Ashoka Buildcon

Ashoka Buildcon has experience of a decade in BOT road projects and it currently has 23 projects under its portfolio, with 16 operational projects. Ashoka Buildcon is among the few BOT developers, which has seen a complete life cycle of a project and has handed over four BOT assets back to the government. Further, Ashoka Buildcon has a strong in-house EPC arm for executing captive as well as third party contracts. Ashoka Buildcon is valued BOT (DCF basis) at equity multiple of 1.6x and 1.1x FY12E and FY13E. Ashoka Buildcon‘s SOTP-based target price is Rs363; Ashoka Buildcon‘s BOT division is valued at Rs 207 and the EPC division at Rs156 at 9x FY12E earnings.

Bajaj Auto

With success of Pulsar135 and Discover twins (100cc and 150cc), Bajaj Auto‘s brand-centric strategy has been validated. The high-margin brands, Pulsar and Discover, now account for 70% of Bajaj Auto‘s motorcycle sales. In addition, continued demand for three-wheelers and robust exports would help Bajaj Auto achieve volume growth of 16.2% in FY12 and 11.9% in FY13. Bajaj Auto’s FY12 and FY13 earnings estimates are Rs107.5 and Rs123.3 respectively. Bajaj Auto has a target price of Rs1,664, discounting FY13E earnings at 13.5x. Bajaj Auto’s FY12 earnings estimate is 3.7% higher than consensus estimate of Rs103.7.

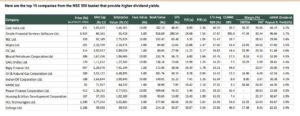

| Company | Sector | CMP (Rs) | Recom. | TP (Rs) | Upside (%) | Market Cap (Rs bn) | P/E (x) |

