Logistics revenue increased to INR 1.9bn in Q3FY26, driven by higher domestic and EXIM...

Management is targeting a 120-150bp CI improvement in core business (with a similar improvement...

HDFC AMC is broadly maintaining its market share at ~11.5% (Ex-ETFs at 12.8%) despite...

Fleur will have a portfolio of high-quality assets with total room inventory of 5,556...

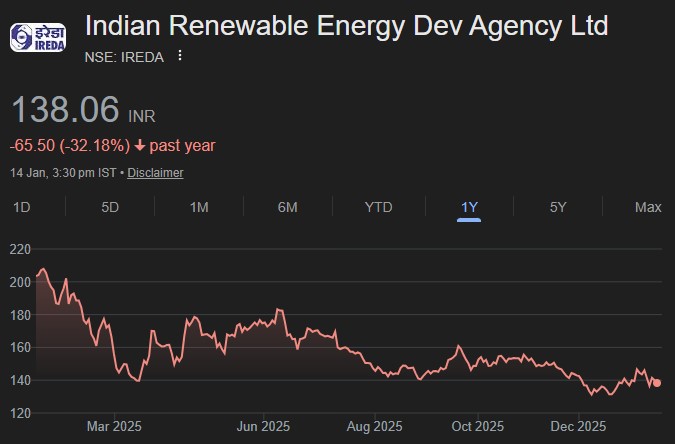

Despite temporary stress witnessed in Q1FY26, performance in Q3FY26 confirms normalization in margins, asset...

Localisation to pick up with expanding manufacturing capabilities

GRASIM has a compelling structural long-term investment case

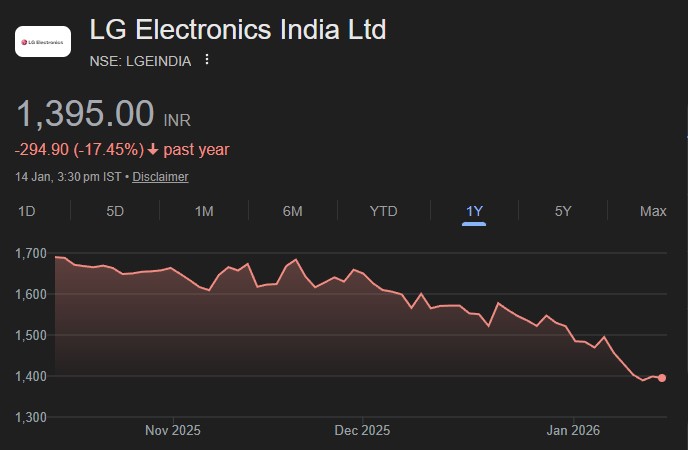

Management has revised its FY26 revenue guidance downward by up to ~5% from the...

With decades of experience in food additives manufacturing and marketing, FOIL has established itself...

GROWW is increasingly building optional growth levers to diversify revenues and improve earnings quality