Key highlights of 3QFY24 result

Strong sales growth driven by festive and wedding season: Senco Gold reported robust sales growth of 23.3% YoY at Rs 1,652 cr which was supported by huge response from festivals such as Dhanteras, Navratri, Durga Puja, Diwali and high number of weddings during the quarter. The company’s blended studded salesratio increased to 11.8% from 11.4% in 2QFY24. Senco aims to grow its blended studded sales to 15% over the next 3-4 years. EBITDA/PAT grew 11.3%/5.8% YoY to Rs 181 cr and Rs 109 cr respectively. EBITDA margin however declined 119 bps YoY to 11.0% as the company’s investments have increased on people, training and overall marketing cost after entering into tier 3 & 4 cities.

For 9MFY24, Senco’s revenue grew ~26% YoY to Rs 4,104 cr out of which volume growth was 9-10% while value growth was 16-17%. The gold segment grew 3-4% in volume terms and 9-10% in value terms while diamond segment grew 27% in volume terms and 40% in value terms during 9MFY24.

Net store addition of 19 during 9MFY24: The company net added 19 stores during the 9MFY24 period out of which 4 were franchise stores and 15 were company operated stores. The total store count of Senco as on date stands at 158. The company will open 18-20 stores per annum in the next 3 years.

Entry into Lab-Grown Diamonds (LGD): Senco has tapped LGD market in order to meet the growing demand in the segment. During the quarter, it opened 2 new LGD stores in Kolkata on a pilot basis and under the brand name Sennes to understand customer behavior in this segment. The management believes there is huge growth potential in this market as it offers high carat at relatively lower prices than natural diamonds. As per the buyback policy in case of LGDs, the customers will receive ~80% of the prevailing diamond rate and 100% of the metal weight which will further encourage customers to buy LGDs not only for adornment but also for investment. Senco will focus on designs (size of the diamonds, etc.) to create difference between natural diamonds and LGDs.

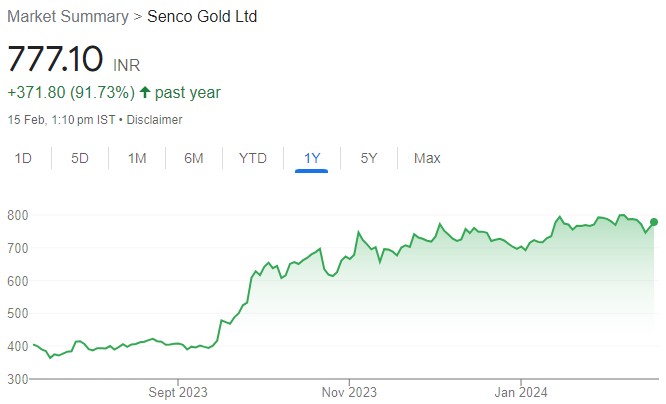

Maintain BUY – Target Rs 920: We believe Senco has huge headroom to grow given its strong legacy in the jewellery business, expanding footprint through a strong and diverse distribution channel, focus on light affordable jewellery with better price point and healthy growth visibility from both its company operated and franchise stores.

We maintain BUY on the stock and keep target price unchanged at Rs 920 valuing the stock at 34.1x PE multiple, which implies an upside potential of 14.0% for 12-18 months.

Click here to download Senco Gold Limited 3QFY24 Result Update by SBI Securities

Leave a Reply