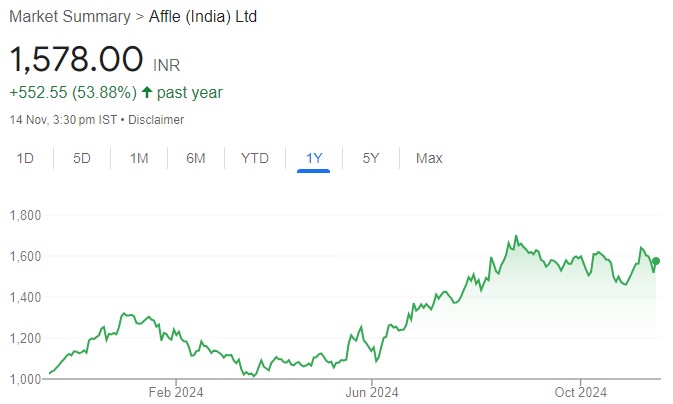

Affle (India) Ltd. (Affle) reported a strong topline growth of 26% on a YoY...

Ratnaveer Precision Engineering (RPEL), is a Gujarat based stainless steel (SS) product manufacturer focused...

REPCO is hopeful of getting its borrowing sanctioned through NHB as it is meeting...

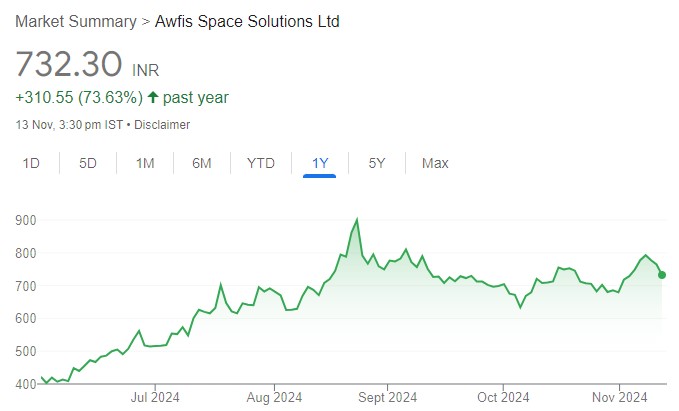

We are bullish on AWFIS’ long-term growth prospects given the: i) favourable demand-supply gap,...

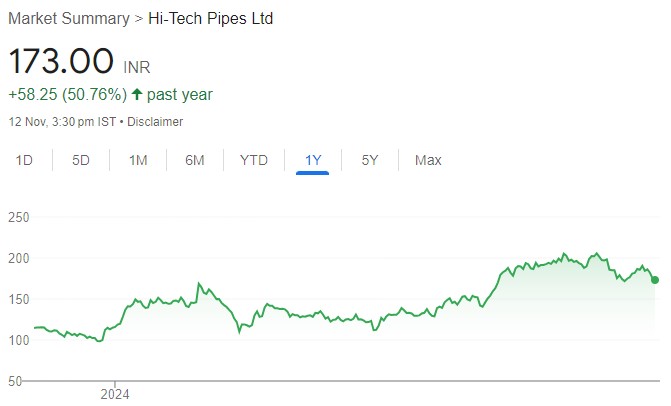

Hi-Tech pipes has mammoth growth prospects in the structural steel tubes space given its...

In the analyst meet, PWGR management highlighted a total capex potential of INR6.6t in...

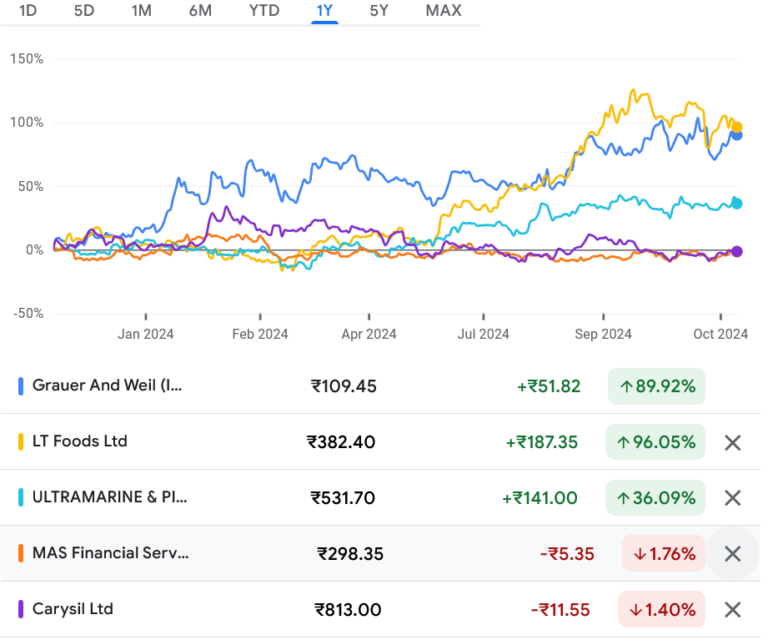

Grauer and Weil (G&W) enjoys a strong moat in its core Electroplating Chemicals business...

Avalon Technologies (AVALON) reported a strong quarter, with revenue growing 37% YoY in 2QFY25,...

Yatharth Hospitals reported a healthy revenue growth which was marginally below our estimates, while...

JBCP is well-positioned to capitalize on immediate growth opportunities. We expect 29% EPS CAGR...