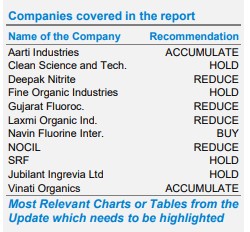

Top Picks:

Navin Fluorine International Ltd: Company’s topline & bottom-line grew at CAGR of >20% over FY16-FY23, primarily led by robust growth from specialty chemicals and CDMO business segments. Going forward, we remain bullish on the stock led by its strong focus on late entry products with completion of cGMP4 by CY24 coupled with strong growth from segments such as HPP &

CDMO.

The stock trades at 29x P/E & 20x EV/EBITDA on FY26E numbers. We assign P/E of 30x on FY26E EPS of Rs 134 and arrive at TP of Rs 4007. “Maintain Buy”.

Vinati Organics Ltd: Company’s topline & bottom-line grew at CAGR of ~20% over FY16-FY23. We believe for the company with demand recovery from ATBS, IBB & higher contribution from butyl phenol/antioxidants, robust performance to be seen post FY24. We believe long term story seems to be

intact especially with expansion in ATBS and downstream products of butyl phenol. “Maintain Accumulate”.

The stock trades at 34x P/E & 25x EV/EBITDA on FY26E numbers. We assign P/E of 40x on FY26E EPS of Rs 50 and arrive at TP of Rs 1997