Moving Towards a Sustainable Defence Ecosystem

Investment Rationale:

Industry background: India is positioned as the 3rd largest military spender (as of FY23) in the world, with its defence budget accounting for 2.2% of the country’s total GDP (USA: 3.5%, Russia: 4.1%, France: 1.9% and China:1.6%). The Government of India plans to spend USD 130 bn during FY24 – FY30, an increase of ~7% CAGR (GDP growth estimated to grow at a CAGR of ~6.5% during FY 24-30) for fleet modernisation across all armed services. The industry received USD 70 bn in the budget for 2023–24.

Lingering tensions in the immediate neighbourhood: The impetus for India’s defence industry was first realised when it faced drastic reverses in its conflict with China in 1962, which prompted India to increase its defence expenditure from 1.5% of the nation’s GDP to 2.3%. Following the war between India and Pakistan in 1965, an embargo imposed by the United States of America (“USA”) upon the export of arms to India heralded an era of defence ties with the Soviet Union.

The uncertainties persist on its northern border with China and the western perimeter with Pakistan. Beyond economic policy, these externalities are also pushing the needle on India to restructure its military while also trying to enhance its defence production and export capacity.

To strengthen defence manufacturing industry and address national security concerns, India has started focusing on domestic companies and reduced foreign defence imports through programs such as ‘Atmanirbhar Bharat’ and ‘Make in India’.

Why invest in India: The Government of India has implemented favourable policies. These include (1) raising the requirements for indigenised content under different categories and increasing the multiples assigned to technology transfer (TOT) in offset guidelines through DPP 2020; (2) promoting the Strategic Partnership (SP) model to encourage private participation; (3) imposing import embargo lists on 928 items in a phased manner for the domestic industry; (4) positive indigenization lists on 4,666 items for DPSUs; (5) increasing the maximum foreign direct investment (FDI) limit to 74% under the automatic route, and (6) establishing defence corridors in Tamil Nadu and Uttar Pradesh.

The Indian government’s target to achieve USD 5bn in export revenue, as set by the DPEPP (Draft Defence Production & Export Promotion Policy), is part of a larger goal of having a turnover of USD 25 bn in the defence sector by 2025.

Opportunities of over US$ 70 bn, distributed over 8–10 years, for our coverage, compared to their total FY23 sales of just about US$ 7 bn. These orders have a high tangibility since the projects in the pipeline are for products that have already been created or for technology transfer (TOT) from foreign OEMs. Defence aerospace accounts for most of the potential, with ~US$ 30 bn, followed by missiles/artillery gun systems at ~US$ 22 bn and defence shipbuilding at ~US$ 16 bn

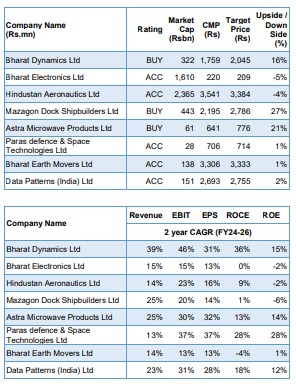

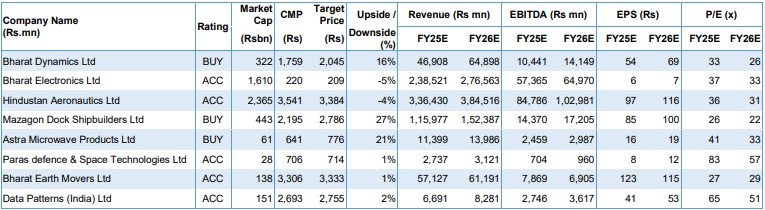

Outlook and Stock Picks: Increasing defence spending will stimulate market growth throughout FY24-FY26. Earlier, the impasse between China and India during the pandemic prompted the government to speed up the indigenisation of military equipment to decrease dependence on imports, facilitating market growth. Even with a sharp run-up in the stock prices of the defence basket (Nifty India Defence index 6m returns- 37%); our outlook on the sector remains optimistic due to the following factors: (1) visibility into long-term execution growth supported by a strong order book and a healthy pipeline; (2) timely execution facilitated by localization, integrated modular construction, and subcontracting; (3) government preference and domain expertise; (4) cash-rich balance sheets that prevent significant working capital challenges due to stage payments; and (5) in-house research and development investments and suitable technological support. Based on the attractive risk-reward ratio, we prefer Mazgaon Shipyard Docks Limited (MSDL), Bharat Dynamics (BDL), and Astra Microwave Private Limited (AMPL).

Leave a Reply