Healthy demand drives ADR higher

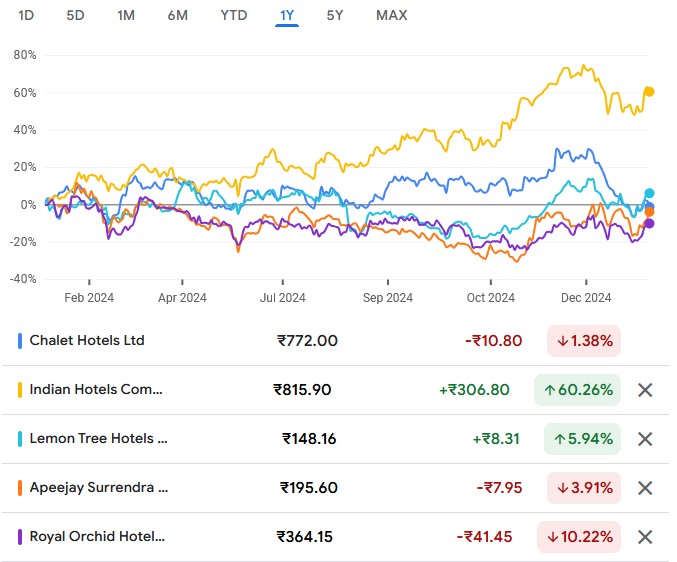

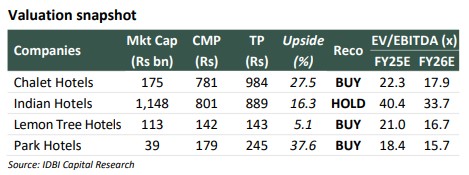

In our monthly Hotels update we have summarized key events of the domestic hotel industry, new hotels signing/addition by key players during the month and pricing trend of key cities for January, 2025. We have analyzed pricing of 171 hotels with ~33,000 keys across 8 cities to understand the trend over last 24 months (Exhibit 1- 8). The industry has been riding high owing to healthy demand led by wedding season. Hotels in pilgrimages reflected robust demand traction in January as cities like Prayagraj, Ayodya, Varanasi witnessed “The Kumbh Mela” related travels in the region. Q3FY25 earnings of the organized players has been encouraging as RevPAR growth remained healthy. The management guided earnings growth trajectory to be healthy in FY26E as well given demand-supply mismatch in inventory and demand dynamics are favoring the hotels. Foreign travel is expected to improve further and strengthen growth of the industry. The companies were aggressive in inventory addition, majorly through management contract/ license agreement. We maintain our positive outlook on Indian Hotels, Chalet hotels and Lemon Tree hotels amongst the listed players.

Investment Rationale

Healthy ADR growth continued: The industry witnessed 7.4% increase on a lower price band on YoY, while on a higher price band, the ADR increased by 10.3% YoY. We believe this indicates underlying healthy demand in domestic hotels market. On MoM, prices were marginally up by 1% each on lower and upper price band. Out of 8 markets, Mumbai and Jaipur reported increase in ADR on YoY basis.

New hotels addition continued at healthy pace: The organized players continued to add new inventory, majorly through management contract and license agreement. New inventory addition has been robust as IHCL and LTH added 7 and 6 hotels respectively, while Royal Orchid added 2 hotels in January, 2025.