EV/EBITDA (x) |

Earnings gr. (%) |

ROE (%) | ROCE (%) | ||

| FY12E | FY13E | FY12E | FY13E | (FY11-13E) | FY12E | FY12E | |||||||

| Ashoka Buildcon | Infrastructure | 255 | BUY | 363 | 43 | 13 | 10.7 |

9.0 |

6.1 |

4.9 | 21.5 | 14.0 | 12.8 |

| Bajaj Auto | Auto | 1,372 | BUY | 1,664 | 21 | 397 | 12.8 |

11.1 |

9.5 |

8.2 | 16.8 | 54.4 | 68.1 |

| Godawari Power | Metals | 171 | BUY | 270 | 59 | 5 | 3.9 |

3.8 |

3.4 |

3.1 | 28.0 | 20.9 | 13.1 |

| HCL Tech | IT Services | 507 | BUY | 630 | 24 | 355 | 15.5 |

12.6 |

7.7 |

6.4 | 27.6 | 21.9 | 26.3 |

| IRB Infra | Infrastructure | 174 | BUY | 227 | 30 | 58 | 12.4 |

16.6 |

8.9 |

8.8 | (12.3) | 17.7 | 21.3 |

| Jagran Prakashan | Media | 125 | BUY | 150 | 20 | 38 | 17.2 |

15.0 |

9.7 |

8.4 | 12.7 | 29.8 | 36.9 |

| Jyothy Labs | FMCG | 203 | BUY | 265 | 31 | 16 | 21.9 |

12.8 |

15.9 |

11.3 | 36.5 | 16.0 | 11.7 |

| Lupin | Pharma | 439 | BUY | 497 | 13 | 196 | 20.2 |

17.4 |

15.8 |

13.3 | 15.1 | 26.8 | 25.2 |

| Mahindra & Mahindra | Auto | 672 | BUY | 836 | 25 | 392 | 16.1 |

14.0 |

12.1 |

10.1 | 5.0 | 21.7 | 23.8 |

| Nestle | FMCG | 4,145 | SELL | 3,208 | (23) | 400 | 40.9 |

34.3 |

26.0 |

21.7 | 19.4 | 81.4 | 125.3 |

| NIIT Tech | IT Services | 188 | BUY | 285 | 51 | 11 | 6.1 |

5.3 |

4.1 |

2.3 | 7.4 | 22.5 | 21.5 |

| Phoenix Mills | Real Estate | 200 | BUY | 238 | 19 | 29 | 14.0 |

12.7 |

11.2 |

10.1 | 38.9 | 11.5 | 8.2 |

| Sintex | Diversified | 184 | BUY | 240 | 25 | 50 | 9.5 |

8.2 |

7.6 |

6.7 | 18.4 | 20.8 | 12.3 |

| Tata Steel | Metals | 561 | BUY | 723 | 29 | 573 | 10.6 |

8.2 |

5.2 |

5.0 | 10.7 | 13.0 | 7.3 |

Godawari Power

Godawari Power is expected to benefit from 28% earnings CAGR over FY11-FY13E on volume growth and margin expansion. This would be driven by higher output from Godawari Power’s Ari Dongri mines, 0.6mntpa pellet plant, and 20MW biomass power plant. Further, 0.6 mtpa pellet plant of Godawari Power’s 75% subsidiary Ardent Steel has stabilized with 37% CU in Q4FY11 and is expected to support earnings growth further. Godawari Power’s FY12 EBITDA estimate is 17% above consensus as it is expected to report improved performance from Ardent Steel. Godawari Power has a ‘BUY’ recommendation on the stock with a target price of Rs 270.

HCL Tech

Uptick in discretionary IT spend and recovery in the European market will boost volume growth of HCL Tech. HCL Tech will also gain from margin expansion through improving employee pyramid and scale efficiencies. HCL Tech’s revenue estimates vary from consensus by (1)% for FY12 and for FY13 it is in line with consensus, underpinned by stronger volumes and modest uptick in pricing. HCL Tech’s EBITDA margin forecast for FY12 and FY13 is higher than consensus by 60bps and 30bps respectively. HCL Tech’s FY12 EPS estimate is in line with consensus whereas for FY13 it is 1% higher than consensus. Buy HCL Tech for a target price of Rs 630.

IRB Infrastructure Developers

With the Infra segment, which has been languishing due to fundamental issues, IRB Infrastructure Developers is preferred given its unique ability to manage and win competitive projects. We strongly believe in the sustainability of IRB Infrastructure Developers business model. IRB Infrastructure Developers is well positioned to add projects worth $1bn per annum. IRB Infrastructure Developers FY12E and FY13E earnings estimates are Rs14.0 and Rs10.5, which are 6% and 36.9% lower respectively than consensus estimates. IRB Infrastructure Developers is expected to have top-line growth of 27.7% at Rs 31.1bn for FY12E and 18.1% at Rs 36.7bn for FY13E vs. consensus estimate of 43.7% at Rs 35bn and 26.9% at Rs 44.5bn. IRB Infrastructure Developers recent correction in stock price provides a good entry point for long-term investors. IRB Infrastructure Developers stock offers an upside potential of 30.3% at our SOTP-based target price of Rs227 vs. consensus target of Rs236.

Jagran Prakashan

We like Jagran Prakashan for its leadership in UP (the largest print market in terms of readership and print ad value). Jagran Prakashan‘s strong position in growing regions such as Bihar and Jharkhand, good cost efficiency, phased and planned expansion into other media businesses, and wide portfolio (including Mid-day, I-next and Cityplus) strengthen our belief that Jagran Prakashan is well poised to benefit from steady growth in the print media sector. In FY11, Jagran Prakashan‘s revenue increased 18.5% to Rs 11.1bn and net profit increased 17% to Rs 2.1bn. Jagran Prakashan’s improved ad yields and increased focus on color ads led to ad revenue growth of 20% and circulation revenue growth of 3.5% (despite increased competition from Hindustan and Dainik Bhaskar). Jagran Prakashan’s revenue estimate for FY13 is 3% above consensus. However, Jagran Prakashan’s EPS estimate of Rs8.3 for FY13 is 8% below consensus. Buy Jagran Prakashan for a target price of Rs 150.

Jyothy Laboratories

we expect numerous positives for Jyothy Laboratories in the medium to long term that would improve profitability. Jyothy Laboratories is among the few companies in the FMCG space which has immense potential for long-term profitability. Jyothy Laboratories‘s estimates for FY13 are among the highest on the street, led by expectation of profitability improvement in Henkel India and 50% debt repayment during FY13. Jyothy Laboratories is assigned 16x to FY13 earnings and add Rs12/share NPV on tax saving of Rs1.2bn @12% discount rate to derive the TP of Rs280.

Lupin

Lupin is one of the best plays in the pharma space, given its strong execution capabilities, improving financial performance and diversifying business model. Lupin’s high-margin branded generic business has been the key differentiator. Lupin‘s strong growth in the US (both branded generic and generic segments), Japan and India would maintain the growth momentum. Lupin‘s FY2013 earnings estimate is 7% lower than consensus. Lupin is expected to have net sales and EPS to log CAGR of 14.4% and 15.1% to Rs 74,424mn and Rs 25.3 over FY2011-13E respectively. Lupin is valued at 22x (in line with the big players in the sector) June’12E earnings yielding a TP of Rs 497.

