Jeff Bezos thanked me for supporting Amazon during its crisis period

Shankar Sharma‘s escapades with foreign multibagger stocks are well known to us.

At a Morning Star conference, which was well attended by dignitaries like Raamdeo Agrawal, Shankar had disclosed how he homed in on Amazon and Apple and bought truckloads of them when they were languishing in the doldrums.

In fact, in 2001, during the depths of the DotCom bust, Jeff Bezos, the illustrious founder of Amazon, had ruefully conceded that the mounting losses coupled with lack of investor support meant that the end of the road was near for the e-com retailer.

“There’s no guarantee that Amazon.com can be a successful company,” the mega Billionaire had said, his shoulders slumped and eyes downcast.

Shankar realized at that precise moment that Amazon had bottomed out and there could be no further downside.

He took the cue and pounced on the stock in a no-holds barred move.

Devina Mehra, Shankar’s charming wife, confirmed the story.

“Ours was the only buy on the Street! Jeff Bezos thanked us for the support,” she reminisced, with understandable pride in her tone.

Within less than 2 years of this interview, we were clear that Amazon was going to make it. Just when Wall Street was 'throwing in the towel on Amazon', ours was the only buy on the Street!

Jeff Bezos even sent us an email thanking us for the support ? https://t.co/a9dCZB6e7P

— Devina Mehra (@1dmfg) August 26, 2019

Using similar modus operandi, Shankar bought truckloads of Apple and Twitter during their depths of crisis and raked in mega bucks.

In fact, Twitter gave a mammoth gain of 150% after Shankar’s recommendation.

Shankar has also revealed his Five Fail-Proof Mantras for finding Multibagger Stocks.

Thanks Pratik. Contra trades aren't actually very contra….the data supports the trade, but consensus disregards data. So I always say: when somebody ignores data, it's they who are being contrarian. Not me! https://t.co/h0Xf4HWHcU

— Shankar Sharma (@1shankarsharma) June 5, 2018

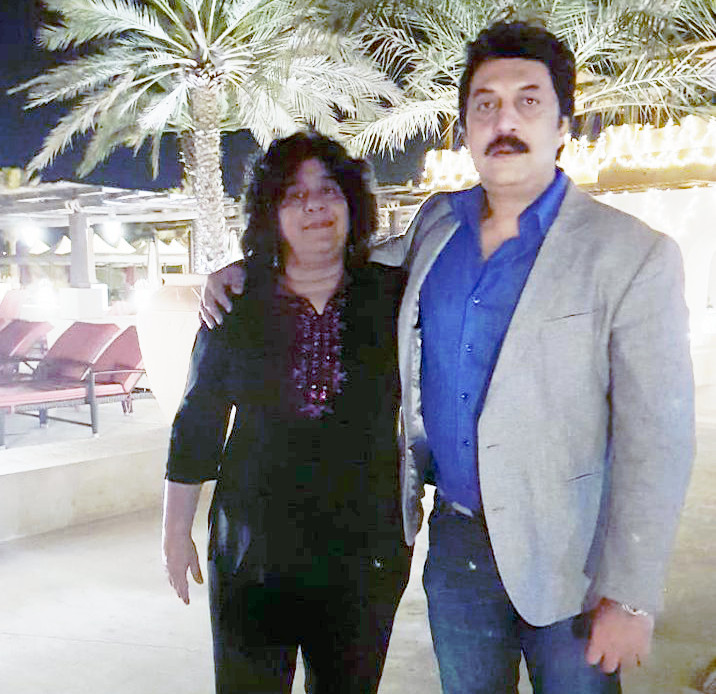

(Shankar with the charming Devina Mehra)

Now ‘Shopify’ delivers multibagger gains of 4000%

In January 2019, Shopify was described as a “Millionaire-Maker stock” in an article in Fool.com.

It was pointed out Shopify is protected by two very powerful moats.

The first is high switching costs. Once a company sets up its e-commerce operations on Shopify, it is painful to switch.

The prohibitive financial costs, retraining employees, downtime, etc create a powerful disincentive to jump ship and move onto a rival.

The second moat is a “network effect” created by the deluge of merchants (over 500,000) into the platform coupled with third-party app developers.

This has created a prosperous and virtuous cycle for Shopify’s ecosystem and nobody will want to leave it.

This analysis is corroborated by an article in investors.com by Aparna Narayanan.

Aparna Narayanan has described Shopify as a “potential Amazon challenger” and pointed out that it ticks off many of the boxes that investors should be looking for.

The stock was a leader in 2019 and continues to act like one in 2020.

She has also opined that key acquisitions and expansions promise more runway for e-commerce and international growth.

Paul Lambert of Tocqueville Asset Management has given cogent reasons as to why Shopify is his pick for an e-commerce play.

He has pointed out that Shopify’s range of services that help small businesses manage their “entire e-commerce platform” makes it irresistible to investors.

Meanwhile, Shankar is grinning from ear-to-ear because he has already raked in mammoth gains of 4000% from the stock.

You guys know that normally I don't Storify any of our picks. But I simply have to Storify Shopify @firstglobalsec an amazing stock it's been: up 40x in 3 years. $60 billion mkt cap! And as a user, can testify to their service and Products. And heck, a potential rival to Amazon https://t.co/cYVbzNRXu7

— Shankar Sharma (@1shankarsharma) February 24, 2020

I am looking for the “next Amazon, Apple, Dominos“, etc

Shankar’s appetite for foreign multibagger stocks has obviously been whetted by the spectacular successes of the earlier picks.

He is now actively looking for the “next Amazon, Apple, Domino's, Netflix, Twitter, Shopify,” etc.

We will have to keep a close watch and clamber onto his stock recos whenever the situation arises!

Looking for the next Amazon, Apple, Domino's, Netflix, Twitter, Shopify… let's see… https://t.co/hc79JVzFfR

— Shankar Sharma (@1shankarsharma) September 4, 2019