ITC Hotels registered resilient performance in Q3FY26 aided by strong wedding, MICE and corporate...

ITCH currently has a portfolio of 213 hotels - 152 operational and 61 in...

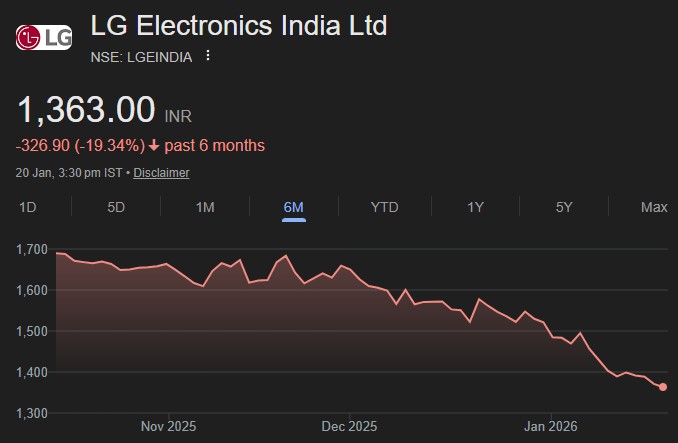

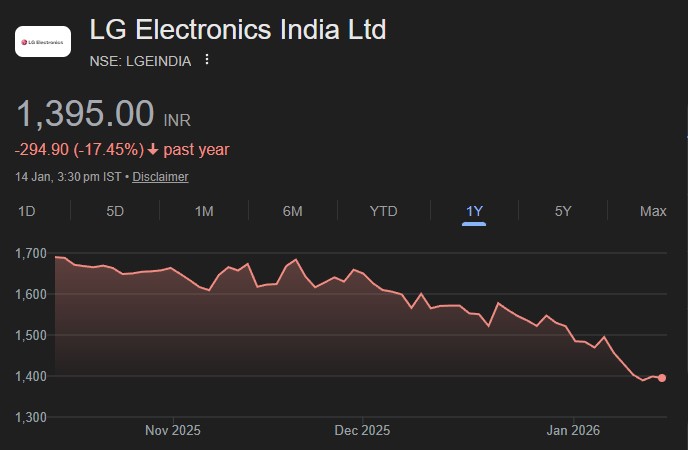

LGEIL benefits from its parentco’s massive scale, focus on technology and R&D (annual R&D...

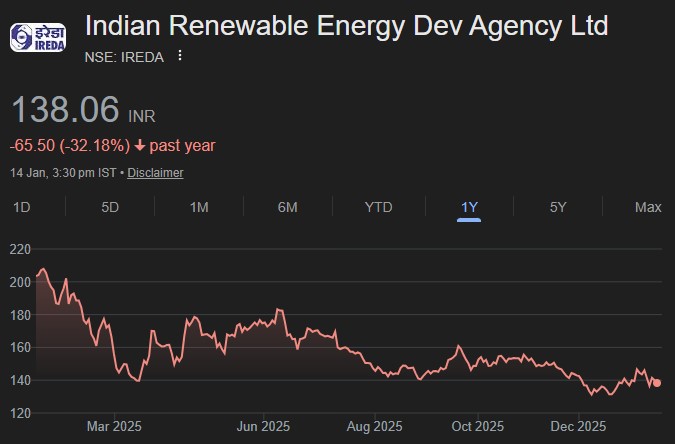

Of the 40GW of projects with pending PPAs, industry channel checks suggest ~17GW...

Logistics revenue increased to INR 1.9bn in Q3FY26, driven by higher domestic and EXIM...

Management is targeting a 120-150bp CI improvement in core business (with a similar improvement...

HDFC AMC is broadly maintaining its market share at ~11.5% (Ex-ETFs at 12.8%) despite...

Fleur will have a portfolio of high-quality assets with total room inventory of 5,556...

Despite temporary stress witnessed in Q1FY26, performance in Q3FY26 confirms normalization in margins, asset...

Localisation to pick up with expanding manufacturing capabilities