Mahindra & Mahindra (M&M)

Mahindra & Mahindra (M&M) has a significant rural presence and the timely onset of monsoons and further forecasts for normal monsoons for the year would benefit Mahindra & Mahindra (M&M). Mahindra & Mahindra (M&M)’s automobile segment is expected to record 13.2% growth in FY12, led by new product launches. Mahindra & Mahindra (M&M)’s tractor segment too is expected to grow 11.1% in FY12, underpinned by higher crop output and increased demand for low horsepower Yuvraj range of tractors. Mahindra & Mahindra (M&M) is expected to have EPS of Rs41.6 and Rs48.0 in FY12 and FY13 respectively. Mahindra & Mahindra (M&M)’s FY12 earnings estimate is 8.5% lower than consensus estimate of Rs45.5. Mahindra & Mahindra (M&M)’s SOTP valuation of Rs836 discounts the standalone business at 13x FY13E earnings.

Nestle India

We believe entry of new players in the hitherto-secure noodles segment challenges Nestle India‘s ‘cash cow’. Further, we believe the premium enjoyed by the Nestle India stock vis-à-vis FMCG peers is unjustified and would correct. Nestle India’s estimates and target price are among the lowest on the street, led by pressure on EBITDA margin and argument of narrowing down the Nestle India‘s P/E premium to 25%. Nestle India is assigned P/E of 30x on next 12-months earnings to derive TP of Rs3,208.

NIIT Tech

NIIT Tech has a large exposure to high-growth, niche verticals such as insurance and travel. NIIT Tech‘s new service lines would boost non-linear growth and lead to improvement in realizations. NIIT Tech has no exposure to the PIIGS zone and it has been able to achieve volume growth in Europe despite economic headwinds. Further, NIIT Tech‘s differentiated strategy with new development of IPs in emerging technologies (like cloud services) and emerging verticals (like healthcare) would boost growth. NIIT Tech‘s top-line estimates for FY12 is in line with consensus and for FY13 it varies from consensus by ~0.5%, underpinned by stronger volumes and modest uptick in pricing. NIIT Tech‘s EBITDA margin estimate for FY12 is 20.4% and FY13 is 20.3% which is in line with consensus. NIIT Tech‘s EPS estimate for FY12 and FY13 is 6.4% and 6.6% respectively higher than consensus. Buy NIIT Tech for a target price of Rs 285.

Phoenix Mills

Phoenix Mills‘ key project, High Street Phoenix (HSP), is now fully operational and is likely to generate rental income of Rs 2-2.2bn in FY12E. In addition, Phoenix Mills‘ rental income would accrue from renewal of 0.15 msf in HSP. Phoenix Mills‘ EPS estimates for FY12 and FY13 are Rs 14.3 and Rs 15.8 respectively. Phoenix Mills‘ FY12 earnings estimate is 40% higher than consensus estimate of Rs10.2. We have a ‘BUY’ recommendation on the Phoenix Mills stock with a target price of Rs238, which discounts FY12E gross NAV of Phoenix Mills by 20%.

Sintex Industries

Sintex Industries has a diversified business model marked by low volatility in sales, profit and cash flows. Sintex Industries is a market leader in the Monolithic and Prefab segment. Sintex Industries‘ earnings estimates (EPS) for FY12 and FY13 are Rs 20.2 and Rs 23.6 respectively. Sintex Industries‘ FY12 earnings estimate is 1.5% higher than consensus estimate of Rs19.9. We have a ‘BUY’ recommendation on the Sintex Industries‘ stock with a target price of Rs 240, which discounts FY12E earnings of Sintex Industries by 12x.

Tata Steel

We expect Tata Steel‘s EBITDA to grow at 8% CAGR over FY11-13E, driven by 1) Improving share of Tata Steel‘s highly profitable integrated Indian operations with completion of 2.9 mntpa brownfield expansion at Jamshedpur in FY12; 2) Transformation initiatives for TSE (sale of TCP, downsizing at Scunthorpe) to improve profitability; 3) Tata Steel‘s improved capital structure (FY11 net D/E of 1.0x vs. 1.3x in FY10); and 4) Tata Steel‘s hedging of high RM cost at TSE on commencement of mining at Riversdale and New Millennium. We find the Tata Steel stock attractively valued at 5.2x FY12E EV/EBITDA. Our consolidated estimates of Tata Steel are lower than street estimates. We value Tata Steel using SOTP methodology at Rs 723.

14 High Conviction Stock Ideas

[download id=”235″]