Till date, GRAN has gone through 24 USFDA inspections since 2009. Out of 24...

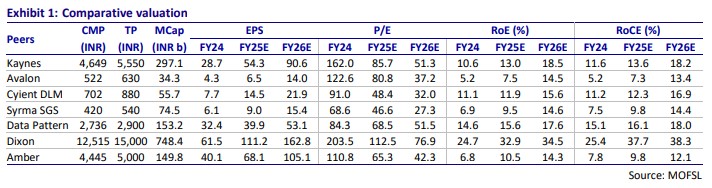

India's Electronics Manufacturing Services (EMS) industry is witnessing a strong revenue growth trajectory, primarily...

NMDC’s stock has been under pressure amid falling iron ore prices along with lower...

SENCO is strategically expanding its presence in eastern markets and other regions. The company...

We recently met Mr. Shyam Srinivasan, the outgoing CEO of Federal Bank (FB), to...

VA Tech Wabag (Wabag) bagged a mammoth order of INR 27bn (equivalent to its...

Headquartered in Chennai, WABAG Group has a history spanning more than 90 years. With...

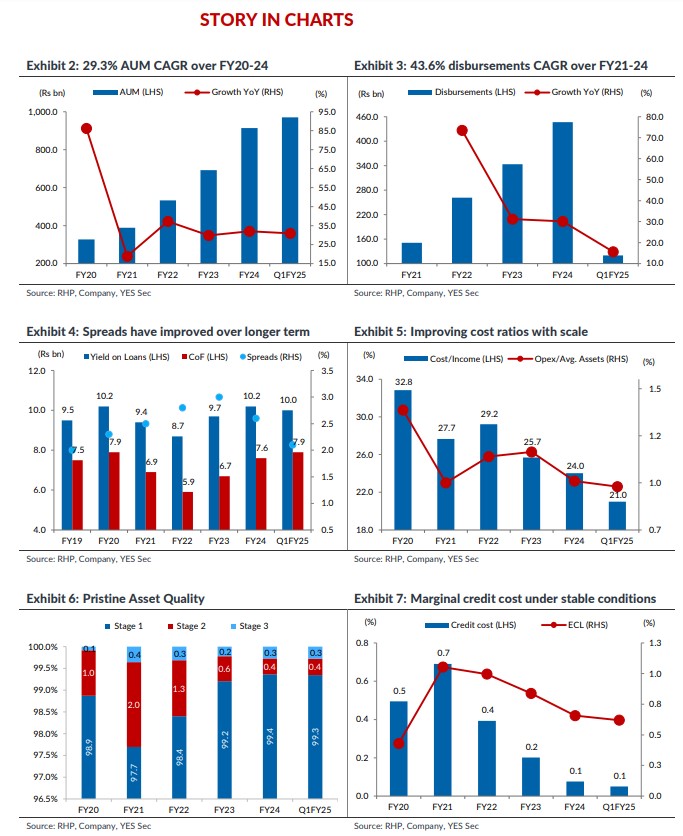

With an AUM of Rs971bn as of June 30th 2024, Bajaj Housing Finance (BHFL)...

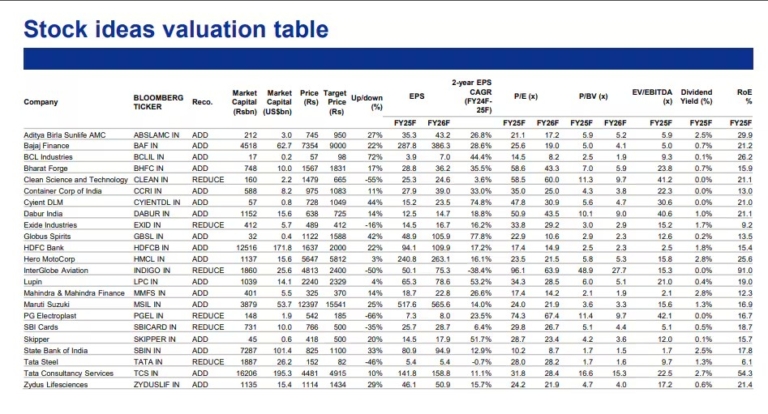

InCred Equities has released its much awaited list of high-conviction stocks for September 2024....

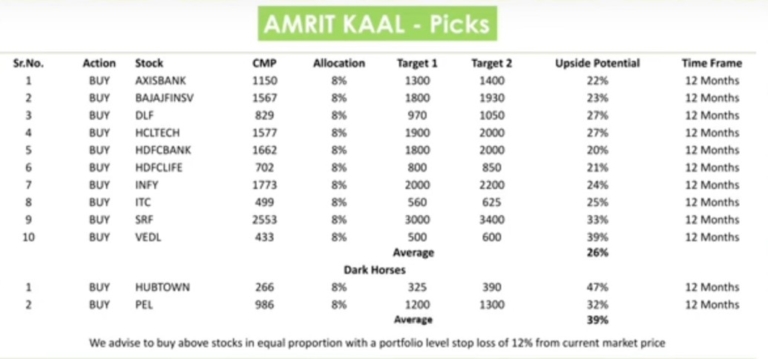

Rahul Sharma of JMFICS has recommended an 'Amrit Kaal' basket of 16 stocks with...