TOP PICKS

Base Building for Better Second Half; Earnings & Tariffs Continue to Drive Market

Strong 1500+ points Rally in Nifty 50 since Oct’25: After seeing some pullback in Jul/Aug’25, a broad-based recovery was seen since Oct’25. Nifty 50 saw a comeback with a 1500+ points rally. This was led by 1) Better-than-expected earnings performance for the first half, 2) Optimism building for 15% tariffs for India, 3) Early signs of consumption pickup, 4) Stable currency, 5) Relative attractiveness in valuations vs other emerging markets, and 6) Positive sentiments. Based on the above developments and after almost 14 months of underperformance, Nifty touched the all-time high level of 26,203 on 28th Nov’25 (similar levels were earlier seen in Sep’24). During the same period, the Midcap index is marginally up by 1% while the Smallcap index is still lower by 9%. In the coming weeks, the market will closely monitor developments in the India-USA negotiations on tariffs, RBI monetary policy, US FED meeting outcomes, and other high-frequency indicators.

Indian Economy on the verge of cyclical recovery; however, Global Challenges Likely to Persist: Despite external risks, India’s domestic growth trajectory remains intact, with key macroeconomic factors supporting a stronger FY26 compared to FY25. Both the RBI and the government are providing support by front-loading all pro-growth fiscal and monetary measures to the Indian economy. These include a) A 50 bps CRR cut in Dec’24, b) A 100 bps rate cut till now, c) Improved bank liquidity, d) The RBI Dividend, e) A consumption boost provided in the budget, and f) An uptick in the government CAPEX spending. On top of this, the government has implemented GST 2.0 reforms. These developments collectively indicate that our economy is at an inflexion point and will gain benefits in the second half and onwards. All these factors indicate an even better FY27 vs FY26. The reform agenda from the central government is again back on track, with recent reforms like GST 2.0, the New Labour policy, and PLI on rare earth magnets indicating that the focus is back on reforms. This has been further strengthened after the blockbuster victory of the ruling government in Bihar.

However, the current geopolitical situation has not been in India’s favour as the Trump administration continues to impose tariffs on Indian products, and the resolution is not on the cards till now. Any prolonged negotiations will further dent export orders, accentuating pressure on the currency and creating headwind for the earnings of the Indian corporates. Till then, the market would remain vigilant on developments around tariff negotiations. Along with the geopolitical situation, the substance of the earnings from Q3FY26 onwards remains critical for the market, as consumption has shown an early sign of pickup, but broad-based earnings and substance remain to be seen by the market. However, the base is building for the better second half, and that will likely drive the market performance further.

Relative Underperformance Provides an Opportunity to Add Equity for the Long Term: On a YTD basis, the Indian market has underperformed the US market and other emerging markets by a notable margin. FTSE India is now trading at a PE premium of 60% to the EM index (PE), vs. an average premium of 44%. During Sep’24, the Indian market traded at a 97% PE premium to EM. And now, after the correction, it is trading at a 60% premium, which looks attractive compared to the past. That said, it is to be noted that relative valuation stabilisation does not necessarily translate into an immediate rally in the current scenario. Markets, in addition to various other developments, are expected to track the following four key parameters: 1) Progress on US trade negotiations, 2) Revival of the earnings growth cycle, which is likely to start from Q3FY26 onwards, 3) Revival in a credit growth cycle, and 4) Transmission of fiscal and monetary benefits into consumption growth.

Style & Sector Rotation – A Key to Generating Alpha Moving Forward: Risk Reward is slowly building towards Mid and Smallcaps. Nonetheless, recovery will be slow and gradual as we progress towards FY26, led by strong earnings expectations, improving domestic liquidity, and stable Indian macros. We believe the market needs to sail through another couple of months smoothly before entering into a concrete direction of growth. As a result, we expect near-term consolidation in the market, with breadth likely remaining narrow in the immediate term. Against this backdrop, our focus remains on Growth at a Reasonable Price, ‘Quality’ stocks, Monopolies, Market Leaders in their respective domains, and domestically-focused sectors and stocks. These, we believe, may outperform the market in the near term. Based on the current developments, we 1) Continue to like and overweight BFSI, Telecom, Consumption, Hospitals, and Interest-rate proxies, 2) Continue to maintain positive view on Discretionary and Retail consumption plays, 3) Prefer certain capex-oriented cyclical plays that look attractive at this point due to the recent price correction as well as reasonable growth visibility in the domestic market in FY26, and 4) Maintain cautious stance on export-oriented sector due to tariff overhang and macroeconomic uncertainties.

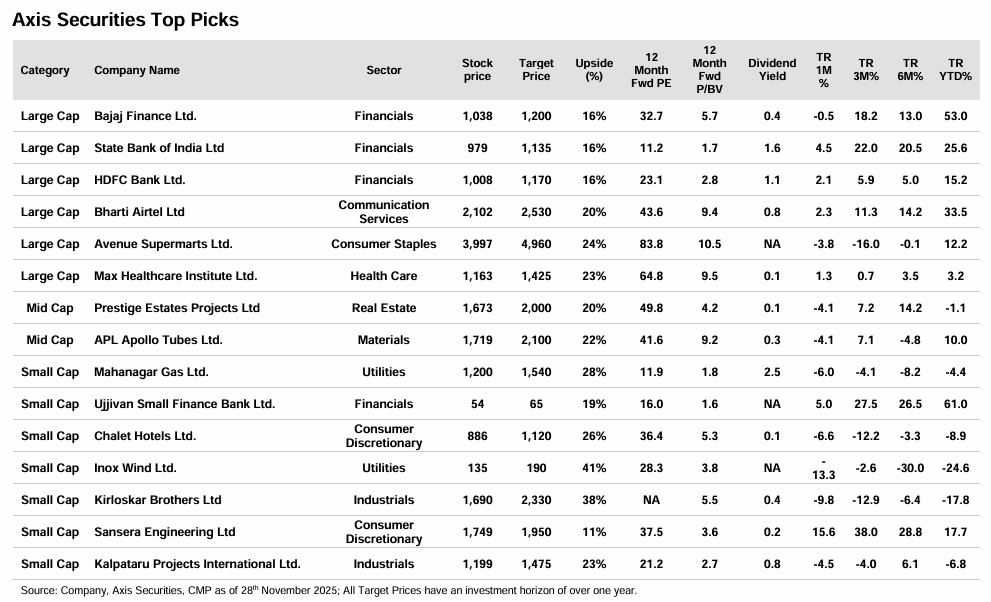

Based on the recent developments, we have made a few changes to our Top Picks recommendations. This includes booking profit in Hero Motocorp and Shriram Finance, and the addition of Chalet Hotels and Ujjivan Small Finance Bank. Our modifications reflect our increasing comfort with ‘Growth at a Reasonable Price’ picks.

Based on the above themes, we recommend the following stocks: HDFC Bank, Bajaj Finance, Bharti Airtel, Avenue Supermarts, State Bank of India, Max Healthcare, Kirloskar Brothers, Kalpataru Projects, APL Apollo Tubes, Mahanagar Gas, Inox wind, Prestige Estates, Ujjivan Small Finance Bank, Chalet Hotels and Sansera Engineering