Tough Phase Coming to An End; All Eyes Now on H2 Recovery

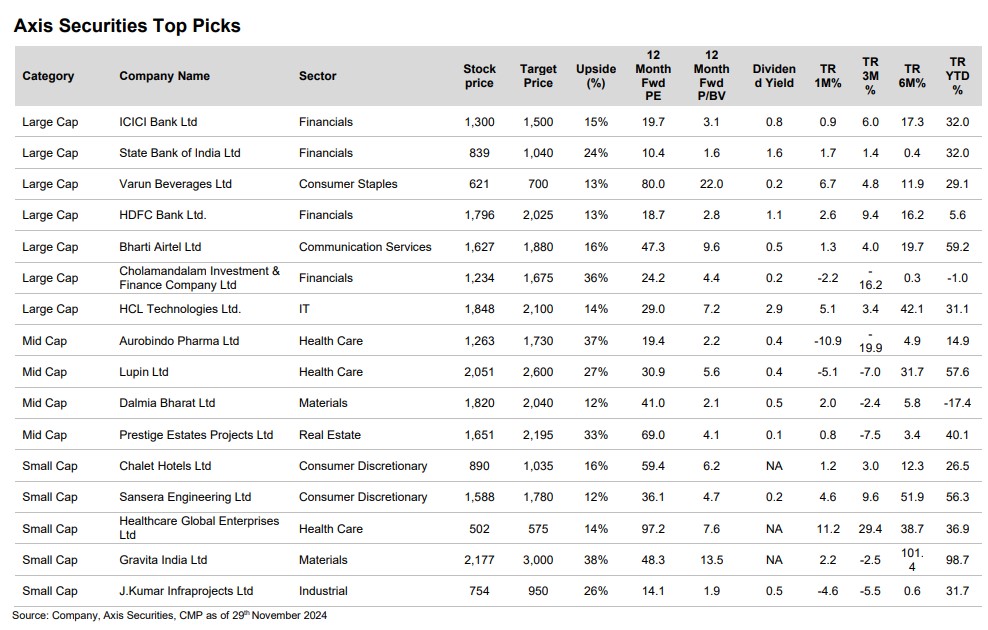

Axis Top Picks Basket delivered a return of 10.9% in the last six months against the 7.1% returns posted by Nifty 50 over the same period. The last three months were highly volatile for the market and notable mixed performance was seen across sectors, market caps, and style indices. The Axis Top Picks basket declined by 2.9% in the last three months but managed to beat the market performance as the benchmark Nifty 50 which declined by 4.4% over the same period. It gives us immense joy to share that our Top Picks Basket has delivered an impressive return of 326% since its inception (May’20), which stands well above the 160% return delivered by the NIFTY 50 index over the same period. In light of this, we continue to believe in our thematic approach to Top Picks selection. The tough phase of the market coming to an end: Oct’24 was a challenging month for the Indian equity market with broad-based correction witnessed across the market cap, styles, and sectors. The majority of the correction was led by 1) FII selling, 2) Lower-than-expected Q2FY25 earnings, 3) A rise in the US 10-year bond yields, and 4) Expectations of China recovery. The correction was further accentuated in Nov’24 due to continued selling by FIIs and a rising dollar index. While Nifty 50 reached an all-time high of 26,216 on 26th Sep’24, the benchmark saw a correction of 8% from the top till month end. The broader market indices including Mid and Smallcap indices corrected by 6.7%/3.9% respectively. The impact of foreign outflow was higher in Largecaps compared to Small and Midcaps as they predominantly owned the Largecap counters. Tough Phase Coming to An End; All Eyes Now on H2 Recovery Axis Top Picks Basket delivered a return of 10.9% in the last six months against the 7.1% returns posted by Nifty 50 over the same period. The last three months were highly volatile for the market and notable mixed performance was seen across sectors, market caps, and style indices. The Axis Top Picks basket declined by 2.9% in the last three months but managed to beat the market performance as the benchmark Nifty 50 which declined by 4.4% over the same period. It gives us immense joy to share that our Top Picks Basket has delivered an impressive return of 326% since its inception (May’20), which stands well above the 160% return delivered by the NIFTY 50 index over the same period. In light of this, we continue to believe in our thematic approach to Top Picks selection.

The tough phase of the market coming to an end: Oct’24 was a challenging month for the Indian equity market with broad-based correction witnessed across the market cap, styles, and sectors. The majority of the correction was led by 1) FII selling, 2) Lower-than-expected Q2FY25 earnings, 3) A rise in the US 10-year bond yields, and 4) Expectations of China recovery. The correction was further accentuated in Nov’24 due to continued selling by FIIs and a rising dollar index. While Nifty 50 reached an all-time high of 26,216 on 26th Sep’24, the benchmark saw a correction of 8% from the top till month end. The broader market indices including Mid and Smallcap indices corrected by 6.7%/3.9% respectively. The impact of foreign outflow was higher in Largecaps compared to Small and Midcaps as they predominantly owned the Largecap counters.