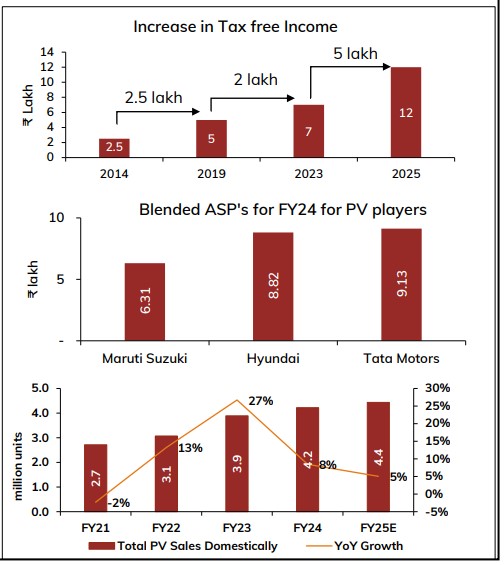

The Government in Budget 2025-26 has tried to balance the three cornerstones of the...

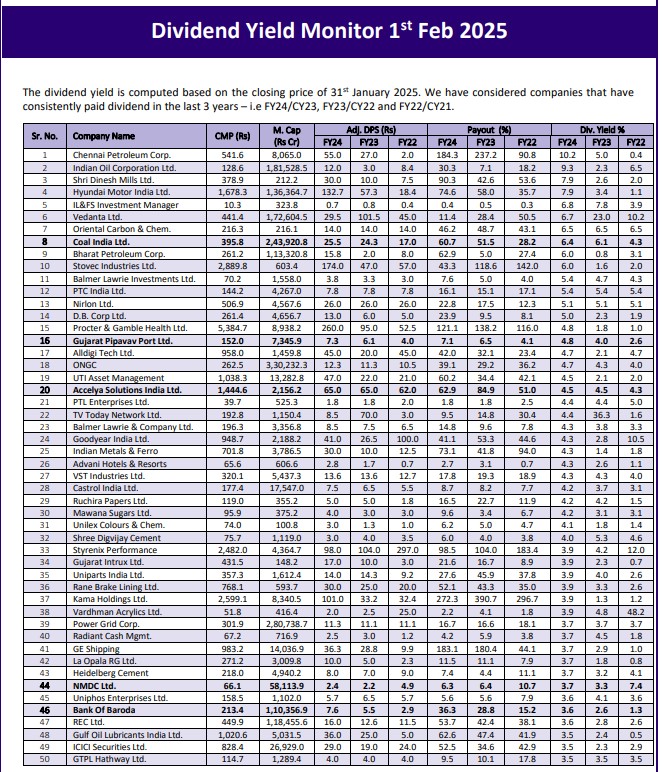

The dividend yield is computed based on the closing price of 31st January 2025....

Chalet has been our preferred pick amongst the domestic hospitality space. The company’s focus...

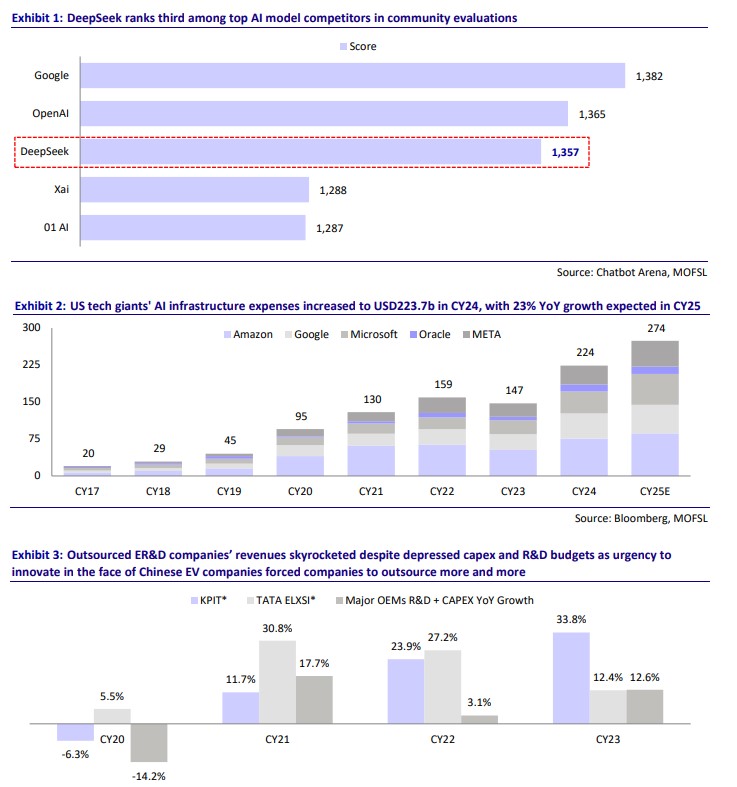

DeepSeek, a Chinese AI startup, has developed the R1 model, which rivals leading AI...

Yatharth has shown a strong performance on a nine-month basis and is likely to...

We view DCB is set to deliver returns and could possibly become a 1%...

We believe strong capacity addition trajectory will drive good financial performance for the company...

L&T Finance Holding (LTFH) is a leading NBFC catering to the diverse financing needs...

Canfin Homes has been best in class HFC player with a robust business model...

MCX is the leader in commodity derivatives exchanges in India with ~98% market share