A place for wealth wizardry and not just academic discussion

One aspect that is worth noting is that the experts at the value pickr forum are not only masters of academic theories relating to investing but they are also accomplished practitioners of the art of investing.

This is established by the fact that till some time ago, the valuepickr forum had its own model portfolio. The portfolio comprised of stellar stocks such as Ajanta Pharma, Mayur Uniquoters, Astral Poly Technik, PI Industries, Balkrishna Industries, Atul Auto, Kaveri Seeds, Poly Medicure etc.

These stocks were identified and recommended when they were still in their infancy and were not as well known as they are today.

Needless to say, each stock has become a mega multibagger and created humongous wealth for the members of the forum.

The stellar contribution of the forum to the cause of wealth creation has led its co-founders, Donald Francis and Ayush Mittal, to be conferred the prestigious title of “Wealth Wizards” by Forbes.

Shemaroo Entertainment gets green signal

Shemaroo Entertainment, a small-cap with a market capitalisation of only Rs. 1000 crore, is the latest stock which has been dissected by the experts of the forum.

After a lot of number-crunching and facts-analysis, the stock has received the green signal from the experts of the forum.

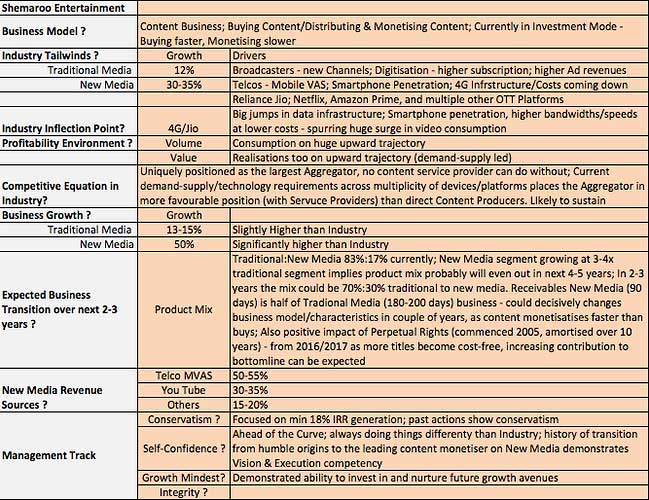

Donald Francis, the co-founder of the forum, has provided a succinct analysis of Shemaroo which sets out all of its virtues and explains why it is investment-worthy.

(Image Credit: Valuepickr forum. Click for larger image)

| SHEMAROO ENTERTAINMENT LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 1,001 | |

| EPS – TTM | (Rs) | [*C] | 21.52 |

| P/E RATIO | (X) | [*C] | 17.11 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 14.00 | |

| LATEST DIVIDEND DATE | 16 SEP 2016 | ||

| DIVIDEND YIELD | (%) | 0.38 | |

| BOOK VALUE / SHARE | (Rs) | [*C] | 145.13 |

| P/B RATIO | (Rs) | [*C] | 2.54 |

[*C] Consolidated [*S] Standalone

| SHEMAROO ENTERTAINMENT LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | SEP 2016 | SEP 2015 | % CHG |

| NET SALES | 113.55 | 93.52 | 21.42 |

| OTHER INCOME | 0.3 | 0.67 | -55.22 |

| TOTAL INCOME | 113.85 | 94.19 | 20.87 |

| TOTAL EXPENSES | 81.77 | 69.95 | 16.9 |

| OPERATING PROFIT | 32.08 | 24.24 | 32.34 |

| NET PROFIT | 14.61 | 11.35 | 28.72 |

| EQUITY CAPITAL | 27.18 | 27.18 | – |

(Source: Business Standard)

No Brainer stock at compelling valuations

Donald Francis has also left no room for doubt about his bullishness for Shemaroo. He has described it as a “No Brainer” and expressed surprise that it has not already caught enough attention. He has also described the stock as a “uniquely-positioned business (at compelling valuations) at a very interesting industry/business inflection point”.

The investment rationale is also cogently summed up:

“A. The business is not being assessed as it should – it is probably mis-understood. If you take into consideration the business model, and how Shemaroo buys content and monetises it with a lag, the normal objections should fade away

B. The business (and Industry) is at an Inflexion point. In a couple of years if it executes well, it’s an entirely different business, throwing out Cash as product mix changes increasingly in favour of New Media, brings working capital cycle in its favour, and starts funding content acquisition more through internal cash generation. In 3-5 years, could this be a very strong business??”

