In the high-stakes world of Futures & Options (F&O) trading, the constant quest for the “perfect setup” and the next infallible strategy can often lead traders down a path of frustration and losses. However, for well-known F&O trader Karthik Raj (@karthik_raj2000), whose own trading journey is characterized by outsized, volatile gains and losses, the key to success lies not in complex analysis, but in relentless, disciplined execution of a simple plan.

Raj’s philosophy, distilled into a powerful call for simplicity and focus, challenges the prevailing narrative that a superior strategy is the ultimate determinant of profit.

The Power of One: Focus and Mastery

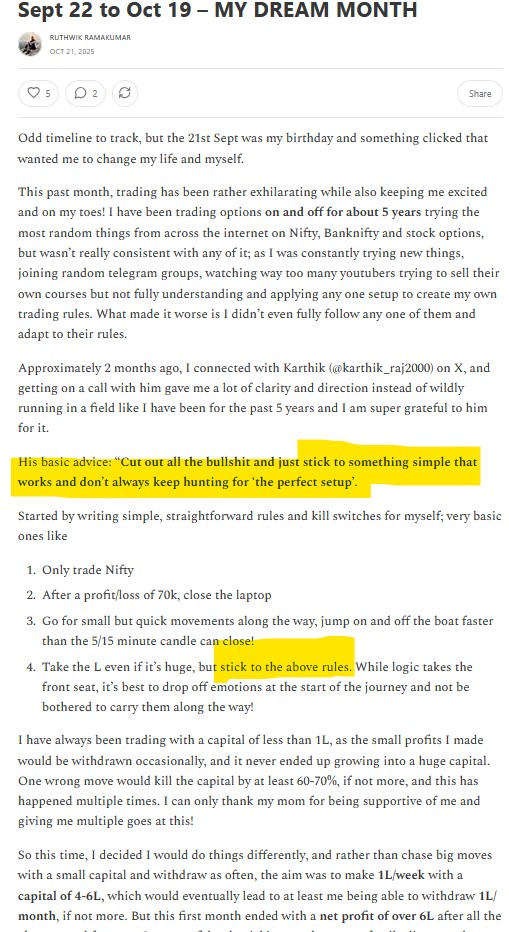

Karthik Raj’s core advice to the trading community is unequivocal: “Cut out all the bullshit and just stick to something simple that works.” He urges traders to concentrate on one instrument and one strategy.

The objective is simple: master the strategy and its critical rules—specifically, those concerning Stop Loss and Profit Target—and follow them diligently. According to Raj, when traders incessantly chase new indicators and setups, they only introduce noise and inconsistency.

“it’s not about strategy it’s about execution and experience… no strategy has 100% win rate so it’s ultimately depends on your execution and your experience….” – Karthik Raj (@karthik_raj2000)

This emphasis on execution is a profound shift from the common trader’s focus on technical analysis. Raj highlights that even the best strategy will fail without the unwavering discipline to follow its rules through market noise and emotional impulses.

Clarity Over Chaos: A Trader’s Transformation

The clarity of this philosophy was a turning point for one trader, who, after five years of “wildly running in a field,” found direction through Raj’s advice. The trader immediately implemented a set of straightforward, non-negotiable “kill switches” to inject discipline into their system:

- Instrument Focus: Only trade Nifty.

- Risk Management: After a profit or loss of ₹70,000, close the laptop—a powerful mechanism to protect capital and prevent emotional overtrading.

- Trading Style: Focus on small but quick movements (scalping), demanding agility and fast execution.

- Discipline Above All: “Take the L even if it’s huge, but stick to the above rules.”

This final rule underscores the core tenet: adherence to the system must take precedence over the temporary pain of a loss. By dropping off emotions at the start of the journey, the trader allows logic to take the front seat, a crucial step in moving from inconsistent gambling to professional trading.

Capitalizing on Volatility: The Proof in the P&L

While Raj advocates for simplicity, his own trading results demonstrate the enormous potential that disciplined execution can unlock, especially in the volatile F&O segment. Reports have highlighted his capacity for spectacular gains:

- A single day’s earning of ₹1 Crore after correctly anticipating a trending move in Nifty Call Options.

- Verified earnings in one month totaling ₹3.63 Crore.

- A highest reported daily profit of ₹77 Lakh during a highly volatile Sensex expiry, showcasing his ability to capitalize on market extremes where many others reported losses.

His success, marked by these massive swings, serves as a high-octane example of what is possible when a trader combines simple rules with exceptional, experienced execution.

F&O trader @karthik_raj2000 reported an earning of ₹1 Cr today. He had bought Nifty 24950 & 25000 Call Options which exploded in value due to the trending move. Most traders were not expecting such a big move & were carrying shorts. Their short-covering aided the upward move pic.twitter.com/SziYMp6pYX

— RJ Stocks (@RakJhun) October 6, 2025

For new and struggling traders, the message from one of the most visible and high-risk traders in the Indian F&O space is a potent reminder: Stop hunting for the perfect strategy. Instead, find a simple one, master its execution, and let ruthless discipline define your trading journey.

For People who always ask what’s your strategy???

Answer:: it’s not about strategy it’s about execution and experience… no strategy has 100% win rate so it’s ultimately depends on your execution and your experience….— Karthik Raj (@karthik_raj2000) August 14, 2025

What’s your biggest challenge: finding a strategy or consistently executing the one you have?