Cummins India (KKC) delivered robust performance in Q1FY26 which surpassed our estimates. Revenue, EBITDA...

Amid a globally uncertain and challenging environment marked by inflation, currency fluctuations, and geopolitical...

Considering export opportunities and now with sustainable double digit margins potential we remain positive...

Man Industries Ltd has stellar growth potential on the back of (a) Foray into...

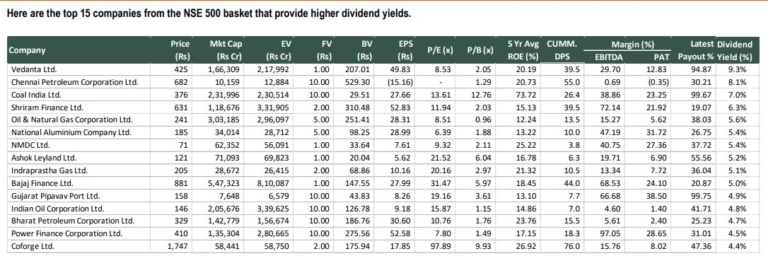

Here are the top 15 companies from the NSE 500 basket that provide higher...

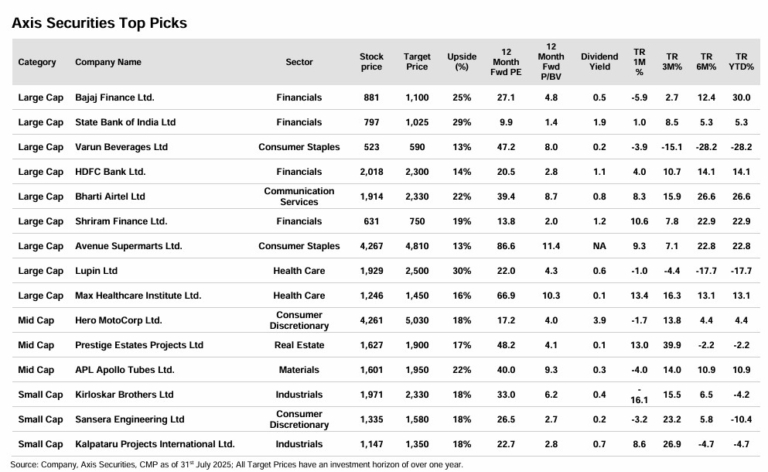

Based on the recent developments, we have made one change to our Top Picks...

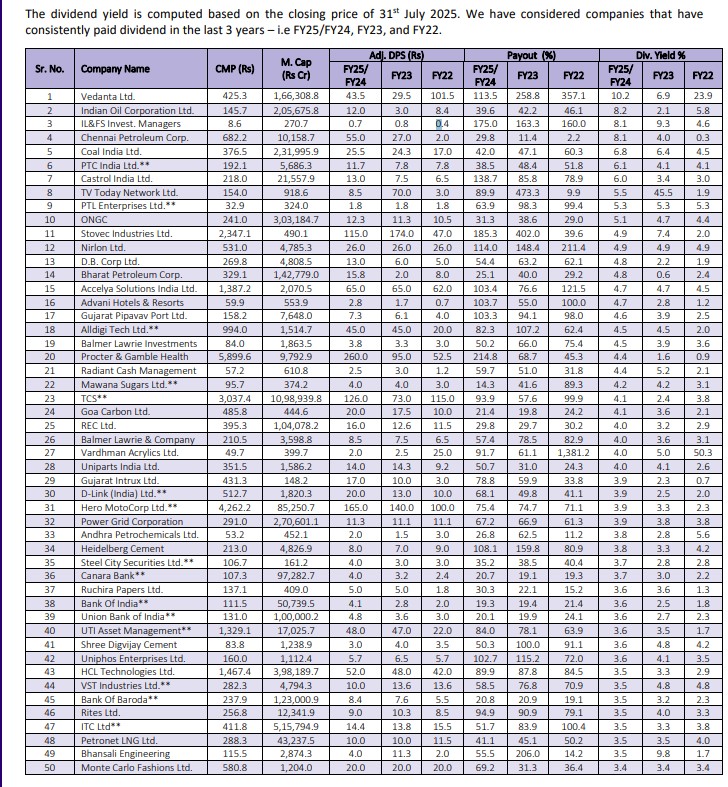

The dividend yield is computed based on the closing price of 31st July 2025....

OCCL reported much better performance & stronger margins than our estimates. The performance was...

Hitachi Energy (Hitachi) reported an EBITDA of INR 1.5bn, thrice its base quarter last...

Sobha reported highest ever quarterly presales of Rs20.79Bn, a growth of 11%YoY & 13%QoQ....