Swiggy is a crucial player in India’s hyerlocal delivery space due to its strong...

IREDA reported strong performance in Q4FY25 with continued growth in AUM at 28% YoY...

We like Genus Power Infrastructure, given its large size, its end-to-end services offerings, including...

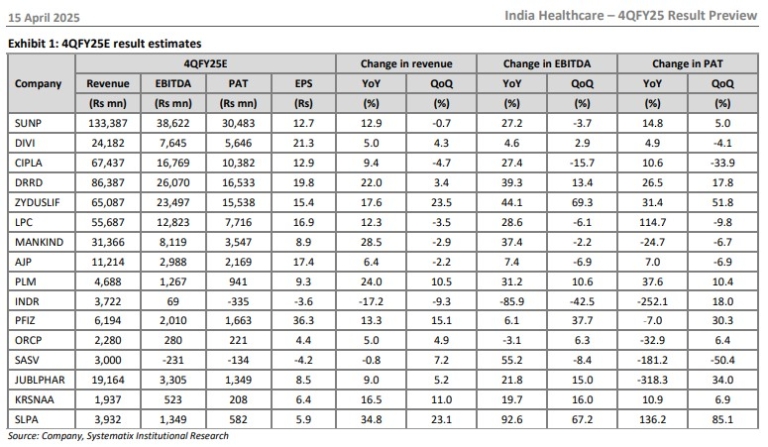

We expect stocks within our pharmaceutical universe to report low double-digit YoY revenue growth...

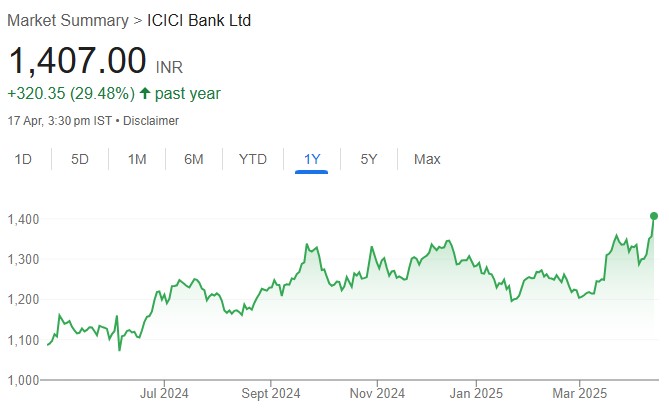

ICICIBC is well on track for robust performance, driven by healthy credit growth, stable...

We believe HDFCLIFE is well placed to achieve its APE growth outlook of 17-19%...

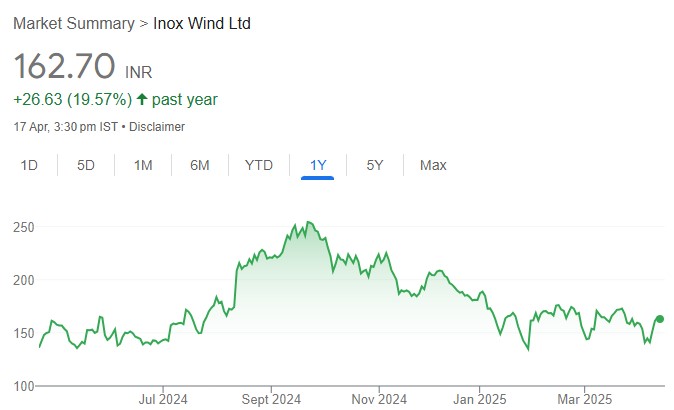

We estimate Inox Wind’s (INXW) 4QFY25 consolidated revenue of Rs 12.9bn (+144% YoY, +41%...

Gokaldas Exports (Gokex), incorporated in 1979, is one of India’s largest manufacturers and exporters...

Niva Bupa has been able to deliver standout growth in health insurance premiums (~40%...

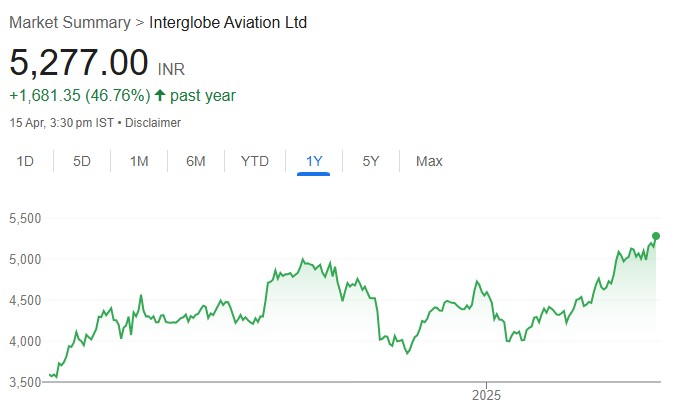

We upgrade INDIGO to BUY as we believe that benign Brent crude prices amid...