About Dreamfolks Services Limited (DREAMFOLKS)

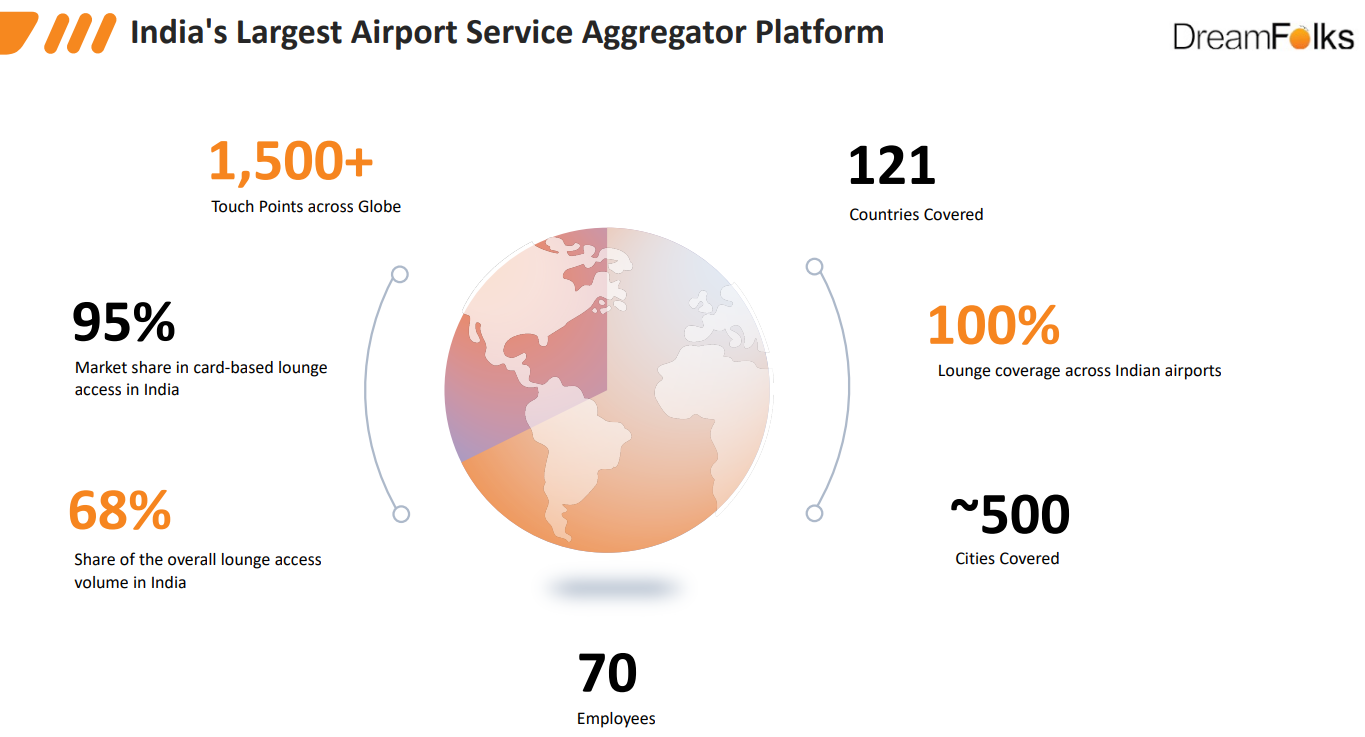

❑ DreamFolks Services Ltd (DFS) was incorporated on April 24, 2008. It is India’s largest airport service aggregator platform facilitating an enhanced airport experience to passengers leveraging a technology-driven platform. Company commanded 95%+ market share in Indian issued credit and debit card access to airport lounges in FY22 and accounted for ~68% of overall lounge access volume in India.

