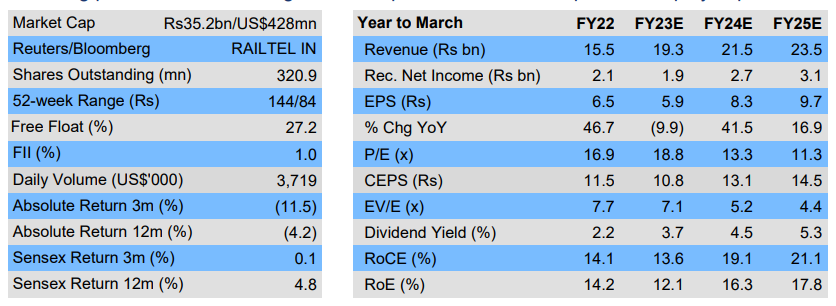

The Quant Mutual Fund bought 2300000 shares of Railtel Ltd at Rs 150.84 each on Friday, 21st July in a bulk deal on the NSE. It is a PSU with 72.84% promoter holding. The Company is debt-free. The dividend yield is 1.84%.

About RailTel

RailTel is a “Mini Ratna (Category-I)” Central Public Sector Enterprise. It is an ICT provider and one of the largest neutral telecom infrastructure providers in the country owning a Pan-India optic fiber network. The OFC network covers important towns & cities of the country and several rural areas.

RailTel was incorporated on September 26, 2000 with the aim of modernizing the existing telecom system for train control, operation, and safety and to generate additional revenues by creating nationwide broadband and multimedia network, laying optical fiber cable using the right of way along railway tracks. Presently, the optic fiber network of RailTel covers over 61000+ route kilometers and covers 6108+ railway stations across India. Our citywide access across the country is 21000+ kms.

RailTel’s various operations are certified for Tier-III (Design & Facility), ISO 27001:2013 Certified for Information Security Management System, ISO 20000:2018 Certified for Service Management System, ISO 9001:2015 Certified for Quality Management System, ISO 27017:2015 Certified for Cloud Security, ISO 27018:2019 Certified for Data Privacy in Cloud Service, ISO 27033 Certified for Network Security, CMMI Maturity Level-4 Certified for Process Improvement.

