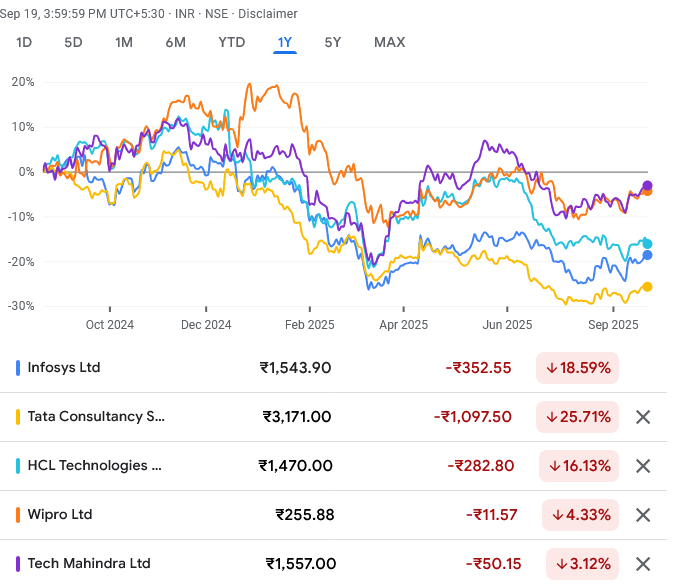

Our top picks are INFY, backed by superior pricing power, consistent execution, and a...

The company reported a robust pending order book of ~25GW as of Q1FY26, valued...

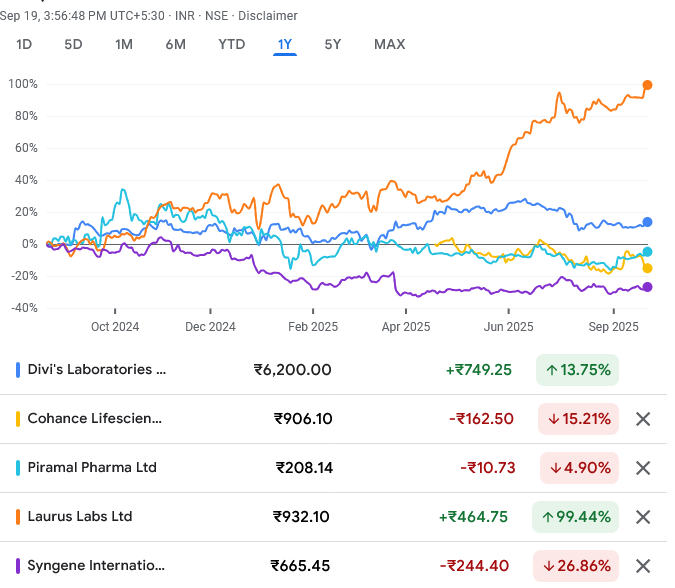

With strong fundamentals, capacity-led growth, and differentiated positioning, JP Morgan views both Divi’s Labs...

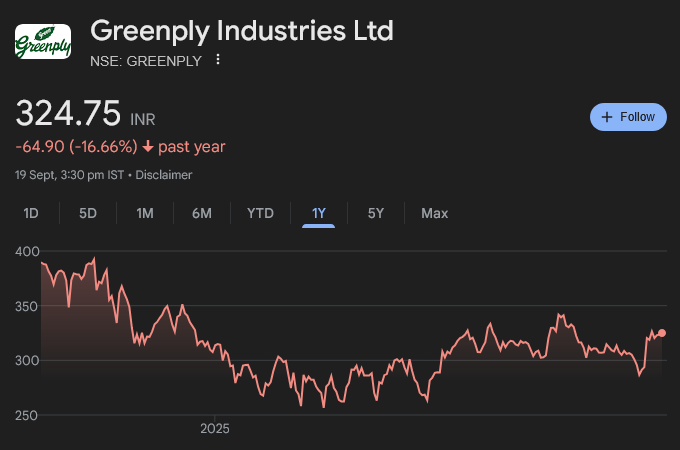

We reiterate GREENPLY INDUSTRIES LTD as our TOP-PICK from our coverage universe. We remain...

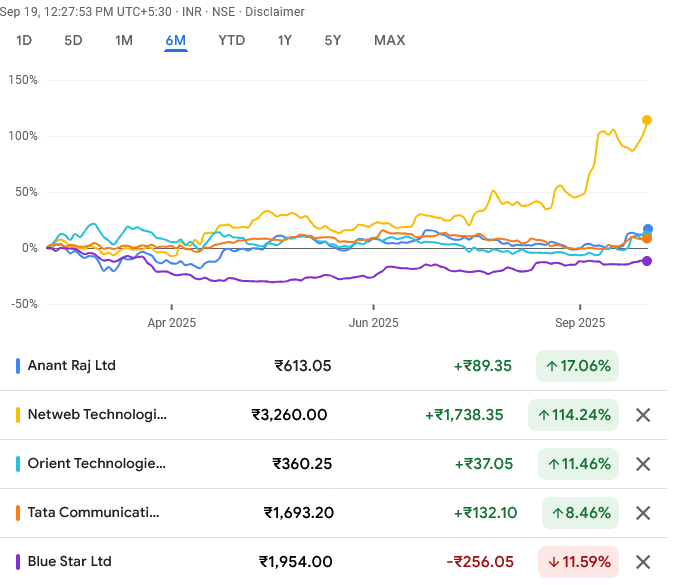

Data centers offer a promising long-term investment theme, but success hinges on execution and...

To secure the best talent, firms are hiring interns straight out of Indian Institutes...

We upgrade the financials, with positive EBITDA now expected in FY28. Considering another inflection...