Raymond is a diversified business conglomerate with presence in Textile, Apparels, FMCG, Realty, Engineering and Prophylactics etc. With the backing of a strong brand, Raymond is reckoned for delivering world-class quality products to its consumers for the past 9 decades.

Five Reasons to Buy

Delivered highest ever quarterly sales; Entered into Sunrise sectors: The company during the quarter 3QFY24 has delivered Revenue/EBITDA/PAT of Rs 2,450 cr/ Rs 426 cr/ Rs 184 cr. The sales for this quarter is the highest ever. The growth was led by support across the verticals. The company has opened 65 new stores leading to a 20% growth in branded apparel sales. The company has opened 100th Ethnix by Raymond while real estate vertical registered 252 units of booking translating into a booking value of Rs 428 cr. The company’s Engineering business forayed into sunrise sectors of Aerospace, Defense and EV components business by Acquisition of MPPL (Maini Precision Products Limited) (The acquisition is still under process).

Real estate continued to demonstrate sustained demand: Residential real-estate continued to demonstrate sustained demand including high demand for luxury homes. During the quarter it has signed 2 JDAs (Join Development Agreements). The company has taken initiatives like emphasis on collections and efficient inventory management and related production cycle to optimize NWC (Net Working Capital). It has been able to reduce NWC to 71 days from 98 days in Sep’19. Thane (100 acres) land development has total revenue potential of Rs 25,000 cr. Nearly 40 acres of land is under development for revenue potential of Rs 9,000 cr while 60 acres (~7.4 million sqft) has another saleable potential of Rs 16,000 cr.

Turned debt free 2 years ahead of the guidance: The company post sale transaction of its FMCG business is presently turned debt free with net cash position of Rs 1,300 cr as of Dec’23. It sold FMCG business for sale proceeds of Rs 2,825 cr in May’23 and has realized Rs 2,200 cr net tax amount.

Go to market strategy for textile segment: The company has taken go to market initiatives for its Suiting, Shirting, Apparel, Ethnix segment in textile division. It is building hyper personified interaction BOT – ETHINX that provides seamless flow of customer journey using WhatsApp based interaction through direct button featured across text, video, image etc. The company has made 65 net store additions during the quarter to take total at 1,841 as of Dec’23 v/s 1,743 in Dec’22. The company has an aggressive plan to open over 500 stores during the next 3 years. It recently demerged its lifestyle vertical which can potentially unlock the value for shareholders (approval is still under process).

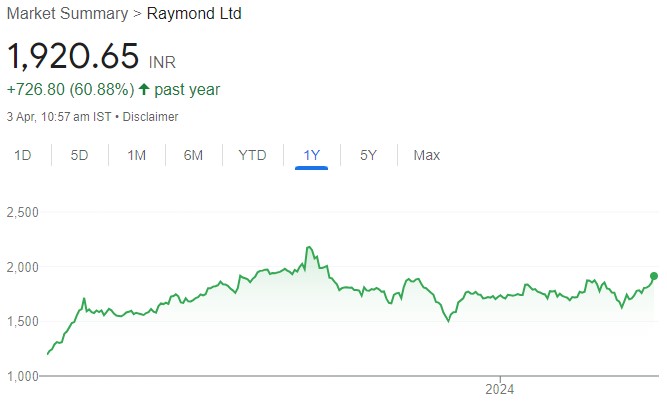

Attractive valuation: At the current price, the stock is trading at a PE multiple of 16.2x/13.7x of its FY24E/FY25E Bloomberg consensus earning estimate.

Key Risk Factors: Any slowdown in consumption; High rate of interest may impact real estate business; High competition

Click here to download Pick of the Week Raymond Ltd by SBI Securities