❑ Over the years, the company has transformed from being an airport lounge access aggregator to an end-to-end technology solutions provider for designing and delivering services that enhance the airport experience. The Company has crafted their service proposition to provide Clients the option of offering a wide-ranging bouquet of Services to the Consumers. Their asset-light business model integrates global card networks operating in India, credit card and debit card issuers and other corporate clients in India, including airline companies with various airport lounge operators and other airport related service providers on a unified technology platform.

❑ Business Model: The company ties up with the lounge partners and other Airport service providers on one side and aggregates that on companies in house developed technology platform to offer these services to the clients. Here, the clients are Visa, Mastercard, Dinners and RuPay who are the card operators. The company charges the clients on a per passenger basis and on the other hand pays the lounge partners and Airport service providers on per passenger basis for the services they are providing. So, the company integrates the access in the card/app and provides tech platform to its clients by charging a certain amount per passenger, retains its margin which is about 15%-16% and rest is paid to service providers by Dream folks. The lounge services contribute 98% of the revenue, for example the company charges Rs. 700 for domestic lounge per passenger user to network providers keeps 15%-16% of margin and rest is paid to airport service providers.

❑ The company has tie ups with almost all card networks which includes Visa, Master Card, Diners/Discover and RuPay and card issuers like ICICI Bank Limited, Axis Bank Limited, Kotak Mahindra Bank Limited, HDFC Bank Limited and SBI Cards and Payment Services Limited. DFS provides technology support to the card issuers and card operators to validate the benefits available to Consumers, provide Card Based and digital access, and billing on one side and on the other side focus on the Operators who provide the Services and give them the option of a single point access to the Consumers along with consolidated footfall and revenue.

Shareholding

The promoters hold 66.02% while the public holds 33.98%. Amongst the public shareholding, two mutual funds, namely, Aditya Birla Sun Life Small Cap Fund and Invesco India Flexi Cap Fund hold about 6%.

Sunil Singhania’s Abakkus Growth Fund-2 holds 9,50,000 shares comprising 1.79% of the equity capital.

