When Daljeet Kohli recommended a buy of Oriental Carbon Chemicals Ltd and projected a target price of Rs. 700 (35% upside from the then prevailing price of Rs. 509), he had not factored in the fact that Prashant Jain, the whiz-kid fund manager of HDFC Mutual Fund, would develop a liking for the stock and launch an aggressive buying action.

On Friday, 19th August 2016, Prashant Jain and his team of ace traders landed up unannounced at the Oriental Carbon counter. In the blink of an eye, they mopped up all the shares in sight which aggregated 185,000 shares.

It is elementary that when a micro-cap with low liquidity witnesses such aggressive buying action, the stock price is bound to sky-rocket.

It is notable that HDFC Mutual Fund already holds 2,75,000 shares of Oriental Carbon. The increase in the holding by 185,000 implies that Prashant Jain believes that Oriental Carbon is still undervalued given its ambitious expansion plans and near-monopoly in the business of supplying a sulfur compound used for the manufacture of radial tires.

Prashant Jain’s confidence augers well for the shareholders of Oriental Carbon (which includes Anil Kumar Goel) because Prashant Jain is known to be a stickler for principles. He does not compromise on the quality of the stock and its valuations.

it is also worth noting that the experts at the valuepickr forum have given a clean chit to Oriental Carbon and not found many red herrings in it. In fact, Ayush Mittal, who is acclaimed as a “Wealth Wizard” by Forbes, was amongst the first to recommend the stock when it was available at throwaway valuations.

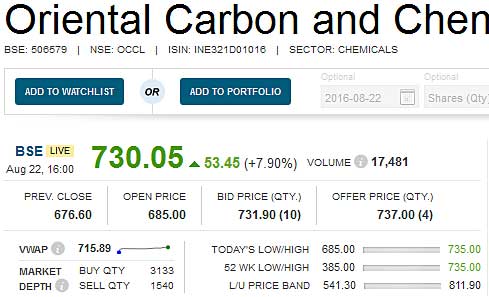

Daljeet is feeling somewhat sheepish about the entire episode because the target price of Rs. 700 which he expected the stock to deliver over 12 long months, has been delivered in barely 60 days.

Now, Daljeet will have to go back to the drawing board and rework his target price. Hopefully, this time he will work out a more realistic target price for Oriental Carbon!

Basant Maheshwari Buys Cupid as per annual report.

Just today’s date, one year back it was quoting at 600. Today Oriental Carbon is 740. Its like saying my stock has gone up from 60 to 74 rupees in one year. And in August 2014 on this date it was at 292. 29 rupees to 74 in two years? This is very POOR investment !!