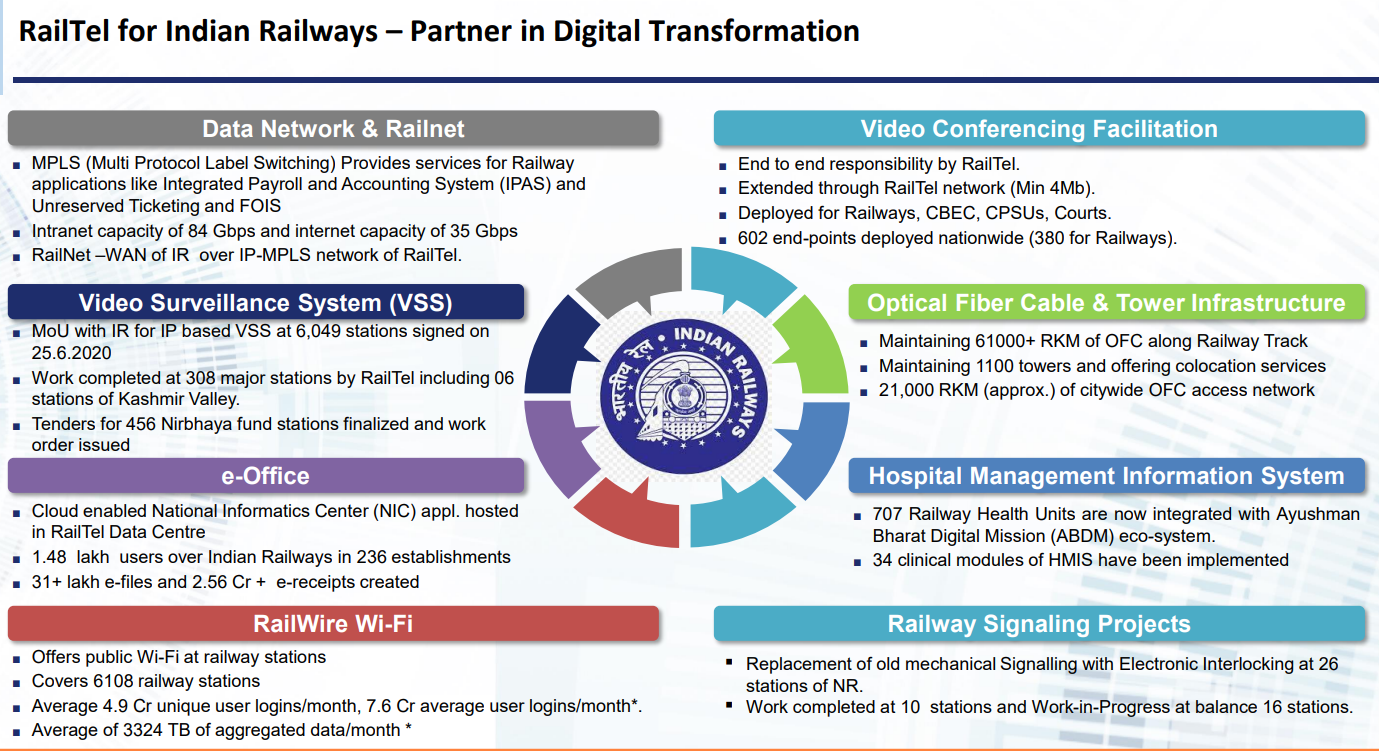

RailTel has a strategic relationship with the Indian Railways and it undertakes a wide variety of projects including provision of mission critical connectivity services like IP based video surveillance system at stations, ‘e-Office’ services and implementing short haul connectivity between stations and long haul connectivity to support various organizations within the Indian Railways. RailTel also provide various passenger services including content on demand services and Wi-Fi across major railway stations in India.

Investors’ Presentation

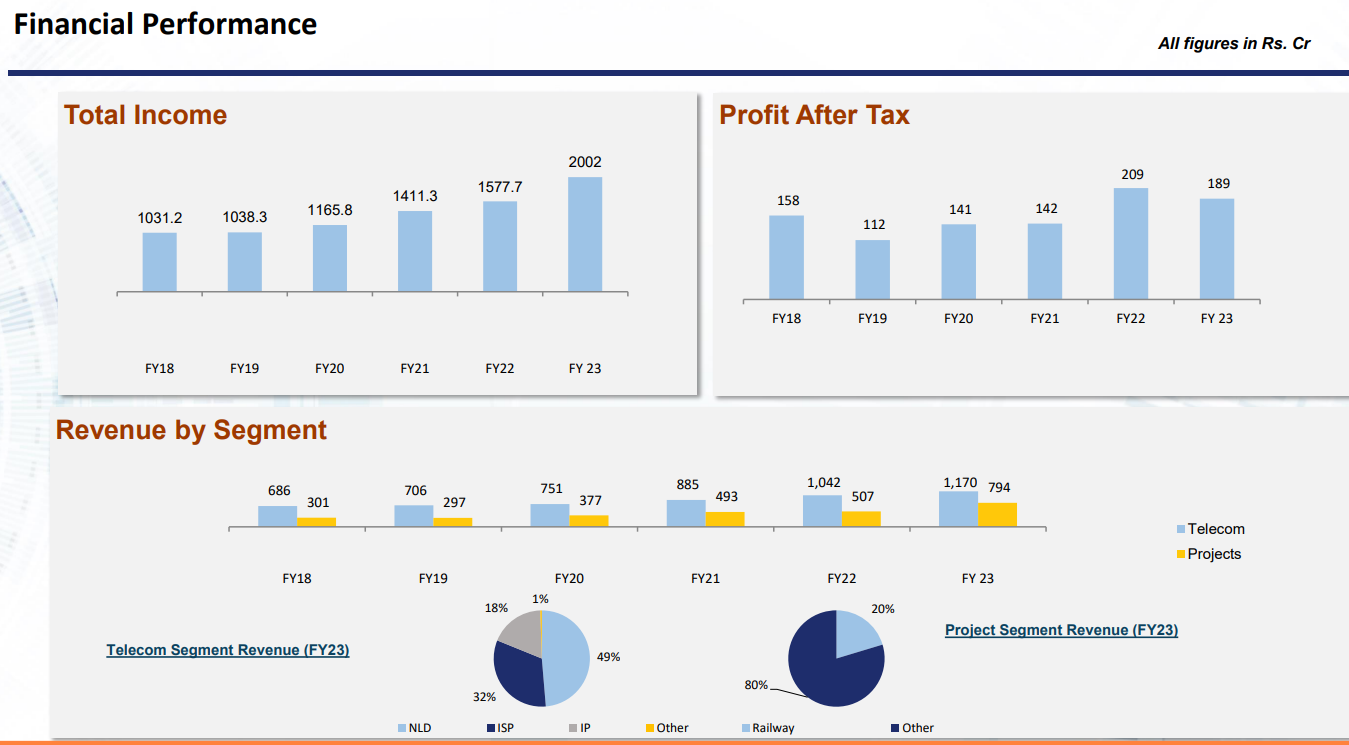

The latest Investors’ Presentation throws considerable light on the business model of the Company and its future prospects. The financial results are also nicely summarized

Research Report

According to ICICI Securities, Railtel enjoyed advantage in Indian Railways due to exclusive access to railway infrastructure such as ROW across tracks of 67k-Rkms, space for setting-up towers etc. Railway has opened infrastructure sharing to private players which should increase competition. However, Railtel believes it is in a strong position due to existing relationships and lead-time for peers to deploy capex.

The Project orderbook stands at Rs50bn (including taxes). Project revenue has dipped 2% YoY to Rs1.7bn, and has largely come from non-railway customers. Railtel has earlier guided project revenue in FY23 at Rs10bn; however, it has only achieved Rs4bn in 9MFY23. Project revenue has been impacted by slower execution due to chip shortage which has hurt electronic availability, but is now easing. It believes Q4FY23 should add another Rs4bn in revenue as Railways projects are recognised. The company has seen increased competition in project tenders and is now chasing volumes over margins. It has guided margin to reduce to 7-8% in project business.