Macro Developments & Q4FY24 Earnings Season Remain Critical

Axis Top Picks basket delivered impressive returns of 46% in FY24, against the 28.6% return posted by the benchmark Nifty 50, implying a commendable outperformance of 17.5% over the benchmark. On a YTD basis, this basket advanced by 6% vs. the Nifty returns of 2.7% for the same period. We are extremely happy to share that our Top Picks Basket has delivered an astounding return of 263% since its inception (May’20), which stands well above the 141% return delivered by NIFTY 50 over the same period. Given these results, we maintain our confidence in our thematic approach to Top Picks selection

In our base case, we maintain our Dec’24 Nifty target at 23000 as we value it at 20x on Dec’25 earnings. The current level of India VIX is below its long-term average, indicating that the market is currently in a neutral zone (neither panic nor exuberance). While the medium to long-term outlook for the overall market remains positive, we may see volatility in the short run with the market responding in either direction. Keeping this in view, the current setup is a ‘Buy on Dips’ market. We recommend investors to remain invested in the market and maintain good liquidity (10%) to use any dips in a phased manner and build a position in high-quality companies (where the earnings visibility is quite high) with an investment horizon of 12-18 months.

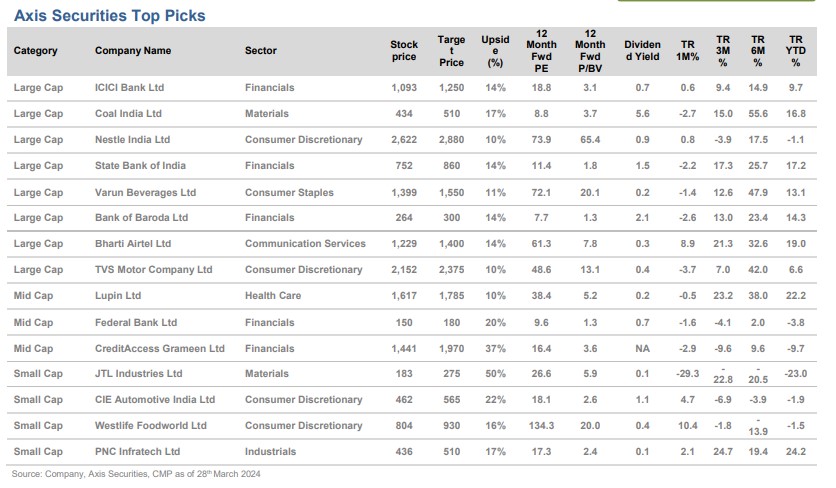

Based on the above themes, we recommend the following stocks: ICICI Bank, Coal India, Nestle India, State Bank of India, Lupin ltd, Federal Bank, Varun Beverages, TVS Motors, Bharti Airtel, PNC infra, CIE Automotive India, Bank of Baroda, Westlife Foodworld, Credit Access Grameen, JTL Industries