Sky Gold has acquired Sparkling Chains Pvt/Starmangalsutra Pvt for INR26cr/INR24cr. It will issue 4,17,542 shares to the shareholders of Sparkling Chains Pvt and Starmangalsutra Pvt on a preferential basis. Apart from this, promoters have lent interest free loans of ~INR38cr, which will be paid off. These acquisitions will help increase SKYGOLD’s addressable market in gold jewellery and diversify its product base. We recently initiated coverage on SKYGOLD which designs and produces gold jewellery. It operates in the casting jewellery space, which accounts for 35% of total jewellery sales in India.

About the acquisitions

SKYGOLD currently operates in a casting jewellery segment which accounts for 35% of total jewellery sales in India. Sparking chains is in the business of manufacturing chains which accounts for 20% of total jewellery sales and Starmangalsutra manufactures mangalsutras which account for 15% of total jewellery sales in India. Through these acquisitions, the addressable market for SKYGOLD has risen to 70% from 35%. Both the entities achieved PAT of INR7.5cr in FY24.

Both the entities were started by promoters two years back. The promoters have grown the business over last two years and are now confident on the scalability of both businesses. Hence the management decided to go forward with the acquisition. Both the entities will continue to operate as 100% subsidiaries of SKYGOLD. New shares were issued at the market price of INR1,197 on a preferential basis, which increases promoters’ stake by 3%. The management expects acquired entities to generate sales/PAT of INR600cr+/15cr+ in FY25.

Getting future ready

SKYGOLD has started the processes to recruit a product head for 18carat jewellery category, and sales head for exports. It plans to increase craftsmen by 2x in the standalone entity over the next three years.

Valuation and view

With its latest acquisitions, the management upgraded its FY27 guidance. It is now targeting sales of INR6,300cr, with over 25% RoCE. We see minimum risk to achieving this guidance. The acquisition is done at 15x FY24 P/Ex which is at a discount to SKYGOLD’s valuation. There is minimal increase in the shareholding of promoters. We see this acquisition as positive and new entities to grow at a faster rate from hereon. Shift to organised from the unorganised segment and growth in exports should drive volumes.

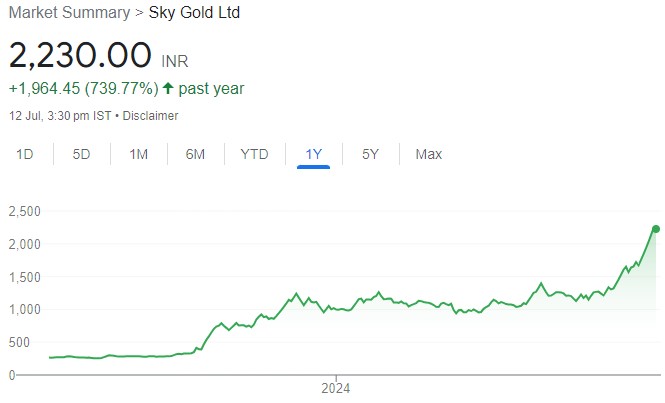

SKYGOLD is run by three brothers, each having over 20 years of industry experience and a sharp focus on scaling up the business. The promoters have shown tremendous execution capabilities and have built long-standing relationships with their clients. It continues to add new customers and gain wallet share from existing clients. Factoring in the acquisitions, we have upgraded our estimates. We expect revenue/EBITDA/PAT to grow 53%/56%/67% over FY24–27. SKYGOLD can be a long-term compounding story. We maintain ‘BUY’ but upgrade our TP to INR3,204 (25x FY27E earnings) from INR1,818 earlier.