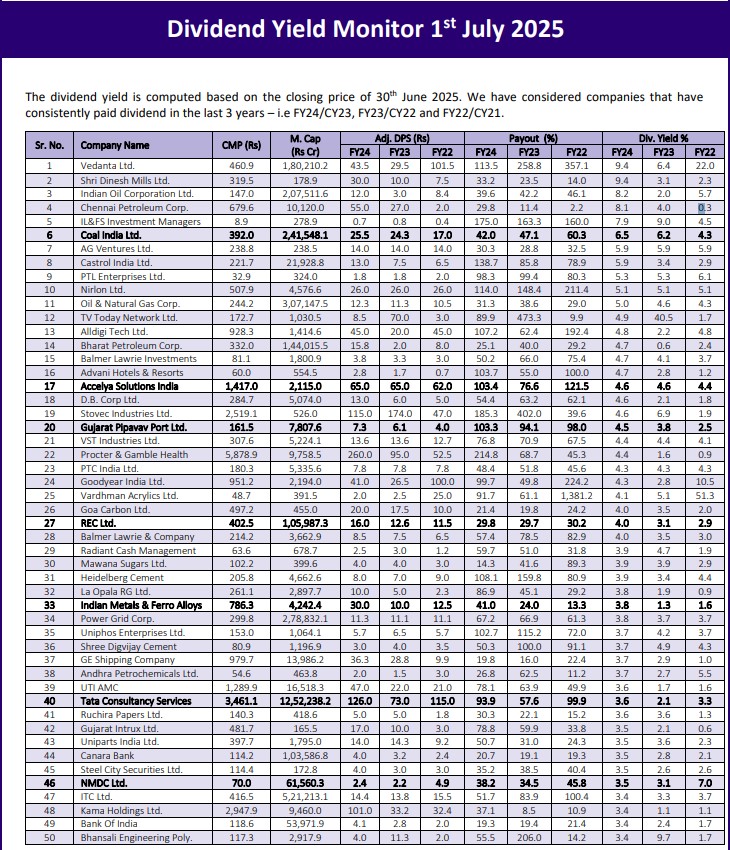

The dividend yield is computed based on the closing price of 30th June 2025....

We met the management of HG Infra led by Chairman and Managing Director Mr....

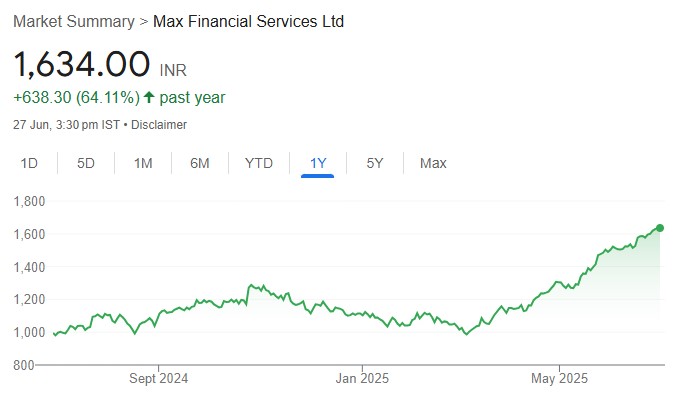

Over the past three years, Axis Max life has posted strong industry leading APE...

Trent remains a stellar business. However, the ask from the business is too high...

We interacted with Power Finance Corporation (PFC) to understand the company’s revised growth outlook,...

We recently hosted in Mumbai the Indraprastha Medical management for an NDR. Key takeaways:...

We recently visited SJS's manufacturing facilities in Bengaluru. The company has built end-toend capabilities,...

Delhivery has outperformed the market since announcing the acquisition of Ecom Express, we believe...

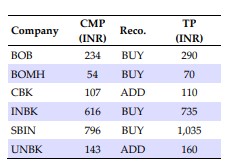

The Indian PSU banking (PSB) sector, once considered structurally broken, is experiencing early signs...

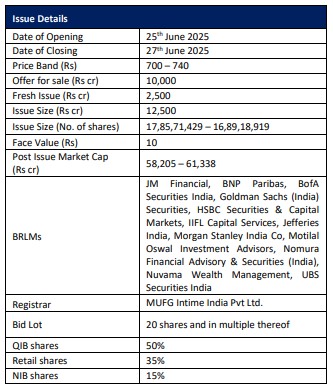

HDB Financial Services Ltd (HDBFS) is categorized as an upper-layer NBFC by the Reserve...