Incorporating revised earnings, our estimates don't undergo any major change. We value Nifty at...

APL Apollo Tubes (APAT) during the quarter reported 9.4%/-0.2% YoY increase in Net sales/PAT...

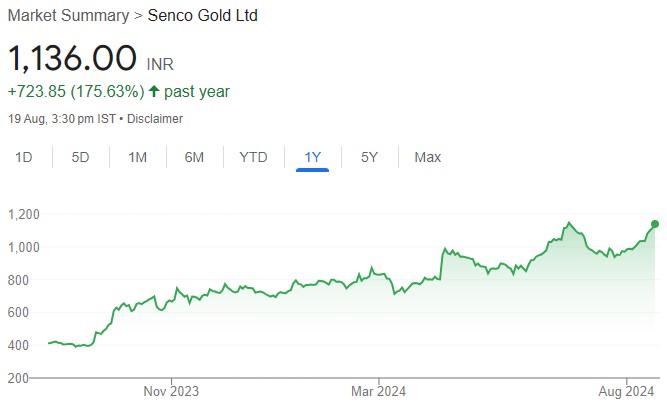

We believe Senco has huge headroom to grow given its strong legacy in...

TCI has been affected by a sluggish macro environment, although it has performed well...

Factoring in its recent blockbuster performance, we have upgraded our estimates slightly. We ...

Hindalco, part of Aditya Birla group, is India’s largest fully integrated aluminium and copper...

At the current price, the stock is trading at 47.2x/29.5x of its FY25E/FY26E earnings...

We believe Azad stands at an interesting juncture where a massive TAM is complemented...

Sobha continues to provide strong growth visibility by unlocking its vast land reserves. Additionally,...

JB Chemicals’ (JBCP) Q1FY25 revenue growth was largely in line with our estimates. Slightly...