Competition from China + declining global prices of chemicals

SRF is the largest listed specialty chemical manufacturer. Its April-June quarter results were very weak. It reported a 14 per cent fall in consolidated revenues due to a muted showing across its three key categories of chemicals, packaging, and technical textiles. Falling commodity prices, leading to inventory corrections amid weak demand, saw its operating profit fall by 29 per cent. Operating profit margins also slipped by 460 basis points (bps) over the year-ago quarter and 380 bps sequentially.

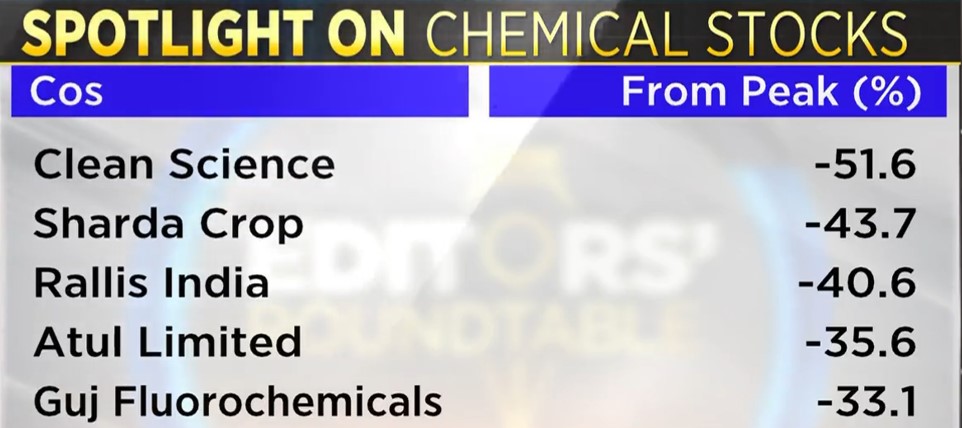

Experts say that multiple global headwinds will weigh heavily on the prospects of Indian specialty chemical companies in 2023-24 (FY24). Stocks in the sector are down 7-18 per cent and have underperformed the benchmarks (up over 10 per cent) in the past three months. They warn that the trend is likely to continue due to multiple challenges.

According to a report by Kotak Institutional Equities, the specialty chemicals sector will witness very weak results due to destocking, demand weakness across certain critical end-use industries and price erosion amid intense competition from Chinese suppliers. Both revenues and margins will remain under pressure.

“The demand woes in the global arena, especially in developed markets such as Europe and US, is impacting exports of Indian manufacturers even though domestic demand continues to support the downside for volumes.

The increased supplies of chemicals from China post easing of covid-related measures has been a key concern for Indian manufacturers. The production in China caught pace while local demand failed to impress, leading to more export of chemicals out of China, especially after the Chinese new year.

The increased competition through higher Chinese exports and declining global prices of chemicals have further impacted the performance of the Indian manufacturers,” experts stated in the Mint.

#EditorsRoundtable | Chemical stocks are seeing sharp fall in earnings !

The cyclical nature of what many believe will be a structural story is playing out hard !@_prashantnair explains.#StockMarket #NiftyBank #nifty50 pic.twitter.com/QIPA6ZZxp2

— CNBC-TV18 (@CNBCTV18News) August 4, 2023

Three small-cap stocks to buy?

Some experts are advising that the specialty chemicals sector has structurally positive longer-term prospects and that the recent slowdown in the chemicals sector does not bring to an end India’s journey of becoming the next chemicals manufacturing hub.

“Although we agree that there is imminent risk of earnings downgrades, especially for non contracted businesses, we highlight that these corrections should be treated as buying opportunities,” analysts at JM Financial said.

Vinay Jaising of JM Financial Services candidly admitted that he was overweight the sector in the past and has been hurt.

“We had a positive alpha for the last year, a sector which hurt us was the specialty chemical sector where we were a lot more overweight. The inventory levels in China are still a quarter or two based on what our analysts suggest to us. It is waiting to come down, so you can see a lot more pain in the next quarter and then it moves down,” he stated in the ET.

He recommended an investment in Tatva Chintan, Ami Organic and Archean Chemicals.

“These stocks all have different stories. If I talk about Tatva, they are playing primarily the SDA chain wherein you are betting on CVs of China taking off. In the future, you are betting on electrolysis and flame retardants as well. In the case of Archean you are betting on the bromine chain and the salt chain. Archean is trading at 10 times one-year forward earnings with a 39% ROIC. So valuations too are going away. So we are betting on these two-three names in the speciality chemical space,” he stated.