Introduction: When the Market Becomes a Mirror

In the world of online trading, success stories spread like wildfire. Screenshots of profits, claims of “consistent income from options selling,” and tales of financial freedom flood social media every day.

But for every such story, there are hundreds that never get told: stories of overconfidence, ruin, and quiet despair.

Recently, one such story emerged on Reddit’s r/NSEbets community. A trader, posting under the name @shayankp, opened up about losing ₹1.1 crore in the Futures & Options (F&O) market over 18 months. His post, raw and unfiltered, revealed the emotional and financial cost of chasing quick profits in one of the riskiest corners of the stock market.

From Bull Run Hero to Derivatives Victim

Like many retail investors, @shayankp entered the market during the COVID-19 bull run. He made ₹45–50 lakhs in equities and believed he had cracked the code.

“At first, it was just small option selling and directional calls. I made good money initially — ₹1–2 lakhs a week. That reinforced the illusion of control.”

Encouraged by his early success, he quit his job to trade full-time. But as his position sizes grew, so did the risks.

By mid-2024, volatility spiked, and the market turned against him. His consistent weekly income vanished. His savings, fixed deposits, and eventually all his capital was gone.

“Looking back, I realise I wasn’t trading. I was gambling with borrowed confidence and no risk management.”

The Bigger Picture: A Nation Addicted to Leverage

His story isn’t unique: it’s becoming a trend.

According to SEBI’s 2023 report, 9 out of 10 retail F&O traders lose money, with the median annual loss exceeding ₹1.1 lakh. Yet participation is exploding.

Why?

Because F&O trading sells a dream of high returns, freedom from 9-to-5, and the illusion of control. Influencers flaunt profits, brokers promote easy leverage, and for a while, it all feels real.

But derivatives are a zero-sum game. For every trader who wins, another loses. And most of the time, the losers are small retail traders going up against institutions with deeper pockets and better risk systems.

“I Feel Completely Broken”: Another Trader’s Cry for Help

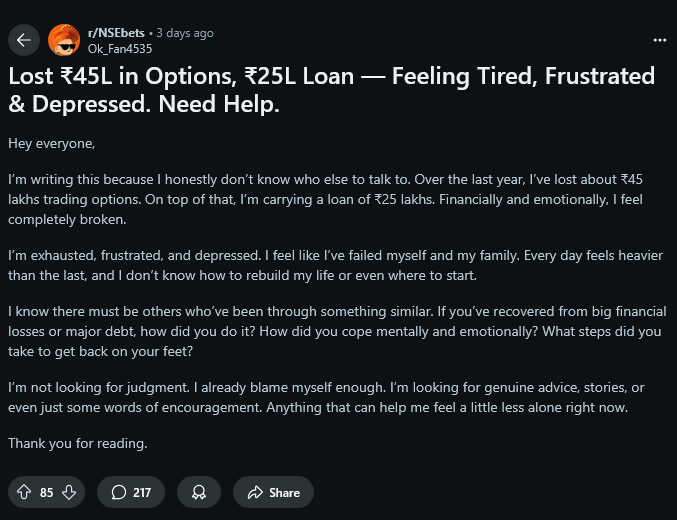

In the same thread, another Redditor, @Friendly-Pepper-9561, shared his own story:

“I’ve lost ₹45 lakh trading options. On top of that, I have a ₹25 lakh loan. I feel completely broken — financially and emotionally.”

The responses he received were not trading tips but words of empathy and realism.

-

“Go back to your job. The losses in derivatives will only get worse.”

-

“Don’t think you’ll recover it through trading again.”

-

“Cut your expenses, repay your debt, and find peace outside the markets.”

One user, who had once lost ₹7 lakh, said he rebuilt his life over two years by working hard and avoiding trading altogether. Another reminded readers that the real victory lies in emotional recovery, not financial revenge.

Why Traders Fall for the Illusion of Control

Early profits in F&O trading feel intoxicating. They create an illusion of mastery that the market can be “controlled.” But in reality, it’s probability, not prediction, that governs outcomes.

Retail traders often:

-

Overleverage their capital,

-

Ignore stop losses, and

-

Trade emotionally after losses.

Meanwhile, professional traders use algorithms, discipline, and strict risk parameters.

As one commenter wisely put it:

“We don’t need extraordinary ROI. If I can get in a month what an FD gives in a year, I should be grateful.”

Rebuilding After a Massive Trading Loss

Losing money in trading hurts. Losing your peace of mind hurts even more. But recovery, both financial and emotional, is possible.

Here’s a practical roadmap inspired by advice from experienced traders:

1. Stop Trading Immediately

Don’t try to “win it back.” When emotions run high, logic collapses. Take a break, even a long one.

2. Rebuild Financial Stability

Cut expenses, find steady employment, and focus on clearing debt. Selling non-essential assets to reduce loan burden is not weakness; it’s wisdom.

3. Heal Mentally and Emotionally

Trading addiction is real. Talk to someone : a therapist, mentor, or friend. Focus on hobbies, fitness, or learning new skills.

4. Redefine Success

Success isn’t about beating the market: it’s about achieving financial security and emotional peace.

The Real Lesson: Overconfidence Is the Enemy

The market doesn’t punish intelligence; it punishes arrogance.

As traders, we often forget that risk management matters more than returns. The stories from Reddit remind us that even smart, well-intentioned people can lose everything when they ignore that truth.

“The market isn’t your enemy. Your overconfidence is.”

Final Thoughts: Beyond the Charts

When @shayankp asked the community, “Should I go back to a job or quit trading entirely?”: the answer was unanimous:

“Go back to work. Rebuild your life. Don’t look back.”

There’s courage in admitting defeat, and strength in starting over.

Because real wealth isn’t built from leverage or luck: it’s built from stability, humility, and learning to live without fear.

💬 What You Can Take Away

-

Don’t mistake a bull market for skill.

-

Don’t chase losses: recover with discipline, not desperation.

-

Don’t trade your peace of mind for profit.

And most importantly:

If you’ve lost big: you’re not alone. But don’t lose yourself trying to make it back.

Very nice article.