Investors’ presentation

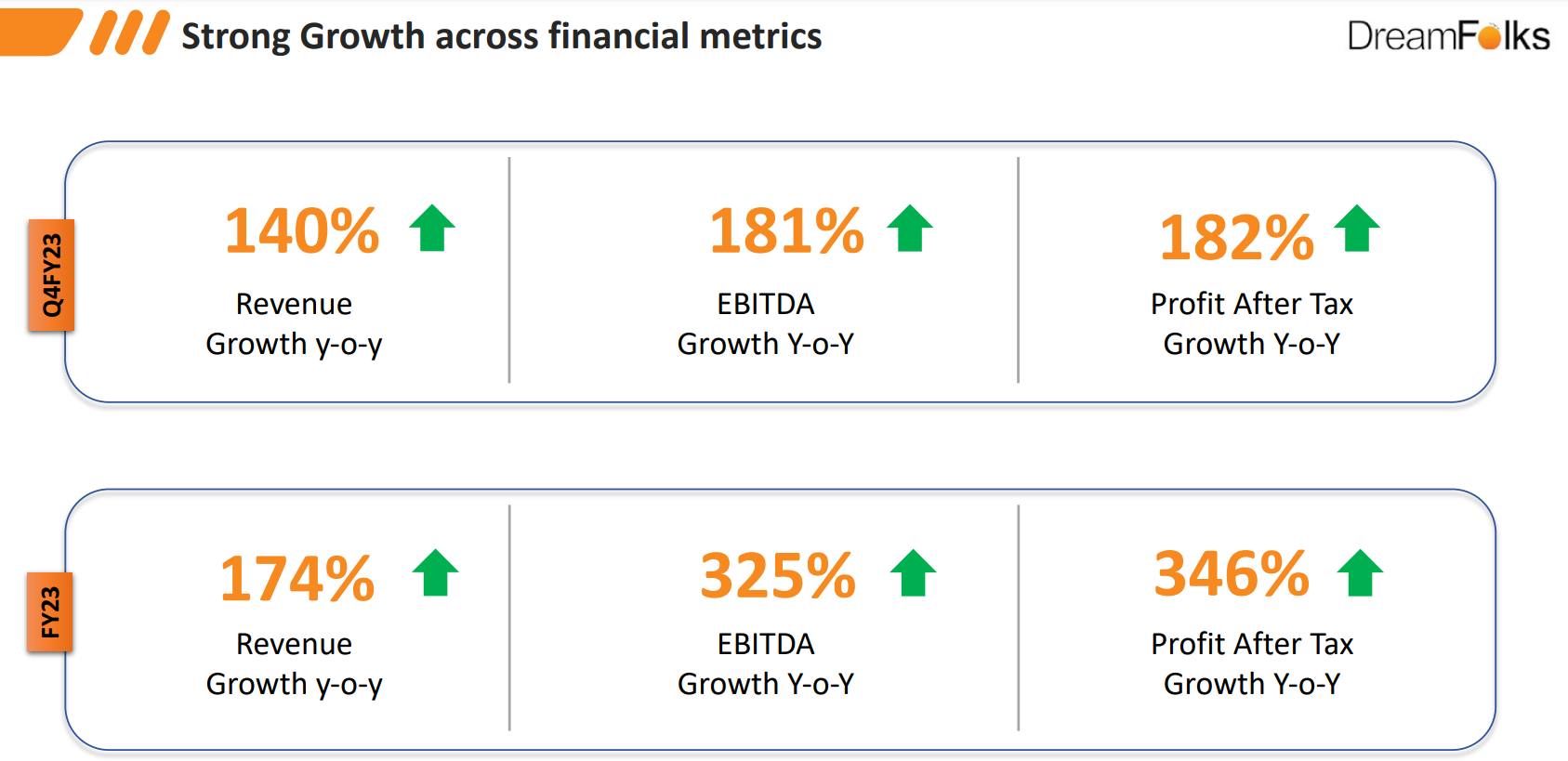

The latest investors’ presentation throws light on the recent business developments and financial performance.

The Company acquired a controlling (60%) stake in Vidsur Golf and rebranded it to GolfKlik. this is to capitalize on a growing Golf market in the country and expand the portfolio of service offerings to now include Golf Sessions and Golf Lessons. This will give customers access to golf games & lessons at golf clubs in India and across the globally. It is stated that the association layers the DreamFolks proprietary tech platform on the global inventory of the golf provider, thus seamlessly blending into the existing customer value propositions of clients.

