Karnataka state government has proposed an INR 200 price-cap for movie tickets. This is...

With Aluminium prices remaining strong above ~USD2.6k/tn levels and the company guiding for Novelis’...

Linda Raschke, the noted Veteran F&O trader & author, has advised that the market...

The prospects for COAL remain strong. We estimate COAL's production to clock a 6%...

Sun Pharmaceuticals Industries’ (SUNP IN) acquisition of Checkpoint Therapeutics (CKPT) would give SUNP access...

Bharti Hexacom (Hexacom), the licensed operator of wireless and fixed-line services under the Airtel...

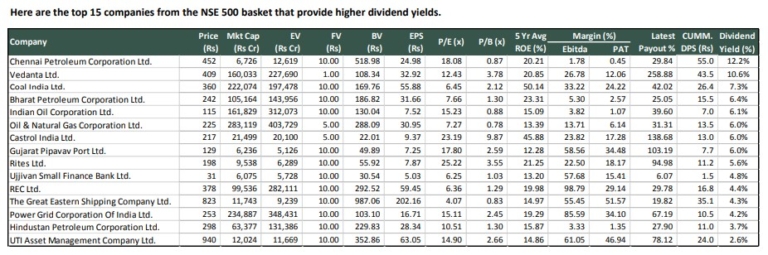

Here are the top 15 companies from the NSE 500 basket that provide higher...

We are raising GSPL from HOLD to BUY due to improved risk reward based...

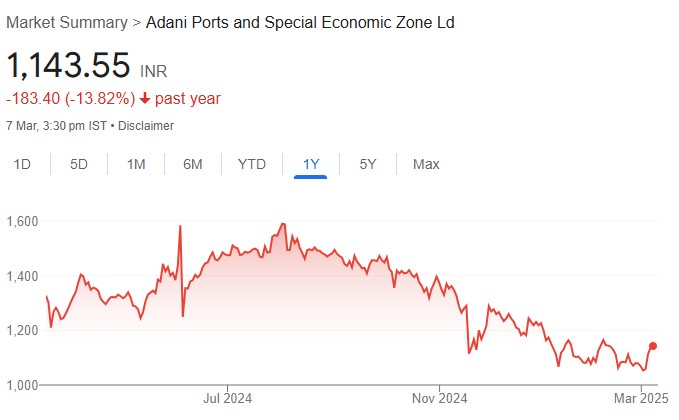

Adani Ports & SEZ (APSEZ) handled 408.7mmt (+7% YoY) of cargo volumes over Ap’24-Feb’25...

PDS remains committed towards achieving its 3-3-3 vision, an intermediate step towards the 5-5-5...