Pharma Back on Growth Track

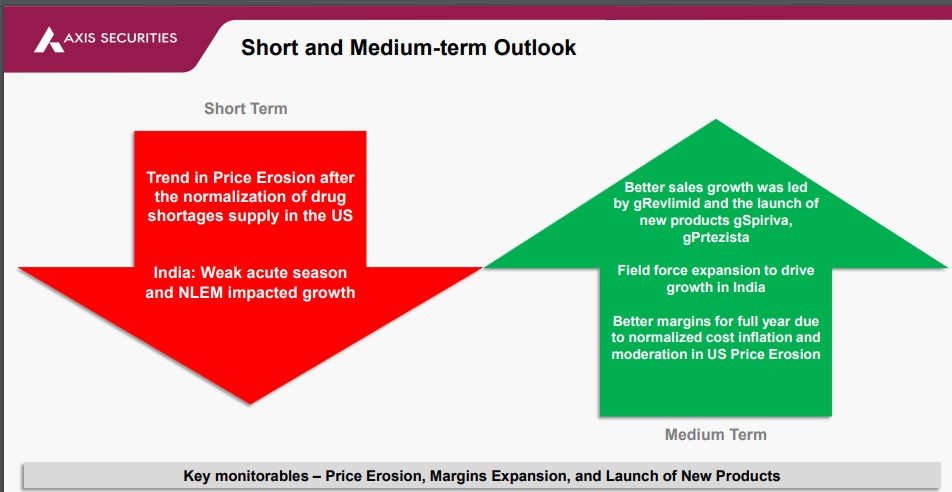

In FY24, high single-digit domestic growth is anticipated. Furthermore, the US market is poised for robust growth, supported by the normalization of prices in the base business and the ongoing ramp-up of gRevlimid, along with new product launches such as gSpiriva and gPrezista.

In the US business, supply constraints have prompted most business leaders to anticipate a significant decrease in price erosion, with expectations that it will remain low for the remainder of FY24.

In India, growth has primarily been fueled by price increases and robust expansion in chronic therapies, with all major companies projecting high single-digit growth for FY24.

Margins will also improve as RM and freight costs normalize, US price erosion eases, and a better mix is achieved.

However, USFDA inspections remain an overhang and price erosion in the US is expected to increase once supply normalize.

Therefore, we continue to eye on companies that are focused on launching niche products in the US market and a strong product mix (Chronic Portfolio) in the Indian market.

LUPIN, CIPLA, and Aurobindo are our top picks in the Pharma universe.

Click here to download Top Sector Ideas Pharma – Q3FY24 by Axis Securities