Performance of Rockstars of Quarterly Results

We started this product on 16th June 2022 to offer our investors (A) An insight on the latest concluded quarterly result season, (B) Take basket approach towards best performing businesses and (C ) Ride on result driven capital appreciation story in equity market. The key features cum benefits of the product are as follows:

• Best suited for medium and long-term investors

• Helps in adequate risk diversification through investment in a basket of stocks

• To have a glimpse of key sectoral developments and align the portfolio as per the current market flavor

• Ride-on stocks that have reported strong YoY and QoQ growth in earnings and are available at a decent valuation

• Helps retail investors to take informed investment decisions

Our stock selection philosophy remains uncompromised with a focus on stocks having 1) Strong management backed by solid corporate governance, 2) Supportive industry outlook along with strong business growth visibility, 3) Attractive margins, return ratios and healthy balance sheet and 4) Strong historical track record

Nifty50 earnings well poised to grow in double digit

Nifty50 trading at 1 Year Forward Rolling P/E multiple of 17.5x

Nifty50 trading at 1 Yr Fwd Rolling P/E multiple of 17.5x which is mildly higher than its long term average band of 15-17x. The premium valuation however is well supported by robust earnings growth, stable government policies, recovery in capex cycle and huge thrust on infrastructure development.

Indian market trading relatively at cheaper valuation than developed markets

Despite premium valuation, Indian market is trading at cheaper valuation v/s developed markets like USA and Japan. Nifty50/Sensex PE however are trading at a premium of 60% to the MSCI EM valuation. We believe, India will continue to trade at a premium valuation due to stable economic and political environment, strong earnings growth of corporate, marked improvement in asset quality and healthy return ratios.

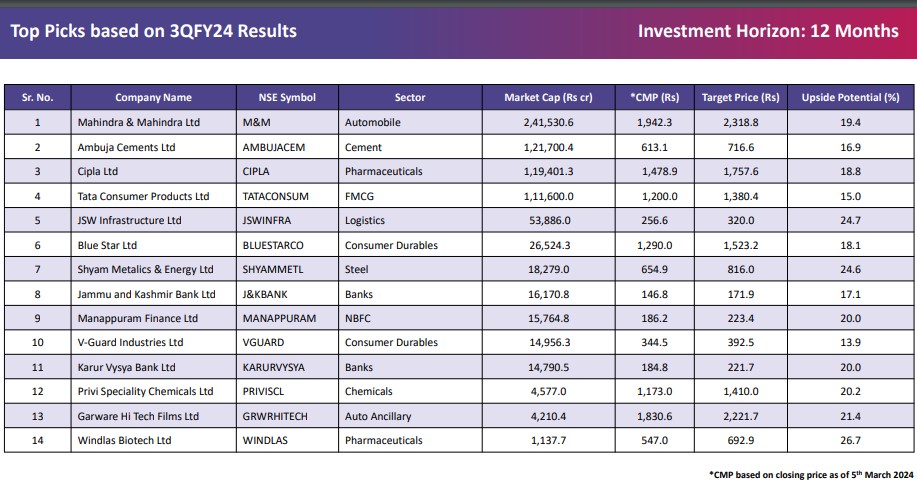

Top Stock Picks based on 3QFY24 Results by SBI Securities for Investment Horizon of 12 Months