Indian Banking Sector

Bank loans to NBFCs moderate whilst unsecured retail credit still running strong

Unsecured retail still strong whilst large corporate credit retains yoy trend: Bank credit growth momentum improved to 20.3% yoy (16.5% yoy ex-merger) with nonfood credit growth of 20.4% yoy (16.6% yoy ex-merger). Growth momentum remained strong across both services (20.7% yoy ex-merger) and retail (18.4% yoy, ex-merger). Three key trends were: 1) adjusting for a high base, other personal loan growth remained strong at 21% yoy ex-merger vs 22% yoy in Sep/Oct/Nov’23. Lending to NBFCs moderated to 15-16% yoy in last 2 months vs 22-25% growth prior to that. 2) strength in housing loans across both PSL housing (7% yoy ex-merger vs 5% yoy growth in Nov/Dec’23) and non-PSL housing (21% yoy ex-merger vs 19-20% growth in Nov/Dec’23). 3) Industrial and large corporate credit retained the yoy trend at 8% and 6% yoy respectively.

Retail loan growth aided by unsecured personal loan growth; pickup in secured retail: Retail loan growth of 18.4% yoy ex-merger continues to be led by unsecured loan growth of 22.4% yoy (ex-merger). Secured loan growth at 16% yoy (ex-merger) lagged overall retail growth and retained the momentum seen since Dec’23, on the back of pick up in housing loans to 16.7% yoy (ex-merger) vs 14-15% growth trends between July to December. The pickup was seen across both PSL housing (7% yoy ex-merger vs 5% yoy growth in Nov/Dec’23) and non-PSL housing (21% yoy exmerger vs 19-20% growth in Nov/Dec’23). Vehicle loan growth moderated to 16% yoy on a higher base vs 20%+ yoy growth trends in last 9 months. Despite RBI’s Nov23 notification of higher risk weights for unsecured consumer loans, growth for unsecured loans, adjusted for a high base, remained strong at 21% yoy ex-merger. Growth momentum remained strong with credit card advances sustaining the 30%+ yoy growth trend. Consumer durable loan growth has also been strong for past 2 months at 13-14% yoy vs earlier trend of 10-11% yoy growth seen during months between Jul-Nov’23. Services credit growth led by strong growth in other services and commercial real estate:

Services credit growth improved to 21% yoy ex-merger (vs 19.6% in Dec’23) mainly due to strong growth in credit to other services (35.6% yoy ex-merger) which have growth by 30%+ in last 3 months vs 20-22% yoy growth prior to that. Growth momentum was sustained in credit to commercial real estate at 16% yoy (exmerger) on the back of uptick in housing cycle. Growth in bank borrowings by NBFCs which constitutes 35% of services credit, has moderated to 15-16% yoy in last 2 months (vs 22-25% growth prior to that). This is likely on the back of RBI action on higher risk weights to mitigate systemic risk stemming from higher interconnectedness between banks and NBFCs.

Industrial credit growth sustains the growth rate of 6% yoy: Industrial credit growth at 8.3% yoy retained the trend from prior months with large corporate credit at 6% yoy. Adjusting for a higher base, MSME credit growth remained broadly stable 14% yoy. In 3QFY24, many of the large private and PSU banks have reported pickup in the corporate credit portfolio. This is reflected in the sectoral numbers for 3QFY24, For the sector, in Jan-24, growth picked up in textiles (18% yoy vs 13-14% growth trend in Aug-Dec’23) and chemicals (14% yoy vs single digit growth between Aug-Dec’23). Infrastructure credit growth was strong at 8% yoy on a low base.

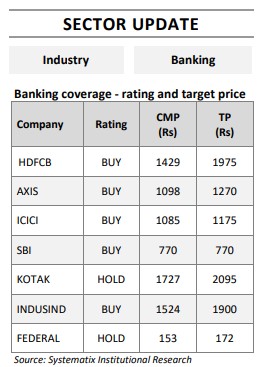

Click here to download Top Bank Stocks to buy and hold by Systematix Research