We initiate coverage on Time Technoplast (TIME) with a BUY rating and a target...

Driven by re-staging ‘Smart and Handsome’ in Q3 FY25 and ‘Kesh King’ (planned) in...

Punjab National Bank (PNB), a leading Indian public sector bank, provides corporate and personal...

The strategic review and potential sale by BP Plc of its lubricant arm, Castrol...

We recently hosted the management of Gokaldas Exports for an investor roadshow, represented by...

Top Conviction Stock Ideas of Q4FY25 from Cement, Metals and Mining, Pharma, BFSI, Infra,...

Hi-Tech pipes has strong growth prospects in the structural steel tubes space given its...

Lumax Auto Tech Ltd (LATL) reported a stellar quarterly performance with Revenue/EBITDA/PAT growing 50%/70%/32%...

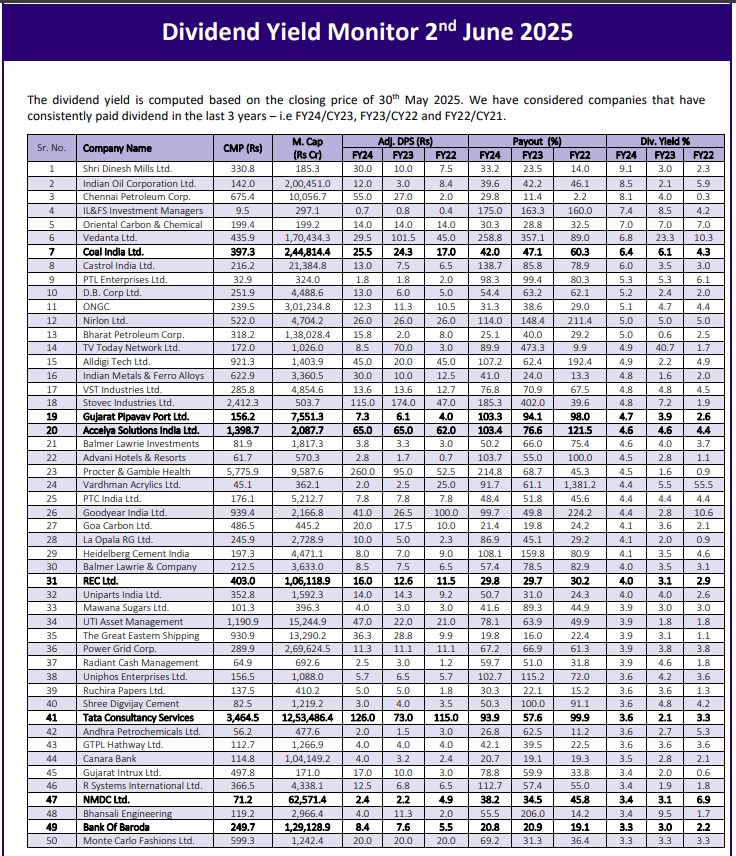

The dividend yield is computed based on the closing price of 30th May 2025....

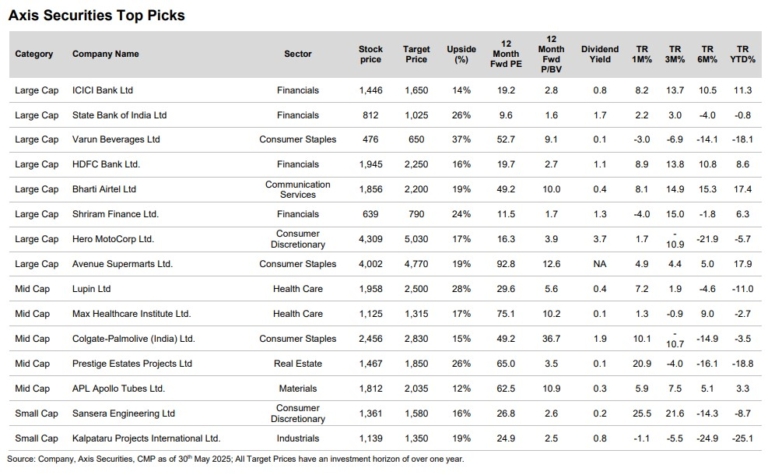

The Axis Top Picks Basket delivered a return of 15.3% in the last three...