Domestic formulations sector: secular growth stories

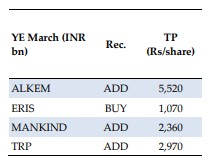

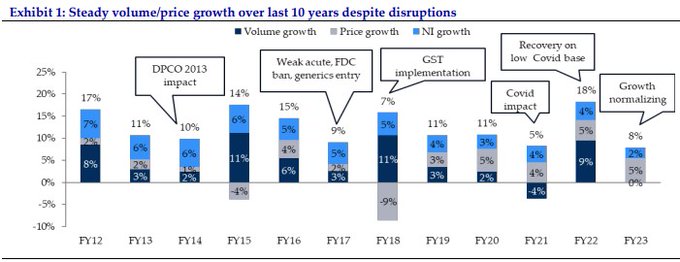

The India Pharma Market (IPM) has maintained a steady ~10% CAGR from FY12 to FY23, despite various disruptions, driven mainly by volume expansion ranging between 5-10% during FY12-18, which subsequently tapered to 2-3% from FY19-23, primarily due to generic competition (FY22 growth was on a low base due to the COVID-19 pandemic). However, this deceleration in volume growth has been somewhat offset by 5-6% price growth annually, since FY19. We expect IPM growth to remain steady at 8-10% over the next few years, with companies boasting strong franchises and brands likely to see faster growth. This growth trajectory will be propelled by (1) continued price growth of 4-5%, (2) gradual volume growth and recovery in the acute segment, and (3) launches of new products. Similarly, leading companies are poised to surpass the IPM through strategies like M&As, expanding field forces, and new launches. We like domestically-focused companies due to their strong pricing power, better margins, and healthy cash reserves/RoCEs, which have led to a recent rerating among domestic peers. We consider the volume recovery in the IPM as a crucial earnings driver, essential for sustaining a premium over the Nifty index. Without it, additional earnings upgrades are unlikely. In light of these factors, we are initiating coverage with a BUY rating for ERIS (TP of INR 1,070) and an ADD rating for ALKEM (TP of INR 5,520), MANKIND (TP of INR 2,360), and TRP (TP of INR 2,970).

Click here to download Top 4 Pharma Stocks to buy now by HDFC Securities