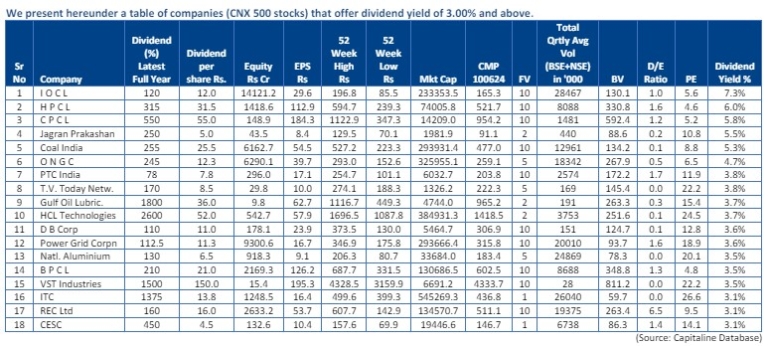

We present hereunder a table of companies (CNX 500 stocks) that offer dividend yield...

In our Sobha (SDL) deep dive note ‘R’eset, ‘R’estart, ‘R’efocus = ‘R’erating, we had...

We expect a 16% earnings CAGR for MANKIND over FY24-27. Considering its strong brand...

Varun Beverages Limited (VBL or the Company) is a significant entity in the beverage...

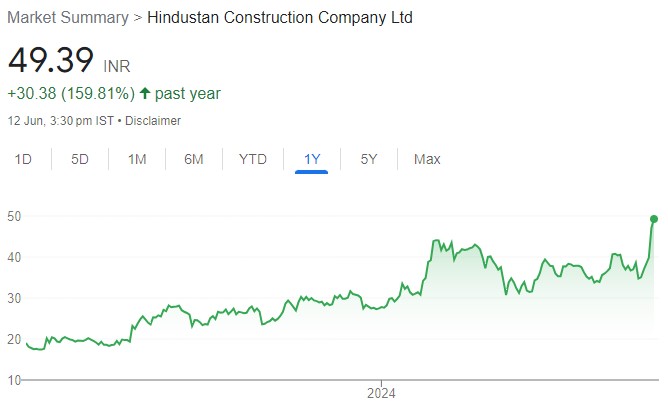

Once the toast of India’s infrastructure space, Hindustan Construction Company (HCC IN) saw its...

Company’s operational and financial performance to improve significantly in the coming period. We estimate...

We are positive on the sector due to the favourable industry dynamics in the...

We initiate Jyothy Labs (JYL) with a high conviction BUY idea, with a TP...

The dividend yield is computed based on the closing price of 5 th June...

Management notes that occupancy and room rates seen in FY24 point to RevPAR growth...