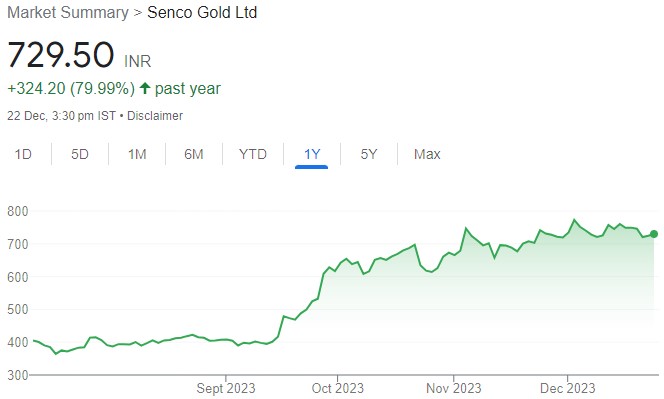

Prashant Jain’s 3P INDIA EQUITY FUND holds 960,000 shares of Senco Gold constituting 1.24% of its equity as of 30th September 2023. The investment is worth Rs 69.8 crore at the CMP of Rs 721. SBICap has issued a research report explaining the fundamentals of Senco Gold and recommending a buy for the target price of Rs 920 which is an upside of 27%.5.

The research report reads as follows:

Senco Gold Ltd.

Sparkling gem at attractive valuation

Senco Gold Ltd. is a pan-India jewellery retail player with a history of more than five decades. The company’s products are sold under the brand of ‘Senco Gold & Diamonds’ through multiple channels which include owned stores, franchise stores and various online platforms. Senco enjoys a wide and directly-owned retail presence across West Bengal, Uttar Pradesh, Odisha, Jharkhand, Karnataka, Maharashtra and Assam. It has 83 Company Operated (CO) showrooms and 62 Franchise Operated showrooms as of Sep’23 across all regions in India.

We believe great growth prospects lie ahead for Senco Gold in the Indian retail jewellery market due to (a) Its strong legacy of over 5 decades (b) Focus on lightweight, modern and affordable jewellery segment (c) Robust business model with right mix of CO/Franchise model and rising stud ratio aiding healthy overall margins and return ratios (d) Diverse distribution channel with growing presence across regions (e) Proper hedging practices to avoid the impact of gold price volatility (f) Positive industry outlook favoring growth of organized players. We expect Senco to grow at Revenue/EBITDA/PAT CAGR of 24.8%/21.8%/21.6% respectively over FY23-FY26E. At current price, Senco Gold is trading at PE multiple of 34.4x/25.9x/19.7x of its FY24E/FY25E/FY26E earnings respectively. We have valued the company at 35.9x PE multiple based on its FY25E earnings and arrive at a target price of Rs 920, implying an upside potential of 27.5% and assign a BUY rating for the stock.

Investment Rationale

Strong legacy of over 5 decades: The company has a track record of >5 decades in the jewellery business ensuring trust and transparency among the customers. It is the largest organised jewellery retail player in the eastern region of India based on the number of stores and among eastern India based jewellery retailers.

Focus on lightweight, modern and affordable jewellery: Though the company has wide range of product offerings catering to different customer segments, it particularly caters to the upwardly mobile class and younger generation as it believes that the consumer preference is shifting away from traditional bulky jewellery to light-weight fashion items. Accordingly, the company’s light and affordable jewellery product range starts at ~Rs 2,000.