Piping back to growth

About stock: Prince Pipes and Fittings Ltd. (PPFL) is one of the largest domestic manufacturers of PVC pipes with a market share of ~5%.

• It has 8 manufacturing units, with a combined capacity of ~4.24 LTPA, across India.

• It has a strong network of over 1500+ distributors.

Investment Rationale

Demand revival and capacity augmentation to drive 10%/12% CAGR in sales volume/revenue growth over FY25-FY28: Prince Pipes has been consistently augmenting its capacities (~11% CAGR over FY21-FY25, 4.24 LTPA as on Q1FY26) through both brownfield and greenfield expansions, enabling it to retain an average market share of ~5%. We believe revival in housing completions from PMAY (Urban+Rural), extension of JJM scheme with enhanced outlay and robust residential sales during CY20-CY23 entering delivery phase would drive plastic piping industry over the next two to three years (Indian plastic piping industry revenues is estimated to grow at 9-10% CAGR over FY25-FY27E). Consequently, we expect Prince pipes to grow its sales volumes/revenues at a CAGR of 10%/12% over FY25-FY28, growing in tandem with industry aided by new capacity addition (Bihar unit – 52,188 tonne).

PVC price stability, operating leverage and better product mix to drive EBITDA margin expansion boosting PAT growth: PVC prices are expected to remain firm with upward bias with anticipated ADD imposition by Finance Ministry by mid-November 2025. Consequently, Prince pipes’ EBITDA margins are expected to revive (~7% in Q1FY26) from Q2FY26 onwards (management targets 12% by Q4FY26) in absence of inventory losses, improvement in product mix (CPVC volumes share to rise to ~25% from 20-22% currently) and operating leverage (led by volume growth revival). Consequently, we estimate its consolidated adjusted PAT to grow at ~69% CAGR over FY25-FY28E led by ~38% CAGR in EBITDA.

Return profile to improve materially from FY25 trough: Prince pipes is working on improving its working capital cycle, focusing on reducing its inventory days (70-75 days by FY26 end from 88 days in FY25). Additionally, its major capex outlay (Bihar expansion and balance payment for Aquel) are expected to complete in FY26. Additionally, strong OCF generation (average ~₹ 300 crore p.a. over FY26-FY28) should aid in debt reduction (gross debt of ~₹ 250+ crore) during FY27 & FY28. Overall, we expect its return ratios to revert to FY24 levels (RoE/RoCE – ~11%/14% from the trough of FY25 (RoE/RoCE – ~3%) in FY28.

Rating and Target Price

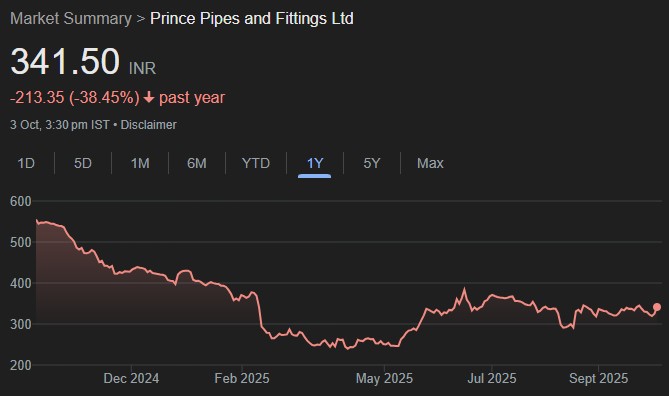

• Prince Pipes is expected to resume its earnings growth trajectory over the next three years post a weak performance in FY25.

• We estimate its Revenues/EBITDA/PAT to grow at ~12%/38%/69% CAGR over FY25-FY28E. We initiate with a BUY rating and Target Price of ₹ 470/- (25x P/E on FY28E).