High Conviction bet

Donald has also candidly disclosed that he has invested upto 10% of his net worth in Shemaroo. This clearly implies that the stock is a ‘high conviction’ bet for him.

Shemaroo was first recommended by Gaurav Parikh

Gaurav Parikh of Jeena Scriptech was among the first to recognize the potential of Shemaroo.

In January 2015, Gaurav Parikh called Shemaroo his “Best Pick for 2015” and recommended a buy. He explained that Shemaroo’s business model of monetising content over existing and emerging digital platforms is immensely scalable. He also emphasized that Shemaroo is the preferred partner of choice for movie producers, broadcasting channels and other media platforms, not only for its vast content but also its industry expertise, knowledge and relationships and that it has established strong relationships with traditional media channels such as UTV Movies, Star Gold, Sony, TV Today, NDTV, Doordarshan and Hathway; new media platforms such as Youtube; telecom service providers such as R-Com, Airtel and Tata Docomo and with production houses such as RK Films, Mukta Arts and Viacom 18 Digital TV.

Gaurav’s recommendation has turned out well because Shemaroo is up a fabulous 117% since then.

Gaurav Parikh also recommended Astec Lifesciences

it is notable that Shemaroo is not a fluke stock pick for Gaurav Parikh. Instead, he also recommended Astec Lifesciences as his “best stock pick for 2016”.

Astec has also posted hefty gains of nearly 150% on a YoY basis.

Astec is also one of Vijay Kedia’s favourite stocks. According to one theory, the stock will see immense prosperity in the foreseeable future because it is under the benign control of Godrej, the blue chip behemoth.

Dolat Capital recommends buy of Shemaroo

Dolat Capital has conducted an expert analysis of Shemaroo and recommended a buy with a target price of Rs. 475. The logic is succinct and easy to understand:

“New media reports yet another strong performance

SHEM reported a healthy Q2FY17 with revenue growth of 21.4%YoY (DCMe: 18.3%). EBITDA margin improved 280bps YoY to 28% largely led by better gross margins. Traditional media segment reported healthy growth of 15%YoY helped by Miniplex and tie up with various DTH providers. New media segment grew 52%YoY helped by increased consumption of content on digital platforms; We believe this segment will continue to grow at a robust CAGR of 43% (FY16-19E) and help drive profitability. We maintain our BUY reco. and roll-over to Sep’17 target price of Rs 475 (Rs 460 earlier) based on 14x one yr. fwd. PER.”

Conclusion

Prima facie, it does look like the experts at the valuepickr forum have once again picked a stellar stock which meets all the criteria that discerning investors look for while making an investment. It does appear that Shemaroo will be yet another feather in the cap of the forum!

In my opinion, the industry is not good to bet on, unless we have strict cyber law around pirated content

#Nivezareview :

Shemarro Entertainment has a consistent profit growth of 33.83 per cent over past five years. Company had delivered significant revenue growth and earnings are stable as well. Stock is trailing at PE of 15x which is reasonable to buy. Last couple of quarters were really good as far as operational efficiency is concerned. During FY16, debt has been on increasing side but as capex is done, better revenue is expected to come out of it. Comparing with peer group, Shemaroo Entertainment looks much stronger with the numbers.

Long term Investment

This is an intermediation business. It acquire content (through temporary and permanent rights) from content producers (mostly movies) and sell (read monetise) it to the broadcasters (traditional like TV channels, Cinema exhibition houses etc and emerging like DTH, digital platforms etc).

Now, everything is going to depend on their content acquisition strategy. Like acquiring good content and good prices with a nerve on ever changing consumer preferences, taste and behaviour. Their existing library is not very inspiring and current growth rate from it doesn’t look sustainable. Plus, forecast of content consumption on digital platforms also appears bit optimistic.

At CMP, margin of safety is not high.

Disclaimer: Purely personal opinion. Use your own analysis and discretion.

Good analysis!

Looks like this column is greatly valued by one and all. Shemaroo up today nearly 10% !

Just look at the bloating net working capital position. Now 500 crores plus against sales of 300 crores odd. All the profits are getting converted to working capital and not one penny for shareholders. And what is more the working capital position is getting worse and worse by 100 crores yearly. So much more than a years sales are now tied up into working capital.

The last stock where people ate mud in such a situation was Opto circuits. Check what happened to it and where it is now.

Beware of this stock at these valuations. This is a bubble which gonna burst badly on those who enter at these crazy valuations. I say this with great responsibility. If you guys want I will post a detailed valuation.

Aravind, its an Eye Opener analysis by you…….

sir, what about aditya birla capital for long or too long term. i want to follow you. please accept my request.