Common sense tells us that whenever there is a steep rally or a steep crash, there is always a reversal at some stage.

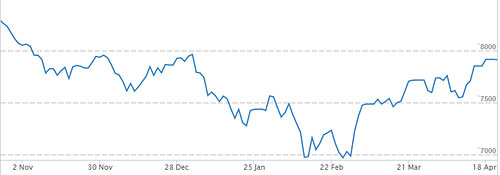

We saw this play out earlier in February 2016 when, after a sustained rally, the markets gave way and the Nifty crashed from a high of 8,633 on 22nd July 2015 to a low of 6,970 on 25th February 2016. Then, the markets went the other extreme and we saw a ferocious rally to 7,929 which is where the Nifty is presently. It is notable that in just about 60 days, the Nifty has surged about 14%. Individual stocks have obviously jumped much higher.

Fortunately, with the aid of technical charting, it is possible to have a fair idea of the levels at which the market will either bottom out or top out.

Nooresh Merani, the leading expert on technical analysis, has been offering sensible advice to us from time to time, cajoling us to buy when the markets are down and cautioning us to sell some when the markets are surging ahead.

It may be recalled that on a previous occasion, when the markets were tumbling out of the China slowdown fear, Nooresh Merani had opined that the markets had bottomed out and the time was ripe to buy stocks aggressively (See Forget China & Get Ready To Make Mega Bucks From Mega Rally).

This call played out partly as promised because the Nifty did surge from 7,791 on 26th August to 8,295 on 23rd October 2015. After that, the markets resumed its downward trend till it touched the bottom of 6,970 referred to earlier.

In his latest video post, Nooresh has struck a cautionary stance. The essence of his post is that the pattern that the Nifty has formed presently is somewhat similar to the pattern that it had formed in the past (2011). This pattern is called the “falling wedge pattern” and it is characterized by “higher tops”, “lower bottoms” and “channel formations” or something to that effect. The bottom line appears to be that when the Nifty surges to a certain level, it meets with stiff resistance and this leads it to retreat to a lower level, albeit till it finds support. The retracement from the resistance level to the support level can be quite deep. However, it may or may not be swift. It could take a few weeks or drag on for months together. Presently, the level of 7,900 is where the Nifty has “broken out of the channel” and entered a critical “zone of resistance”. A “channel breakout” is normally accompanied by a correction and so it is a good time to get into cash is Nooresh’s prognosis.

Nooresh has also advised that a change in trend is usually accompanied by new sectors taking the lead. This happened earlier when sectors like Pharma and FMCG had taken the lead from the erstwhile favourite sectors and it could happen again with new sectors (perhaps Textiles and Specialty Chemicals(?)) becoming the leaders of the next bull market.

So, raising cash at present is unlikely to prejudice us. On the contrary, it will give us the opportunity to deploy funds in the new sectoral leaders is Nooresh’s opinion.

Leave a Reply