The Rising Giants PMS portfolio managed by Marcellus Investment Managers intends to invest primarily in high quality mid-sized companies (less than Rs 75,000 crores market-capitalisation, predominantly in the Rs 7,000 crores – 75,000 crores range) with: 1) Strongly moated dominant franchises in niche segments; 2) A track record of prudent capital allocation with high reinvestment in the core business and continuous focus on adjacencies for growth; and 3) Clean accounts and corporate governance. From a universe of ~450 companies in this segment, a portfolio is constructed of 15-20 companies which make it past Marcellus’ proprietary forensic accounting & capital allocation filters as well as our bottom-up stock selection & position sizing frameworks.

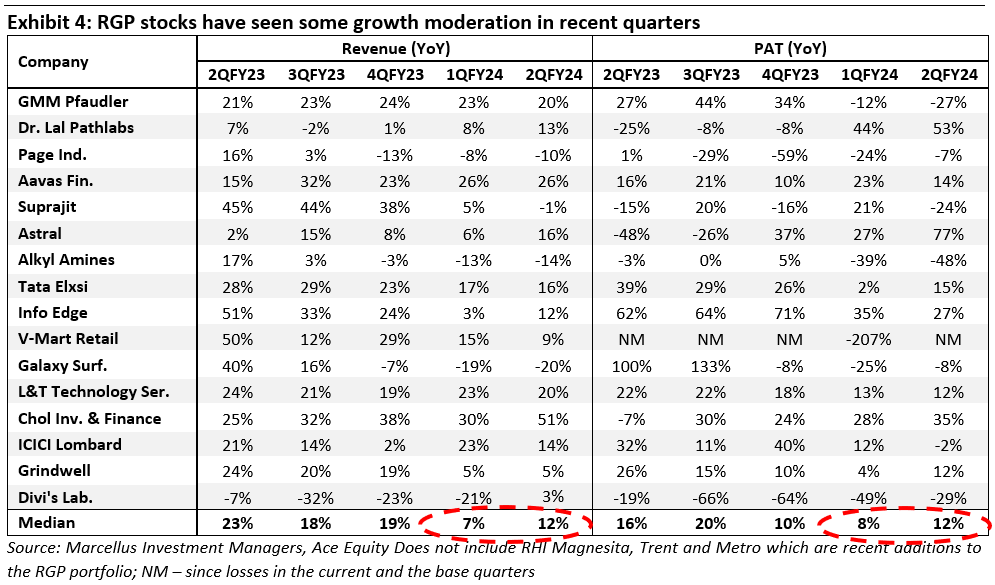

Long term fundamentals of Rising Giants portfolio remains healthier compared to the benchmark

| STOCK | CMP (Rs) | YTD Return |

| GMM Pfaudler | 1608 | 2 |

| Dr. Lal PathLabs | 2697.2 | 23 |

| Page Industries | 37401.05 | -11 |

| Aavas Financiers | 1445.6 | -20 |

| Suprajit Engineering | 371.7 | 13 |

| Astral | 1913.95 | 30 |

| Alkyl Amines | 2138.15 | -20 |

| Tata Elxsi | 8316 | 32 |

| Info Edge | 4803.2 | 23 |

| V-Mart Retail | 1695 | -40 |

| Galaxy Surfactants | 2825.3 | 14 |

| L&T Technology Services | 4450 | 20 |

| Cholamandalam Investment | 1125 | 54 |

| ICICI Lombard | 1441.15 | 16 |

| Grindwell Norton | 2110 | 15 |

| Divi’s Lab | 3600 | 7 |

| RHI Magnesita | 2776 | 24 |

| Trent | 2577 | 92 |

| Metro Brands | 1281 | 48 |

Additions to the Rising Giants portfolio:

1. Metro Brands Limited

Metro Brands Limited (MBL) is the one of the largest and fastest growing Indian footwear retailers with a revenue and earnings CAGR of 15% & 20% respectively over FY18-23. MBL is the most efficient footwear retailer in India as evidenced by store level ROI of ~60-80% which is almost twice as high as other footwear retailers despite the challenges in managing close to 6,000 to 8,000 SKUs per store across ~750 stores.

MBL’s competitive advantage is the promoters’ skill in buying & merchandising which comes from over four decades of hands-on experience along with a Theory of Constraints based automated replenishment at the store level to bring in efficiencies, strong vendor relationships (built over four decades) who give MBL favorable terms in new designs and payment cycles, and a unique incentive structure at the store level (80% pay for store level staff is variable). The store level pay structure ensures that store staff has a strong incentie to offer the best customer service and give the right inputs to the buying & merchandising team at HQ.

MBL’s proven track record of running the most efficient footwear business in India makes it the platform of choice for global brands entering India. While MBL started as a standalone store in 1955 under the name ‘Metro Shoes’, it subsequently launched multiple formats like:

– Mochi (started in the year 2000 to cater to fashion footwear);

– Walkway (started in the year 2009 to cater to value segment);

– Crocs Exclusive Brand Outlets started in the year 2016 with MBL having Right Of First Refusal for offline Crocs stores and today running 80-85% of Crocs stores in India.

In 2022, MBL was awarded as licensee of the UK based FitFlop brand in India. Recently the firm has acquired licensing rights for the brand ‘Fila’ in India to cater to the sneakers & sports shoe segment. Across its 5 brands, MBL mainly caters to the formal & casual segment of the market with aspirational product offering as evidenced by ASP of ~Rs1600-1700.

2. RHI Magnesita India Limited

RHI Magnesita India (RHIM India) is the Indian subsidiary of RHI Magnesita (RHIM Global), a global leader in manufacturing & servicing of refractories with ~30% market share (ex-China). Refractories are non-metallic material having very high melting points enabling its usage as an internal lining in furnaces, kilns or any other vessels in the Metal, Cement and Glass industries.

The key investment thesis in RHI Magnesita India revolves around the following points:

Highly critical nature of refractories: Even though refractory accounts for only 2-3% of the overall cost, without refractories the customer’s plants cannot commence production. Additionally, refractories go through general wear and tear and hence need to be replaced at regular intervals, which is a very tedious process and entails plant shutdowns which may take as long as a day. Given the low-cost but critical impact of refractories, a customer demands products with the highest quality and longest life, thereby reducing the downtime risks.

RHI’s Quality and R&D focus: RHIM India’ leadership in the Indian refractory market is underpinned by its superior product quality. This superior product quality is a result of RHIM Global’s high focus on R&D (1700+ active patents) and ability to continuously come out with better quality products that have longer lives. Channel checks suggest that RHIM India is a dominant player in the refractory industry with 40%+ market share in the Basic Oxygen furnace + Laddle segments.

Significant reinvestments by RHIM India in the recent years: In the last 5 years, RHIM India has been on an acquisition spree wherein it has added various flywheels and gained new capabilities. For instance, by merging all the subsidiaries of RHIM Global into RHIM India (listed entity), RHIM Global has aligned its interest with that of the minority shareholders. Similarly, the Dalmia acquisition has further fortified RHIM India’s moat through access to an extensive manufacturing base as well as facilitating entry into the Cement/Industrial and Blast Furnace refractory segments.

3. Eicher Motors Limited

Eicher Motors (EML) is an Indian automobile company housing two brands under its fold: Royal Enfield (catering to the Premium motorcycle segment) and VECV (catering to Trucks and Buses segment). The key investment thesis in Eicher Motors revolves around the following points:

Premiumization of Indian 2Ws: Rising income levels & financing penetration alongwith customer aspirations are likely to drive premiumisation of the Indian 2Ws and Eicher Motors is expected to be a key beneficiary of the same. In late 2000s, Eicher Motors, with its Royal Enfield brand, revolutionised the premium motorcycle market in India by launching its famous ‘Classic 350’ motorcycle in 2009. Thereafter, Eicher Motors, cemented its initial success by swiftly expanding its distribution network from 250 dealer points in FY12 to 2000+ dealer points in FY23 and at the same time launched various new models in the premium segment over the last 10 years, viz. Bullet 350, Himalayan, Meteor 350, etc. Consequently, from FY13 to FY23, Royal Enfield sales have grown 6x from 122,000 units in FY13 to 734,000 units in FY23 in the domestic market.

