The Union Budget 2015-16 is expected to lay out a medium term plan to achieve sustainable growth. One of the key hopes from the Budget is clarity on structural reforms and a roadmap for investment revival. The government is also expected to continue to adhere to fiscal prudence to attain macroeconomic balance and provide headroom for monetary easing.

The quality of fiscal consolidation is the key to macroeconomic stability amid expectation of spending pattern shifting in favour of capital expenditure, away from subsidies, to kick start the investment cycle which is seen as a bottleneck in moving to a high growth trajectory. On the tax front, we expect focus to shift to widening of tax base, clarity on implementation of GST and a stable tax regime through postponement of GAAR and dropping of retrospective taxation.

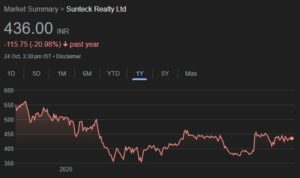

We have a positive outlook for the capital goods, cement, infrastructure, real estate and banking stocks amid expectation of higher budgetary allocations for capital expenditure and push for manufacturing. Tax incentives for metal and mining, power and tyres support positive outlook of these sectors. We expect the Budget to have a neutral impact on automobile, FMCG, IT and telecom sectors.