Key highlights of 4QFY24 result

Strong YoY performance albeit margins were under pressure due to increased competition: Senco Gold reported robust sales growth of 39.7% YoY at Rs 1,137 cr supported by higher footfall growth, rise in gold prices and attractive offers & launches during the quarter. EBITDA/PAT grew 31.5%/23.6% YoY to Rs 88 cr and Rs 32 cr respectively. EBITDA margin was under pressure due to heightened competition leading to more offers and discounts during the quarter. Senco’s EBITDA margin dropped 48 bps YoY to 7.7%, however, going forward the management aims to keep operating margin at ~8%.

For FY24, Senco’s revenue grew 28.5% YoY to Rs 5,241 cr. Retail revenue growth was 25% YoY mainly led by higher SSSG of 19%, higher stud ratio, higher export sales and 23+ new store. Diamond jewellery sales during the year grew 37% YoY while stud ratio improved 100 bps YoY to 11.4% in FY24. Senco will continue to focus on its strategy to grow stud ratio by 100-120 bps per annum. D/E improved from 1.2x to 1.1x aided by free cash flows during the year and IPO proceeds which were utilized to reduce working capital. Senco’s old gold exchange with customers has grown substantially over the last 2 years from ~15% of the overall business in FY22 to 32% of the overall business in FY24. The loyalty customer value stands at 55%+ for the company at present indicating strong consumer confidence.

Net store addition of 23 in FY24: The company net added 23 stores during FY24 out of which 6 were franchise stores and 17 were company operated stores. The total store count of Senco as on date stands at 159. The franchises have been more focused in the Eastern India expansion. Senco inaugurated Dubai store on Akshaya Tritiya which is still in the process of setting up customer connect. The company will open 8-10 each company owned and franchise stores in FY25, 70-80% of which will be focused in Eastern and Northern India as the company wants to play on economies of scale and brand leverage.

Growth outlook for FY25: Despite strong FY24, the company aims to clock topline and bottomline growth of 18-20% and 15-20% respectively in FY25. The company going forward will increase the GML in the total borrowing to 70-75% from current 55% levels which will help reduce cost as GML carries interest rate of 3.2-3.8% while other debt component such as cash credit or demand loan carries interest rate of ~9.5%.

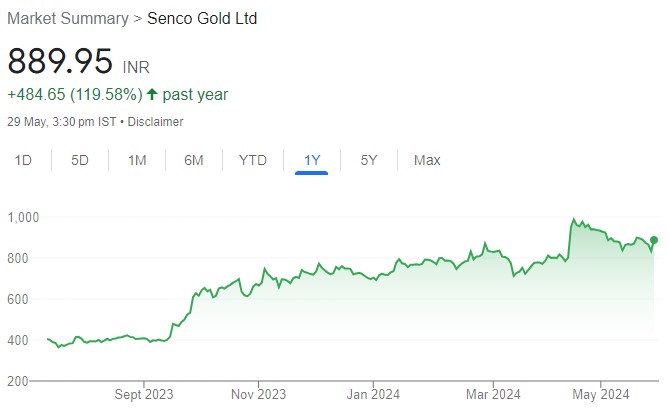

Maintain BUY – Target Rs 1,025: We believe Senco has huge headroom to grow given its strong legacy in the jewellery business, expanding footprint through a strong and diverse distribution channel, focus on light affordable jewellery with better price point and healthy growth visibility from both its company operated and franchise stores.

We maintain BUY on the stock and upgrade our target price to Rs 1,025 which implies an upside potential of 17.3% for 12-18 months.

Click here to download Senco Gold Limited 4Q FY24 Result Update by SBI Securities