Research Reports

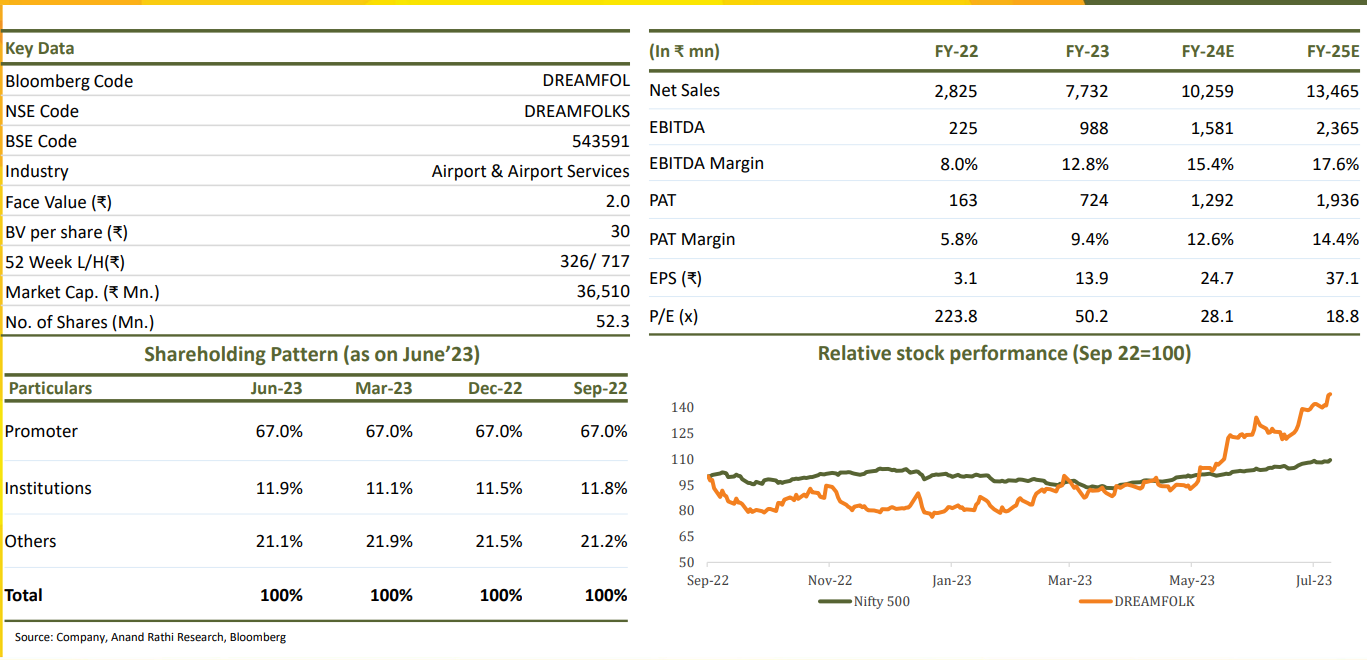

Anand Rathi has released a detailed research report in which all aspects are covered. A buy recommendation has been given on the following logic:

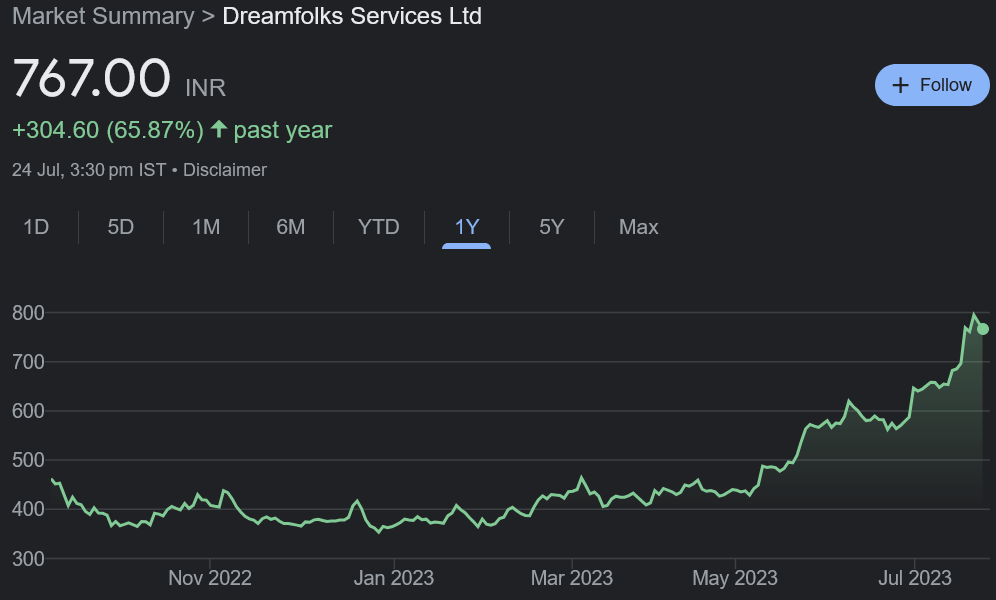

“DFS commands good margins and runs an asset light business, that is, well-poised to grow as the air travel industry is poised to show growth going forward. Its dominance is unparalleled as it facilitates access to 100% of lounges currently operational in India with 95% of market share in card-based airport lounge access. At the current price, the stock is trading at a P/E multiple of 28x and 19x FY24E and FY 25E earnings, respectively. We initiate a coverage with a “BUY” on this stock with a target price of Rs. 855 per share”

This is also explained in detail in the following video: