Key changes in Uttar Pradesh excise policy

Good times are here to stay; maintain high-conviction BUY: Uttar Pradesh has recently released a new excise policy for FY26, highlighting a series of reforms, which in our view, shall benefit mainstream liquor companies. Radico is likely to be a significant beneficiary, since UP contributes to 25% of its domestic volumes. The following reforms are likely to boost volume growth in the state: (1) allowing the sale of LUPs (60 ml and 90 ml) for both the regular and premium segments, which shall drive conversion from country liquor to regular IMFL and encourage trials in the premium segment; (2) creation of a composite shop distribution network—permitting the sale of beer, liquor and wine from a single store, which will increase the overall distribution reach. Moreover, the existing liquor retailers will have to wind up their business and reapply in the e-lottery system; and (3) reorganising supply chain of liquor, thereby freeing up working capital for liquor companies. However, in the near term, liquor companies may witness demand headwinds, as existing retailers de-stock their inventory. Incrementally, we were disappointed via the fact that the anticipated price hikes for UPML (UP manufactured Liquor) did not come through which could further strain profitability (margins in UPML are around 5-6%).

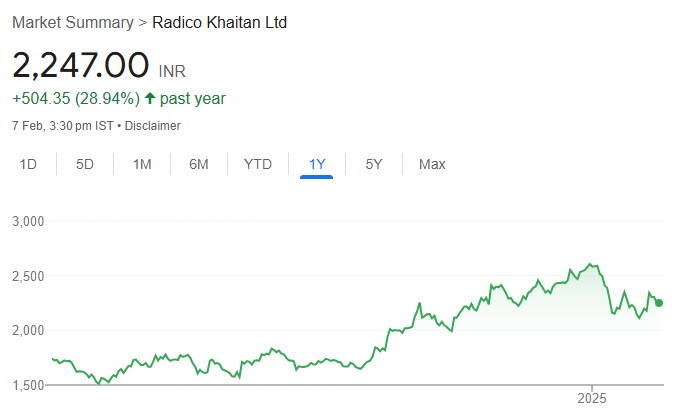

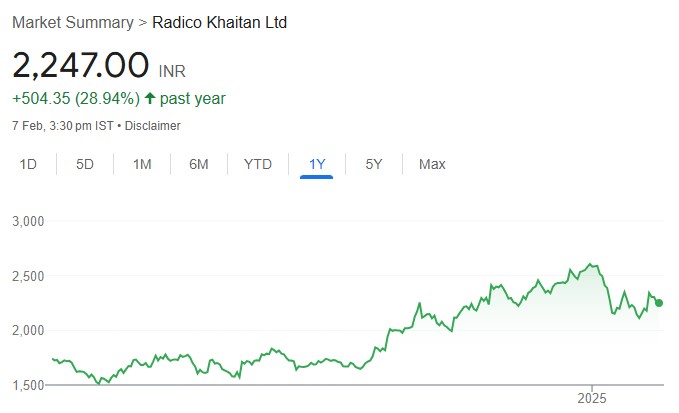

View and outlook: We continue to maintain Radico as a high-conviction BUY with a target price of INR 2,600 (52x FY27 EPS). We expect the company to deliver revenue/EBITDA/PAT CAGRs of 15%/26%/34%, respectively, over FY24-27, driven by the following factors: (1) favourable policy interventions in high-salience states of Karnataka/AP—reduction in excise duties (Karnataka) and a new liquor policy favouring private players (Andhra Pradesh); (2) the regular IMFL segment seeing an uptick after many quarters of subdued volumes, due to a favourable base and policy interventions; (3) improved salience from the high-margin luxury/premium segment, as management doubles the malt capacity; (4) moderation in the RM index, along with management initiatives on cost optimization, such as the commencement of the Sitapur distillery, shifting to PET bottles from glass in the regular segment, and the removal of mono cartons, all supporting margins.