Strong Competitive advantages built around the Royal Enfield Brand: Over the years, various players have tried to enter the Premium Motorcycle segment. However, Royal Enfield has remained relatively unscathed due to the following competitive advantages:

Aspirational appeal of the brand: Royal Enfield motorcycles have been well ingrained in Indian society with the brand gaining a cult-status in the riding community. The company is monetising this loyal base to the fullest by not just selling motorcycle but also by selling various non-motorcycle components such as apparel and equipment.

Dealer viability as a barrier for new entrants. Premium motorcycles/vehicles require a different distribution set-up to provide a premium customer experience to the end customer – a motorcycle enthusiast catering to the customer, premium quality store lighting and layout, etc. Thus even if a conventional peer enters this segment, they still need to set up a distribution network from scratch. Further, existing dealerships of established OEMs (incl. Royal Enfield’s) generate majority of their income by servicing the vehicle whereas margins earned on motorcycle sales are only able to cover the day to day running costs of the dealership. Since servicing income is not available to a new distribution channel, setting up a new dealer network is extremely difficult even for existing OEMs.

Replicating India’s growth story in export markets: Over the last five years, Eicher Motors has been focusing on the export market where its strategy is to follow the Indian template of creating aspiration and building a loyal customer base in the exports market. The Company has done extremely well on the exports front where it has increased volumes from less than 5k units in FY16 to over 1lakh units in FY23. With many markets still available for Royal Enfield to tap, there is immense scope for further growth in the Exports market. Exports currently account for 13% of Eicher’s revenues.

Healthy market share gains for VECV’s trucks & buses: Eicher Motors has a JV with Sweden’s AB Volvo – Volvo Eicher Commercial Vehicles Limited (VECV), wherein Eicher holds 54.4% in the JV. Similar to the motorcycle portfolio, Eicher has done well in the Trucks and Buses segment as well by launching new products (viz. the Pro Series) as well as expanding its distribution network. Resultantly, the company has in the last 5 years, increased its market share in light and medium duty trucks from 29% in FY19 to 32% in FY23 and from 4% in heavy duty trucks in FY19 to 8% in FY23.

4) Trent Ltd.

Trent is a retail business with successful formats like Westside and Zudio, and a JV with Zara (which is 49% owned by Trent). The competitive advantages of Trent lie in its end-to-end control of supply chain (back-end – direct from manufacturer to stores) and product development – which translates into greater value-for-money proposition for customers, relevant of the merchandise and hence inventory turns (6x) which are the best in the industry. Once these strengths were developed for Westside, formats like Zudio have subsequently been built on the same tenets through usage of common vendors, warehousing, and logistics at the back end and common store opening teams at the front-end. Capital efficiency is maintained despite rapid scalability of Zudio due to its unique store expansion business model of running the store as COCO (company owned, company operated) in the first year and then transitioning to FOCO (franchisee owned, company operated) from the second year onwards.

The company also has an incubation in the Food & Grocery retail space called Star Bazaar. Star was started n 2014 the company converted it into a JV with Tesco UK. Today the JV has 63 stores under operations primarily in West & South India.

Near term earnings growth prospect for Trent will be linked to Westside (more of the same), Zudio (propelled by store network expansion) and Star Bazaar (profitability turnaround and store network expansion). However, Trent continues to incubate newer retail formats, some of which could become as successful as Zudio in future. Four new formats are already under incubation viz. Misbu (cosmetics), Utsa (ethnic wear), Samoh (Occasion wear), & JV with MAS brands for athleisure & innerwear. Scalability of Trent’s business across as well as within retail formats is supported by the depth and width in its management talent – expats hired from reputed foreign retailers like M&S, Woolworths etc and several layers of internally groomed talent, including those recruited from TAS (Tata Administrative Service).

Whilst at first glance, Trent’s P/E multiple looks rich, there are three factors which have to be incorporated while considering its valuations: a) INDAS 116 impact (accelerated store count expansion of any retailer leads to P&L reflecting up-fronted costs of rentals which is a non-cash item and is therefore ignored by us); b) a drop in losses and the potential turnaround of Star Bazaar format at a store level; and c) the impact of rapid growth of Zudio on Trent’s forward P/E multiple in the near future.

Leave a Reply